The National Trend: Resilience of Multifamily Sector Showcased During Period of Economic Uncertainty

The pandemic brought on by the COVID-19 outbreak has now tested the global economy for more than seven months, and clear trends have formed in the real estate capital markets space—perhaps most notably the increasing allocations toward U.S. multifamily product. This is due in part to secular trends, as well as the property type’s historical resilience during uncertain economic times.

Just prior to the pandemic, the allocation of capital toward the multifamily sector exceeded that for every other property type. COVID-19 has only accelerated the preference of buyers for defensive property types such as multifamily and industrial, and for targeting less densely populated cities with room for growth. With a lack of for-sale opportunities in the industrial market, multifamily has gained favor with investors due to its high level of liquidity compared to other asset classes.

From April through August, multifamily investment sales volume topped that of all other asset classes, accounting for 34.3% of total volume, an increase from the 26.7% allocation multifamily received just five years ago. Of the $29.1 billion invested in multifamily property during this recent five-month period, 65.4% went to garden-style apartments. By comparison, the second largest share of investment came from industrial investment sales, which comprised 23.0% of the total, while office investment sales came in a close third at 22.5%. Retail, hospitality, and all other real estate product types combined only tallied 20.2% of the total. In addition to sales volume, one of the top metrics investors are examining in the COVID-19 era is rent collection, which for the multifamily sector has remained resilient during the pandemic, at 92.2% for professionally managed apartments in the U.S. through September 27, according to NMHC.

Most multifamily transactions since the onset of COVID-19 have come from private groups, while many of the large institutional players have stayed on the sidelines during this time of uncertainty. Despite this, most institutional groups have already indicated that multifamily and industrial opportunities will be the prime focus of their capital investment yet to be deployed. As of September, $205 billion in dry powder has accumulated in closed-end real estate funds, of which the bulk will be allocated to multifamily assets once institutional investors return to the investment sales market at large. In addition to the sizable amount of dry powder, debt capital remains plentiful for multifamily. GSE lenders have nearly $80 billion earmarked for the rest of 2020, and the Federal Reserve announced it will let inflation run above 2% with a target range of 2.25–2.50% through 2023, keeping interest rates near record low levels for an extended period of time. With low domestic interest rates and negative interest rates overseas, investment into U.S. multifamily product offers strong risk-adjusted returns.

