The National Trend: Growing Urgent Care Sector Proves Vital During Pandemic

Prior to the onset of COVID-19, medical service providers had been expanding rapidly into retail spaces including shopping centers and urban storefronts. Common medical retail tenants include urgent care centers, dentists, physical therapy providers, dialysis clinics and eye care centers. The primary driver of this trend has been the desire to create a convenient experience for the patient/consumer as retail developments tend to offer high visibility, ample parking and central locations near residential populations.

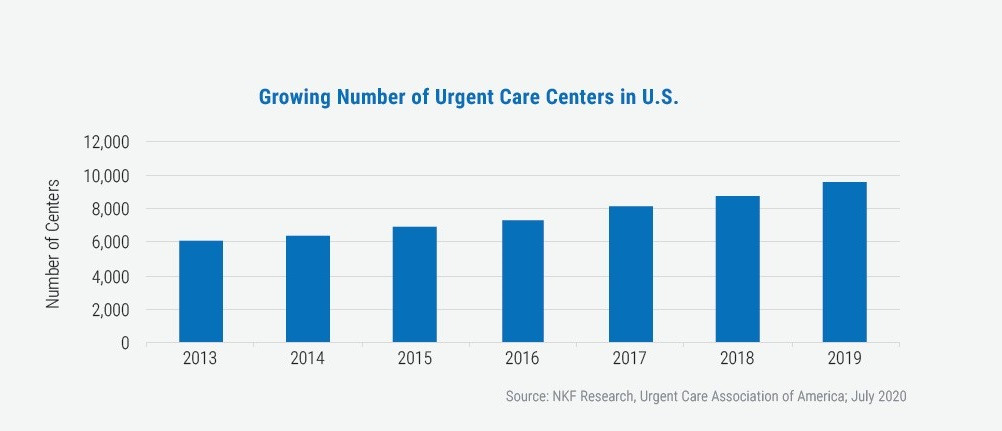

Urgent care centers in particular have seen dramatic growth in recent years, with the number of locations across the U.S. increasing by 58% since 2013. Many of these providers are located inside chain drug stores. For example, MinuteClinic operates more than 1,100 locations within CVS Pharmacy and Target Stores. Other urgent care centers lease their own retail spaces, including such national leaders as Concentra, MedExpress and NextCare.

Since the pandemic began, retail health clinics have been offering both diagnostic and antibody tests for COVID-19. Additionally, they provide walk-in services for individuals looking to avoid hospital emergency rooms. As Americans continue to live alongside the virus, receiving healthcare in a retail setting may prove to be not only a more convenient option but also a safer one. Medical retail establishments typically have their own exterior entrances, differentiating them from multitenant medical office buildings and hospitals that often require patients to use hallways and elevators, thus complicating social distancing and potentially creating greater exposure to pathogens.

Featured Market: New York Metropolitan Area

CityMD, a leading urgent care provider in the New York metropolitan area, started with a single location in 2010 and has since expanded to 123 locations in the Tristate region, including storefronts in Manhattan as well as both in-line and pad sites in premier suburban shopping centers. As New York and New Jersey became the early epicenter of the pandemic in the United States, CityMD began offering COVID-19 testing at all of its locations. Despite these expanded services, some clinics had to be closed temporarily due to staff and supply shortages; with providers in triage mode, leasing was put on hold. Looking ahead, activity is expected to resume and demand for urgent care and other medical retail uses is only expected to grow more popular among consumers.

What Are the Implications for Our Clients?

For asset owners, medical retail offers an additional source of demand for retail real estate and may help fill new vacancies. Asset owners should be cognizant that some medical retail tenants may be challenging to accommodate due to their need for expanded utilities or complex equipment—which translates to costlier build-outs—or the requirement for a zoning variance. When recruiting and vetting prospective tenants, property owners may wish to focus on medical occupiers that will draw shoppers to their centers and create synergy with neighboring tenants. Meanwhile, healthcare providers may want to take advantage of rising vacancy rates to consider expanding their retail locations that offer patients convenient and safe access to medical care.

The blending of healthcare service delivery and retail functions is not easy to execute; Walgreens announced in November that it would close 160 in-store clinics, although it would keep open approximately 220 others that were run through a partnership with healthcare systems. However, Walmart Health is expanding, having just opened its fourth freestanding facility dedicated to health and wellness; these stores occupy retail space but provide healthcare services in addition to products. Ultimately, the value to consumers of convenient, walk-in healthcare services in retail space suggests that well-executed plans by retailers can be successful, yielding benefits for disciplined retail investors as well.

Sources: CityMD, Commercial Observer, Forbes, Newmark Research, PNC Real Estate, Urgent Care Association of America