Sign-up to receive Newmark Industrial Thought Leadership updates.

- Insights>

- Market Report Page>

- 2Q24 U.S. Industrial Market: Conditions & Trends

2Q24 U.S. Industrial Market: Conditions & Trends

August 19, 2024

Newmark presents the second quarter 2024 U.S. Industrial Market: Conditions & Trends report.

Economic Conditions and Demand Drivers

- The economy continues to present mixed signals on the future of expansion. Consumer spending, industrial production, and inflation readings all positively exceeded expectations in the second quarter of 2024. However, the labor market is cooling and firms continue to grapple with high interest rates, contributing to higher bankruptcies.

- Container traffic at U.S. ports has surged to its highest level in two years as shippers hedge against disruption and retailers gradually build up inventories to normal levels. Annualized growth in imports is forecast throughout the latter half of the year.

- Manufacturing construction spending continues to hit new heights, measuring $121.5 billion in May 2024, nearly double the pre-pandemic 5-year average. The South is collecting the lion’s share of this investment, where manufacturing growth is also driving additive demand for industrial space.

Leasing Market Fundamentals

- Nationally, absorption measured 38.3 MSF, 42% higher than the previous quarter, although still 40% off quarterly averages from 2017 to 2019. Preleased deliveries are demonstrating outsized contribution to total net absorption, driving over 100 MSF of new occupancy year-to-date. Conversely, older buildings, particularly those constructed before 2000, registered net move-outs of 41 MSF.

- Vacancy continues to increase as new supply puts pressure on fundamentals. Vacancy rose to 6.4% in the second quarter of 2024, on the heels of 112 msf in new deliveries..

- Asking rent growth continues to decelerate, measuring 4.6% annually, the slowest growth since 2020. Rents, particularly in bulk space, will likely see a modest reset this year.

Capital Markets

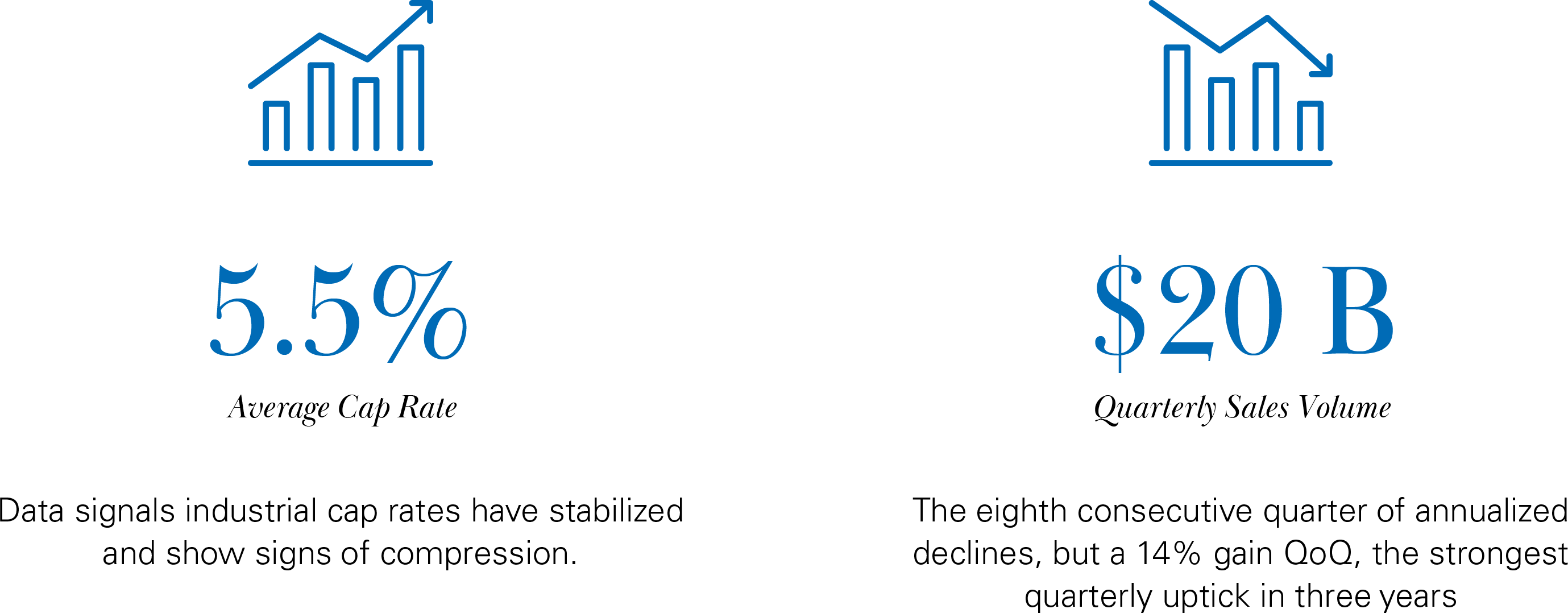

- The second quarter ushered in $20 billion in sales volume. This was the eighth consecutive quarter of annualized declines, but a 14% gain QoQ, the strongest quarterly uptick since 4Q 2021. With renewed anticipation of rate cuts this year, investor sentiment is improving and translating to greater activity.

- Industrial cap rates have stabilized and show signs of compression: private-market industrial cap rates came down 10 bps quarter over quarter to 5.5%.

- Industrial debt originations languished in 2023 but have come roaring back in the first half of 2024 at an estimated $43.2B, a substantial increase over 1H 2023.

Outlook

- Vacancy will rise another 10 to 20 basis points by year-end, but is likely nearing the cyclical peak. Supply – both in deliveries, and in development – will fall back to pre-pandemic levels by 2025.

- Industrial employment has seen modest gains year to date. In the second half of 2024, potential strikes threaten East Coast port and transcontinental rail activity. Underlying trends continue to reshape the manufacturing workforce composition. Since 2016, the number of PhDs in the sector has surged by over 50%, reflecting shifts from manual labor to more technologically advanced roles.

- Record commercial real estate loan maturities are coming due between now and 2026. However, among all property types, the industrial sector has the lowest share of potentially troubled loans maturing.