Featured Markets: Dallas and Washington, DC

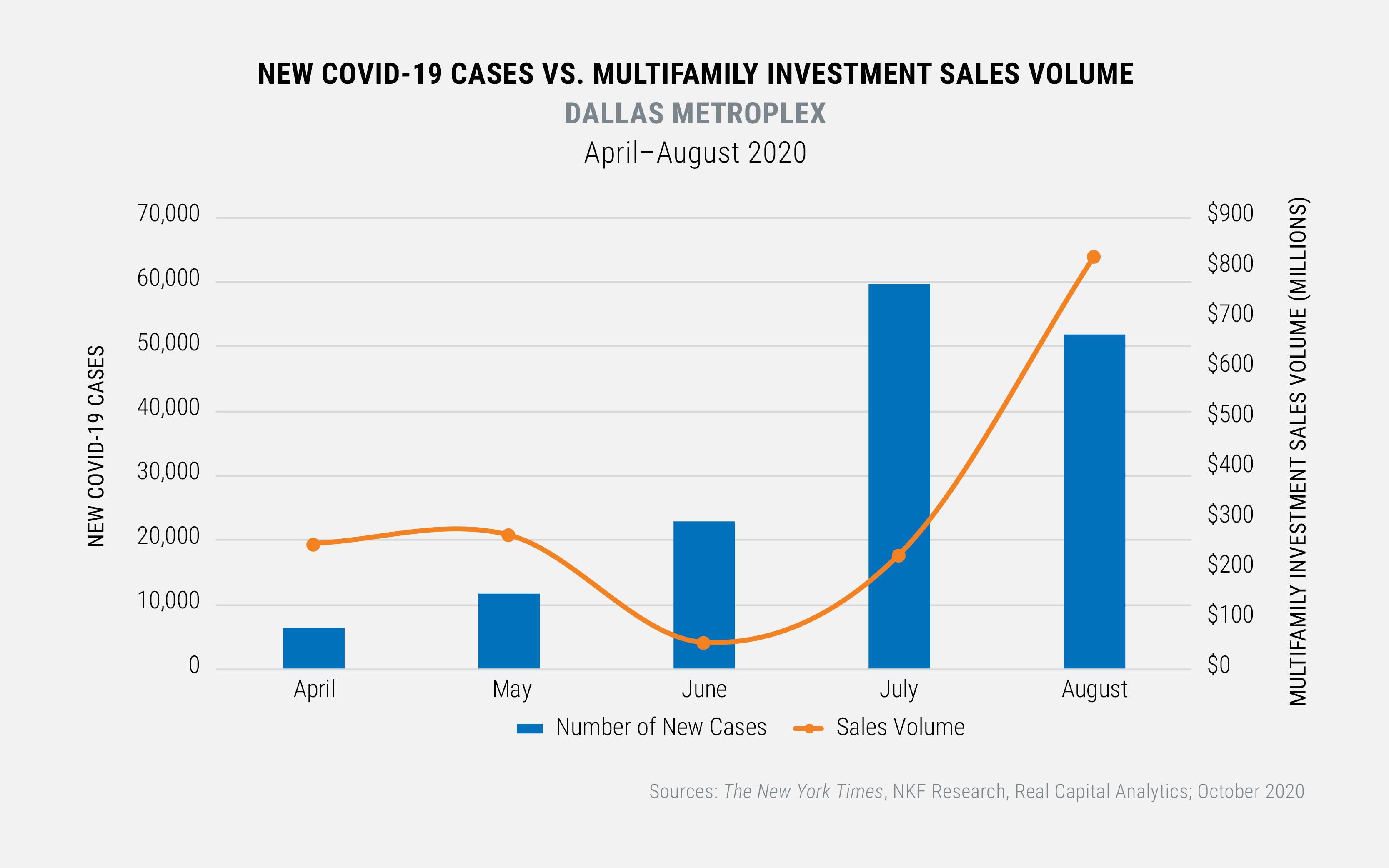

Dallas has been one of the hottest multifamily markets during the pandemic, drawing more than $1.6 billion of investment from April to August, with more than $800 million coming in August alone (see adjacent exhibit). When looking at the monthly number of COVID-19 cases compared to monthly sales volume totals, the increasing levels of investment despite the number of cases peaking in July and August reflect the long-term confidence investors have in the Dallas multifamily market. Aiding this movement is the significant number of corporations relocating to Texas as a whole. Many investors that were previously heavily allocated to dense, coastal markets now have begun to look for opportunities in the Sunbelt, particularly in Dallas.

