The National Trend: Expansion of Online Grocery Shopping Spotlights the Need for New Cold Storage Warehouses

Cold storage facilities have historically performed well during economic downturns, with the grocery sector being the main occupier of cold storage space. During the previous two national recessions, the food and beverage industry had been the third-best performing retail sector, with a 3.7% month-over-month growth rate, even as the overall retail sector experienced a 6.1% decline in sales. In 2010, after the Great Recession, more than 6.1 million square feet of cold storage inventory was developed in the U.S.—the most delivered in one year since 1990. However, it is not only grocery chains that require cold storage facilities; medical and pharmaceutical research companies, whose importance is highlighted during a pandemic, depend on a climate-controlled environment to protect clinical studies and the development and distribution of therapeutic treatments.

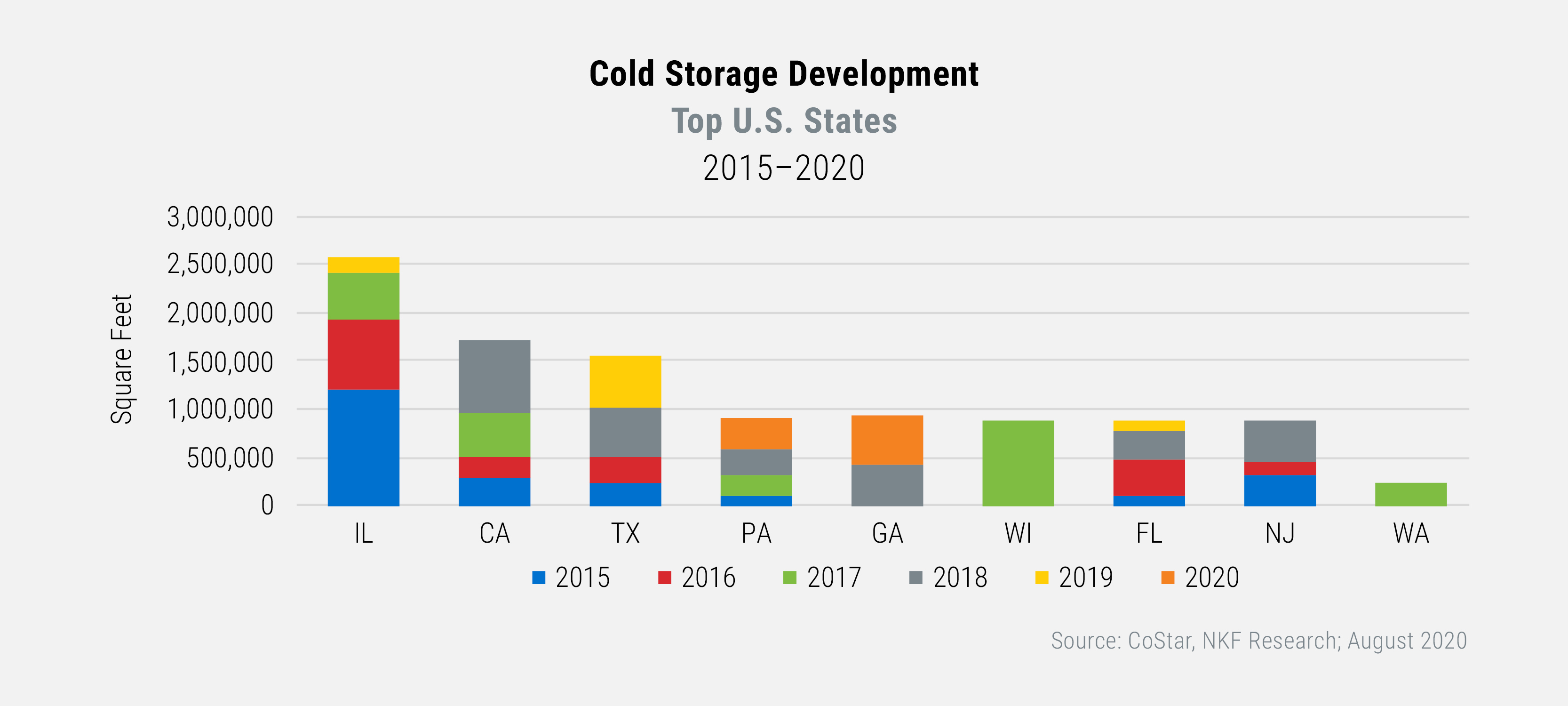

Cold storage warehouse development has been steady, with the delivery of approximately 24 million square feet of new inventory in each decade since the 1990s. Notably, more than two-thirds of the new inventory from the 2010s was delivered after 2015, with approximately 15 million square feet completed in the past five years; Illinois, California, and Texas have led the nation in development during that period. The industrial sector was already experiencing a shift in supply chain activity prior to COVID-19, and e-commerce increased the need for technological advancements in order to meet the growing demand for last-mile distribution. The food and beverage sector was one of the leading industries for industrial leasing during the most recent economic expansion.

During the initial weeks of the COVID-19 pandemic, stay-at-home orders helped online grocery sales climb to unprecedented levels as more consumers opted for safety rather than the risks of in-store shopping. A survey conducted by Brick Meets Click/Shopper found that 46% of consumers will likely continue to use online grocery delivery platforms after the pandemic abates, demonstrating that customers are shifting their food shopping habits. This is a similar change to what the broader retail industry experienced with e-commerce during the previous decade. This transition has thus far resulted in an oversupply of perishable products (like meat, dairy and vegetables) relative to the cold storage space available. As grocers and logistics companies adjust to consumers’ new habits, demand for cold storage facilities is likely to rise, in turn increasing rents.

Featured Market: South and Central Florida

