May 2018

Demand Drivers Are Shifting the Industrial Development Pipeline

By Graham Hildebrand

The National Trend: New Industrial Product is Being Shaped by E-Commerce

A robust national economy over the past 24 to 36 months has generated additional demand for goods and more consumer spending in the United States. This spending, however, has accelerated a shift away from many mid-level, traditional, brick-and-mortar retailers, even as some luxury and discount chains continue to thrive. As one estimate suggests that nearly two-thirds of all American households now have Amazon Prime – stunning market penetration for any single service – the distribution segment of the industrial market is experiencing a rapid rise in demand for space. E-commerce and evolving consumer buying habits are shaping developers’ priorities for the location, type, and size of new industrial construction. They are responding to a market that has generated an average of more than 60 million square feet of quarterly demand since the start of 2014, and has a national vacancy rate of just 5.3 percent.

A shift toward fulfillment centers that support e-commerce hinges on logistics for many developers. A key differentiator between an in-store distribution center (i.e., sending goods to a Home Depot or Sears) and e-commerce fulfillment (sending goods to a single household) is location. Since a distribution center focuses on stores, a rural location – where land is cheap and space is plentiful – is appropriate. For direct-to-consumer fulfillment, however, the facility’s location is typically near a major metro area to support last-mile delivery. Additionally, the type and style of many new industrial developments revolve around e-commerce. Since e-commerce fulfillment centers require more workers and greater automation compared with traditional industrial product, developers have begun to focus on building design components such as slab depth, clear heights, power load, and bay depth. Another trend that is influencing industrial space demands throughout the United States is the combining of facilities. The trend of a combined distribution and fulfillment center (DC/FC) allows a company to aggregate its inventory and become more efficient as a result. As e-commerce firms focus on a customer’s buying patterns, this efficiency in facility design/use is crucial to achieving a strong return on occupancy costs.

Featured Market: Dallas/Fort Worth’s Rapid Expansion of Industrial Inventory

The Dallas/Fort Worth industrial market is one of the strongest in the nation. With three consecutive years of net absorption (occupancy growth) greater than 20 million square feet, it is clear that tenants view the DFW area as a key part of their supply chain and logistics strategies. Developers are responding, with more than 30 million square feet of industrial space delivered to the market last year. Keys to continued strength for the Metroplex’s market are its central location and its available land for development, as well as its educated labor force and reliable power grids. These characteristics will allow the DFW industrial market to continue to evolve and meet the needs of occupiers.

More specifically, the way in which e-commerce is a demand driver for industrial space is apparent throughout the subsets of the DFW industrial market. Recent large lease transactions in the furniture e-commerce arena, including Nebraska Furniture Mart’s 1.9 million-square foot combined retail store/distribution center near the Sam Rayburn Tollway and Plano Parkway, reflect a market that continuously adapts to new opportunities. Additionally, 2017 brought large e-commerce-related leasing activity near Alliance and DFW International Airport by UPS. Wayfair leased nearly 900,000 square feet near I-35 and Wintergreen, and Amazon continued to expand its footprint within the DFW market by leasing more than five million square feet of space at six DC/FC properties.

What Are the Implications for Our Clients?

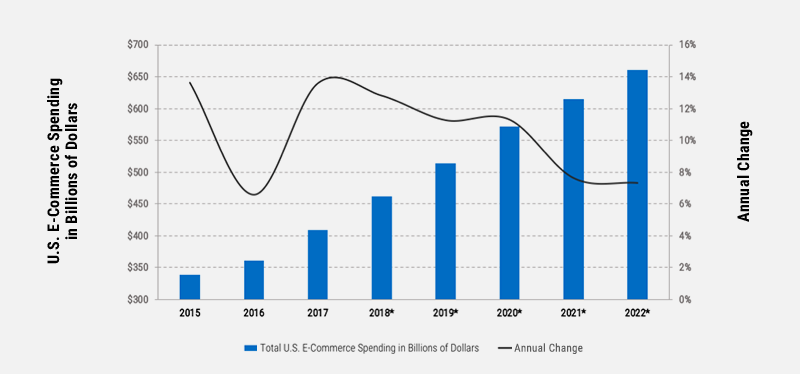

The shift in industrial demand toward distribution and fulfillment centers to support online retailers presents a unique opportunity for both tenants and investor/developers. Developers can benefit by the creation of thoughtful and well-located speculative projects because companies are notoriously underestimating the amount of space they will need for e-commerce activities – the market is growing at approximately 10 percent per year, as shown in the adjacent graph.

U.S. RETAIL SPENDING THROUGH E-COMMERCE

*Forecasted spending

*Forecasted spendingSource: Statista, Bureau of Economic Analysis, Newmark Research; May 2018

Tenants with e-commerce-based industrial needs may wish to focus their search for space on modern warehouses that have higher parking ratios, higher clear heights, and greater power loads. Older industrial product sometimes can be modernized to service today’s distribution and fulfillment processes, but tenants should be proactive in seeking space that is flexible enough to accommodate further expansion of their activities, given the rate of overall growth in this sector.