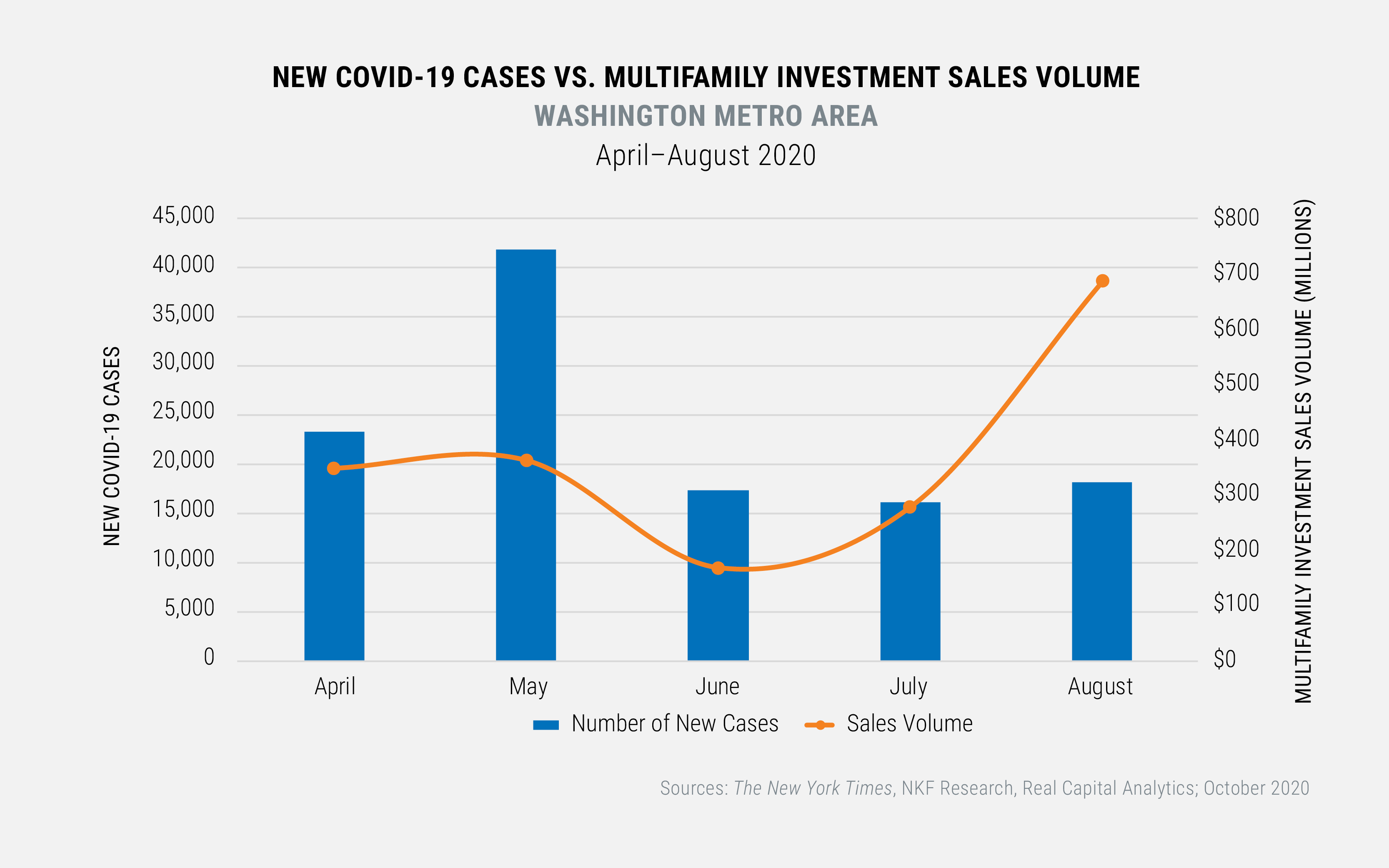

In the Washington, D.C. metro area, investors took a more cautious approach as COVID-19 cases peaked. May was the worst month for the area in terms of the number of new cases, with 41,814. Monthly investment declined in June, but as new monthly cases leveled off below 20,000, multifamily investment sales volume rose quickly (see adjacent exhibit). The national capital region has a highly educated workforce and government employment that fuels the demand for apartments; at the moment, the region’s Northern Virginia and Suburban Maryland suburbs are attracting investor interest because of their strength in the government contractor, technology, and healthcare sectors. Notably, Amazon’s second headquarters in Arlington, Virginia and the NIH headquarters in Rockville, Maryland are centers of attention. Although investors paused when the virus first arrived in Washington, a lower incidence of new cases and a strong mix of industries instilled confidence in the market’s fundamentals.

Implications for Our Clients

While the long-term outlook for multifamily investment remains sturdy, ambiguity around how long the pandemic will last and uncertainty surrounding the pending election will cause some near-term volatility in multifamily capital markets. The possibility of a shifting regulatory environment post-election may initiate a rush to conclude deals in the weeks ahead. Of note, the outcome of the election could yield a change for some real estate tax codes, such as the potential elimination of the 1031 exchange, a vehicle frequently used by investors during the previous cycle. Volatility in investment activity during the next few months is to be expected, but the long-term prospects for the multifamily sector remain strong, and the sector is currently one of the preferred destinations among commercial real estate investors.

Sources: National Multifamily Housing Council (NMHC), The New York Times, NKF Research, Preqin, Real Capital Analytics