December 2018

Expanding Port Activity is Driving the Value of Adjacent Industrial Real Estate

By Eric Messer

The National Trend: East Coast Industrial Markets Are Entering a New Era

Over the past 20 years, American ports have experienced congestion and an inability to serve the newest generation of enormous container ships – with implications for industrial real estate. The Panama Canal expansion project, which was completed in 2016, doubled the capacity of the canal by adding a new, wider lane of traffic, allowing larger ships to pass. This has increased the demand for larger container vessels, which are causing bottlenecks and customs delays at U.S. seaports. For years, California ports were the only ones in the U.S. that could accommodate the largest vessels from Asia. However, now that these largest ships can transit the expanded Panama Canal, some are making their way to East Coast markets. The increase in East Coast port activity is driving improvement projects at these locations, which in turn are raising the value of industrial real estate adjacent to the ports.Featured Market: South Florida

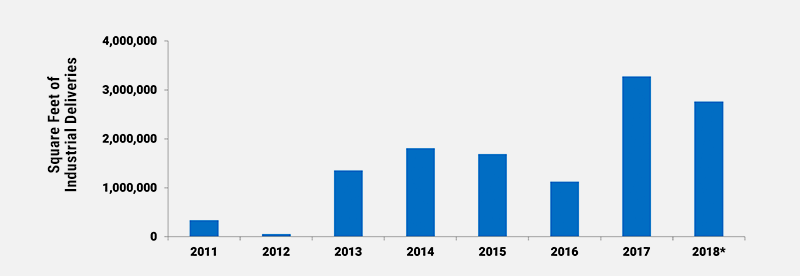

With the completion of the Panama Canal expansion and the protracted economic recovery, PortMiami has experienced a sharp increase in container volume—it is up 14.4% since the expansion project began in 2007. South Florida’s strong ties to Latin America and the Caribbean, coupled with having the closest East Coast ports to the Panama Canal, have been a huge boon for the region’s industrial market. Miami’s industrial vacancy rate of 3.7% remains near a record low despite the addition of more than 12.4 million square feet of new inventory since 2011, as shown in the adjacent graph. Newmark has tracked more than 35.2 million square feet of mid-to-large lease transactions (deals greater than 20,000 square feet) during that same period, which equates to nearly 10% of the total industrial inventory in the South Florida region. Miami hosted the vast majority of these deals, with 27.3 million square feet leased.INDUSTRIAL MARKET DELIVERIES

Miami Metro Area

2011-2018

*Through 3Q 2018

*Through 3Q 2018 Source: Newmark Research; December 2018

During the mid-2000s economic expansion, the majority of warehouse leases were completed by companies tied to the residential real estate industry. However, during the most recent economic boom, leasing activity has been led by logistics and distribution companies, which have constituted nearly 11 million square feet of large transactions. The retail/wholesale segment has followed, with 6.5 million square feet leased – activity attributable to the growth of e-commerce and distribution of goods to Latin America and the Caribbean. The evolution of leasing activity mirrors the reshaping of port activity.

PortMiami recently completed more than $1 billion in improvements, with the main cargo channel deepened to 52 feet, the installation of four Super Post-Panamax cranes to handle container ships with the largest capacity, completion of the PortMiami Tunnel connecting the port directly to Interstate 95, and the modernization of the port’s on-dock freight rail system. Similarly, Fort Lauderdale’s Port Everglades is planning more than $1.6 billion in improvements in order to retain its position as the top container port in Florida. Meanwhile, the Port of New York and New Jersey, a chief competitor, is in the midst of a $4 billion improvement plan that includes raising the Bayonne Bridge and deepening the harbor. On the West Coast, in an effort to retain their dominance, the Ports of Long Beach and Los Angeles are modernizing, too, with a combined $7.1 billion in new investments, including dredging, redeveloped terminals, new wharfs, and enhanced rail services.What Are the Implications for Our Clients?

In order to keep up with trade’s global evolution, retailers, supply chain managers, and third-party logistics companies are in need of improved distribution facilities in close proximity to urban areas – industrial real estate that supports rapid delivery of goods. Industrial developers are adapting to these needs by increasing storage capabilities while adjusting warehouse designs to improve the efficiency of operations. Most notably, the average warehouse size has increased 143% since 2007. In addition, high-tech conveyer methods and advanced automated storage and retrieval systems are adding to build-out costs—warehouse construction spending increased by 29% annually over the past five years.

Developers who had the greatest foresight about port-driven changes also experienced great rewards. Recent investment sale prices of these new and leased-out distribution facilities have, in some cases, more than doubled per square foot compared to warehouse sales that took place during the previous economic boom. Complementing and helping to drive the increase in port activity—and the related demand for warehouse space—is the rise of e-commerce, which is projected to grow by 60% over the next five years. Large fulfillment centers are breaking ground almost daily, and investors have a hearty appetite to acquire U.S. industrial properties, especially in gateway cities like Miami, Los Angeles, Seattle, and the greater New York City area. Owners and developers of modern distribution product near major ports have an opportunity to achieve strong returns as the renovations of those ports continue and global trade expands further.