The National Trend: Industrial Development Has Been Pushing Farther Out

The Newmark research team has examined the urban industrial revolution at length in recent years as the advent of e-commerce and last-mile logistics has driven demand for assets close to urban cores throughout the nation. A resurgence in urbanization, from both a housing and office perspective, has taken hold in many of the nation’s largest metro areas as well. As a result, developers of housing and other mixed-use projects have been vying with industrial users for many of the same infill assets and land parcels. How might these trends be reshaped by the COVID-19 pandemic in both the short term and long term?

During the most recent expansion cycle, access to low-cost labor—important to many industrial space users—has become scarce, especially in the nation’s most vibrant markets. With rising costs, fewer developable parcels and shallow labor pools, construction activity in many markets began to push outward. Often, new projects have clustered just beyond metro area boundaries or in neighboring tertiary markets. All else equal, this trend would likely have held steady given such strong market fundamentals, but the COVID-19 outbreak has halted economic growth, and social distancing measures have resulted in many construction site closures throughout the U.S.

Good examples of the recent national trend toward exurban industrial development are plentiful, and Southern California’s Inland Empire is one. The region’s Tejon Ranch Commerce Center, which encompasses millions of square feet of industrial space, is located 60 miles north of Los Angeles and 30 miles south of Bakersfield. The site lacks modal connectivity and clear proximity to the Ports of Los Angeles and Long Beach. However, retailers such as Ikea and Famous Footwear have established distribution centers there due to its central location within the state.

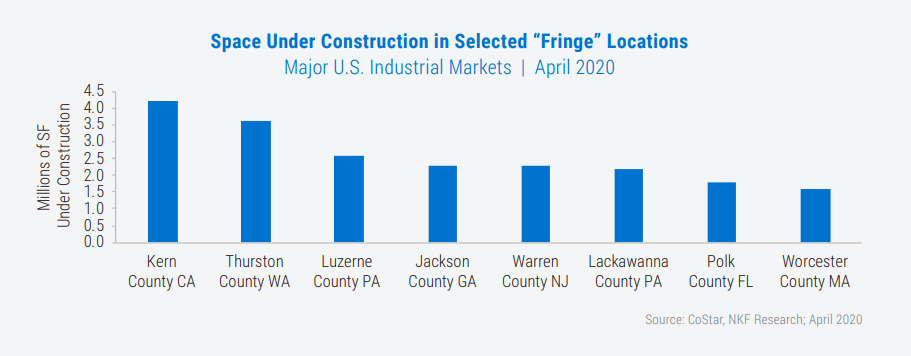

Similarly, industrial development in the Seattle market is moving toward the edges of the metro area and beyond. Thurston County, which is just south of the metro boundary, near the state capital of Olympia, boasts 3.5 million square feet of industrial construction. See the adjacent graph for recent industrial development in selected “fringe” locations in major U.S. markets—portions of a metropolis that are outside the region’s core but have become important to the industrial functions of that metro market.

A similar story is emerging on the East Coast. Areas such as Western New Jersey, Southern New Jersey, Upstate New York and parts of Southern Connecticut have seen a recent increase in industrial development. Bridge Point 78, a 3.8 million-square-foot industrial park in Western New Jersey, is a good example of this trend. In nearby Central Pennsylvania, prime sites in the 78/81 Corridor Market are dwindling and the cost of land has more than doubled in the past five years while the labor pool is tapped out. These factors have combined to push industrial development further from the market’s core. In Atlanta, the need to build mega distribution centers has forced development north due to the availability of land. Similarly, Florida’s Polk County—located between Tampa and Orlando—was a hotbed for industrial development during the most recent cycle.

Due to the COVID-19 pandemic, several states where this industrial development trend has been prevalent have implemented various types of moratoriums on non-essential development. This includes Massachusetts, Pennsylvania and Washington. In some locales it is becoming increasingly difficult to get permits processed and inspections completed even without a construction stoppage. The full extent of the COVID-19 outbreak’s effects on industrial development have yet to be realized, but there likely will be fewer projects moving forward in the near term, notwithstanding the fact that the industrial sector is best positioned for success during the economic downturn due to the ramp-up in e-commerce.

Featured Market: Boston

While super-regional distribution hubs have been expanding over the past few years, secondary regional markets such as Boston are seeing the same trend. In recent years, industrial developers have been active in the Boston metro area, with a particular focus on the warehouse/distribution product type on the region’s fringes. A resurgence in urban living and working attracted new office, multifamily, life science and other mixed-use projects to places like Boston, Allston/Brighton, and Cambridge. Accordingly, urban industrial product began to face pressure from developers who were looking to repurpose those properties to meet the need for new housing and office or lab space. Ultimately, rising land costs and industrial rents pushed developers and users further from Boston’s urban core. In fact, over a five-year period from 2015-2020, average industrial asking rents increased by roughly 60%, and land pricing has experienced a similar trajectory over the past five years. Examples of tenants’ flight to the suburbs and beyond include companies such as Hirsch Glass and Boston Trolley, which both sold long-time headquarters in the city and relocated to more affordable submarkets. Worcester County, Southern New Hampshire and Bristol County (in the Providence metro area) have all witnessed an increase in industrial development as asset owners sought to save on land costs and tap into tenants’ desire for cheaper lease rates.

The full impact of Massachusetts’ moratorium on non-essential construction activity due to the COVID-19 pandemic remains to be seen. With much shorter development timelines than office or multifamily properties, a brief pause should not create significant delays for new industrial product, but the ability to contain the virus will determine both the need for new industrial product and the timeline on which it can be delivered.

What Are the Implications for Our Clients?

Prior to the COVID-19 outbreak, the implications of geographic expansion of industrial markets seemed clear for occupiers, investors and developers. Industrial tenants—especially large users—in need of warehouse/distribution space were faced with dwindling options. Modern, high-quality distribution space has been harder to come by as demand from retailers and other e-commerce companies drove industrial rents to cyclical highs. Now, a more pronounced shift toward online retail could further enhance demand for warehouse/distribution space

Developers will likely continue to seek opportunities in more fringe or exurban locations; those with multi-modal access will be the most desirable. While investors will remain attracted to urban industrial assets due to their proximity to large population bases—and those urban assets will remain desirable locations for last-mile logistics facilities—fringe locations will be popular into the next cycle for their scale and lower cost. Near-term headwinds resulting from the COVID-19 pandemic likely will curtail development, in part due to construction moratoriums, but well-capitalized investors may find opportunities to take advantage of the market’s temporary uncertainty.