The National Trend: Demand for Innovative Healthcare Solutions Has Catalyzed Need for Specialized Commercial Space in Established and Emerging Life Sciences Markets

The global spread of COVID-19 and ensuing economic volatility has highlighted the critical importance of the Life Sciences sector. In this health-driven crisis, Life Sciences companies around the world are on the forefront of the fight against the virus, mobilizing to create, test, produce and disseminate a vaccine. The U.S. Government alone has invested hundreds of millions of dollars through its Biomedical Advanced Research and Development Authority (BARDA) to support clinical testing and eventual production of a vaccine, which is still months away in a best-case scenario.

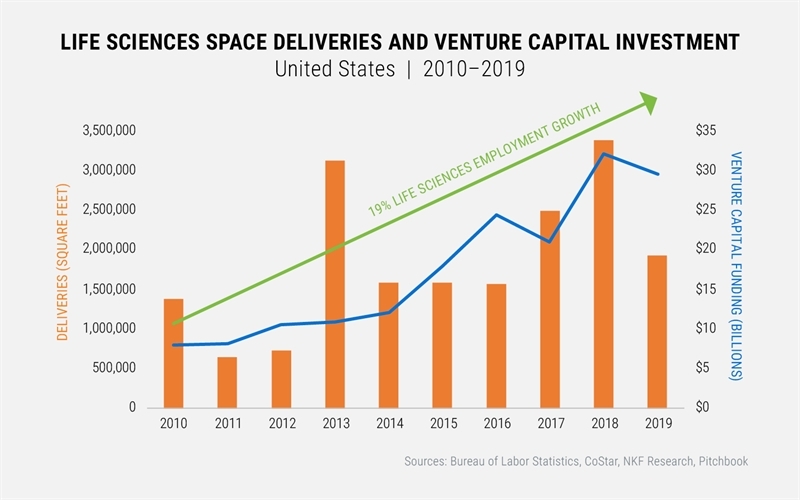

Prior to COVID-19, the Life Sciences sector was booming. In recent years, accelerating scientific discovery in the Life Sciences field brought cutting-edge therapies and healthcare solutions to meet human needs, and this expanding activity has driven demand for specialized Life Sciences space—research and development (R&D) labs and office buildings, medical testing facilities, and advanced manufacturing environments that comply with Good Manufacturing Practices (GMP). Annual venture capital (VC) investment flowing into Life Sciences deals increased substantially over the past decade, and in the first quarter of 2020, VC funding reached $9.1 billion, the highest quarterly funding volume in four years. With strong investment flowing into the sector, employment increased by 19% between 2010 and 2019, exceeding overall national employment growth of 16% over the same period.

While overall employment has been severely affected by COVID-19, dropping 14.0% from February to April 2020, employment in Scientific Research and Development Services has fallen only by 2.5% over the same period, less of a decline than experienced by most other major industry sectors. (For example, Financial Services employment declined by 3.0% and Information employment declined by 8.9%.) This modest decline demonstrates this essential field’s resiliency even at a disruptive point in the cycle. A sustained, elevated demand for specialized space remains in effect, particularly in the country’s premier Life Sciences hubs. At the end of the first quarter, Boston’s Life Sciences market had an availability rate of 7.3%, and within the market Cambridge was even tighter at 3.2%. San Francisco Bay Area’s market had an overall availability rate of 5.7%, with the Mid-Peninsula at just 2.5%. While new deliveries will help alleviate the pinch—anticipated 2020 deliveries of 4.5 million square feet are more than double the prior five-year average—many of these deliveries will be pushed back to 2021 as construction has been halted due to the coronavirus.

More Life Sciences space will likely be needed in the long term as a direct result of the impact of COVID-19 and in preparation for future pandemics. Problems in the Life Sciences supply chain have been exposed: beginning with China, national shutdowns around the world constrained the flow of materials for drug development into American Life Sciences firms at a time when they were most needed. To address these supply chain concerns going forward, firms may trigger a repatriation of manufacturing, driving greater need for GMP manufacturing space in major Life Sciences markets. This crisis has also revealed specific challenges within the United States surrounding the decentralized nature of Life Sciences material development and production. With heavy restrictions on travel, necessary in-person oversight of production activities has been interrupted for Life Sciences firms in which contract manufacturing and R&D facilities are often hundreds of miles apart; this may drive future development in an effort to bring production closer to the core R&D.

Featured Markets: Bay Area and Philadelphia

The Bay Area is the country’s largest and most established Life Sciences market with a lab inventory of 27.7 million square feet. In a market where demand has dwarfed supply for years, new developments currently under construction total 2.9 million square feet, equal to 10.5% of existing supply. Tenants such as Amgen, AbbVie, and Celgene have already preleased 74.5% of this new space. Pressure on tenants in this market to find space and a diversity of innovation across the industry is leading to emerging hubs of specialized practice. Philadelphia is one such emerging market, on the map because of its burgeoning gene and cell therapy innovations which are helping drive a wave of new development of Life Sciences space. In Philadelphia, 621,000 square feet of Life Sciences space is under construction (equal to 7.6% of standing inventory), a significant portion of which is advanced manufacturing space, including Bay Area-based Iovance Biotherapeutics’ 136,000-square-foot facility under development in the Philadelphia Navy Yard.

Even in the midst of disruption, the Bay Area and Philadelphia markets are seeing interest in both well-established and early-stage Life Sciences companies looking to expand. In the first seven weeks of the Bay Area’s shelter-in-place order, seven Life Sciences companies signed for 160,000 square feet in new leases and renewals. Additionally, Bayer HealthCare submitted a development agreement to the City of Berkeley in early April for a 30-year plan to expand its facilities by nearly 1.0 million square feet and 1,000 employees. Further, after receiving a $100 million Series C funding round, Pivot Bio announced at the end of April it would hire an additional 50 employees this year. In Philadelphia, Spark Therapeutics, a premier gene therapy company, signed a lease in April to expand to the 60,000-square-foot building at 3000 Market Street in what is the epicenter submarket of the local Life Sciences landscape, University City. Also, multiple R&D lab and contract manufacturer space requirements remain in the market, including some new inbound users. With the anticipation that firms may bring even more manufacturing closer to “home base,” there are multiple proposed Life Sciences projects in the pipeline that may commence construction later this year or in 2021 in order to meet tenant demand.

What Are the Implications for Our Clients?

COVID-19 has catalyzed new demand for Life Sciences space directly related to combatting the virus, such as new space requirements for firms awarded contracts for test, treatment and vaccine development. Looking forward, the sweeping impact of COVID-19 and refreshed awareness of the dangers of pandemics may catalyze further development even after the virus has been contained.

In the immediate term, tenants needing critical expansion space will be stymied by delayed construction timelines. In the intermediate term, the current dip in new development will continue to result in pent-up demand. Overall, the combination of an increased need for lab space with a relatively constrained supply could mean that Life Sciences buildings will remain an attractive opportunity for investors and developers, despite the high cost of entry. The Life Sciences sector is supported by strong venture capital investment; development opportunities may be particularly appealing in hubs where there has been a persistent deficit of new supply for specialized practice areas.

Sources: Bureau of Labor Statistics, CoStar, Crunchbase, Newmark Research, Pitchbook