The Southeast is the most populous region in the United States, home to more than 25% of U.S. residents, and Florida is a center of activity for the distribution of refrigerated goods. Food and beverage companies leased more than 6.6 million square feet throughout South and Central Florida, as each of those markets accounted for 3.3 million square feet of cold storage transaction activity since 2015. During the same period, six cold storage buildings were completed, comprising 872,923 square feet and placing Florida seventh in the nation for cold storage development (see the adjacent graph). In the Tampa-Saint Petersburg market, three buildings totaling nearly 500,000 square feet were completed, while two buildings totaling more than 280,000 square feet were built in Miami. Orlando’s industrial market had one cold storage delivery of 101,000 square feet during the past five years. Five of the six deliveries were occupied by food and beverage companies, including a 157,400-square-foot facility in Miami’s Eastview Commerce Center which now houses a produce distributor that expanded from 65,000 square feet.

Another 1.2 million square feet of cold storage space is in Florida’s pipeline in order to meet projected demand. One 185,000-square-foot building is currently under construction in Countyline Corporate Park in Miami and another 312,000 square foot building is planned there for delivery next year. Both buildings are located in the Hialeah submarket of Miami-Dade County. The three remaining proposed buildings are in the Central Florida region and comprise an additional 723,000 square feet of new cold storage space.

Implications for Our Clients

For developers, cold storage facilities offer a unique niche in the

industrial market and will likely address a growing need as online

grocery shopping habits become entrenched with many of the consumers who

tried such services during the COVID-19 pandemic. This specific segment

of the industrial market will likely benefit as well from increased

global demand for pharmaceutical production/distribution—a key user of

cold storage space—over the next few years, especially in response to

the COVID-19 pandemic. Industry professionals have begun to discuss the

possibility of a new hybrid classification capturing the blending

of cold storage and warehouse space, as logistics and distribution are

continuously evolving. Although build-out costs are significantly higher

when developing cold storage facilities (at $150/SF to $250/SF)

compared with more typical warehouse product, occupiers tend to remain

in place, as few competing buildings are able to accommodate such needs.

The cold storage industry is likely to remain under supplied for some

time even after accounting for the development pipeline, as food

manufacturers, exporters and importers often need such space in order to

grow their businesses. Industrial developers who can produce efficient

cold storage space are likely to benefit from this projected growth in

demand.

Sources: Brick Meets Click/Shopper, Bureau of Labor Statistics,

CoStar, GlobeSt.com, IBISWorld, National Real Estate Investor, Newmark

Knight Frank