The National Trend: Relative Returns Attract International Capital to the U.S.

The global pursuit of yield, adoption of quantitative easing programs and proliferation of real estate capital markets following the Great Recession have all contributed to a robust influx of foreign investment in U.S. commercial real estate. Since 2010, international sources have invested more than $365 billion in U.S. commercial real estate, mostly in a handful of “safe haven” markets and with long-term investment horizons. In the core office markets of New York, Washington, and San Francisco, foreign investors have filled the gaps left by domestic ones that have shifted their attention to higher-yield core-plus and value-added strategies.

Higher returns relative to prime cap rates in London and in parts of Asia, as well as the scale and liquidity of the U.S. market, continue to fuel demand from overseas investors. Furthermore, with treasury note returns very low in many developed economies, capital flows from abroad into U.S. commercial real estate should remain strong. Certain countries have limited investable product at home, which has contributed to the compression of their core cap rates and thus the desire of investors to look elsewhere for yield. The U.S. looks particularly attractive because of its strong job creation and overall economic growth.

International capital sales volume for the past 12 months totaled $52.6 billion, down nearly 40% year-over-year. Contributing to this decline are Middle Eastern countries – which have slowed their acquisitions as oil prices recover – and China, whose late 2016 government-imposed capital constraints primarily affected investment by insurers like Anbang. Despite these restrictions, China is the third-largest investor year-to-date, trailing only Canada and Singapore in spending on U.S. commercial real estate. Canada has long been the largest investor in U.S. commercial real estate, a result of favorable domestic conditions, proximity to the U.S., and a lack of domestic supply. Germany, Israel, Japan, Singapore and South Korea also have emerged as reliable capital sources.

Featured Market: New York Remains the Top Destination

Led by HNA Group’s acquisition of 245 Park Avenue for $2.21 billion, Manhattan remained the top destination for international capital over the past 12 months and represented 19.8% of all foreign investment into U.S. commercial real estate, greater than the next three largest market destinations combined. Despite a lack of core assets reaching the market, New York continues to benefit from strong demand for minority and partial interest in trophy office buildings. In one of the year’s highest-profile transactions, China Investment Corporation acquired a 45% partial interest stake in 1221 Avenue of the Americas, valuing the property at $2.29 billion.

International capital sales volume for the past 12 months totaled $52.6 billion, down nearly 40% year-over-year. Contributing to this decline are Middle Eastern countries – which have slowed their acquisitions as oil prices recover – and China, whose late 2016 government-imposed capital constraints primarily affected investment by insurers like Anbang. Despite these restrictions, China is the third-largest investor year-to-date, trailing only Canada and Singapore in spending on U.S. commercial real estate. Canada has long been the largest investor in U.S. commercial real estate, a result of favorable domestic conditions, proximity to the U.S., and a lack of domestic supply. Germany, Israel, Japan, Singapore and South Korea also have emerged as reliable capital sources.

What Are the Implications for Our Clients?

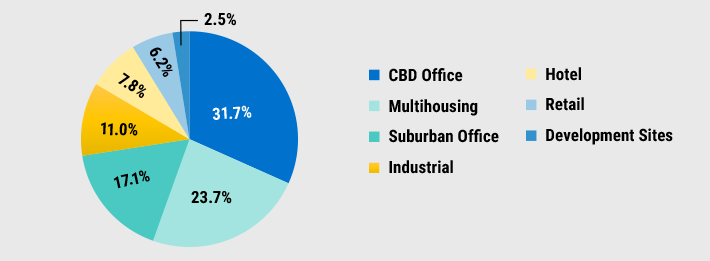

Although international capital has historically sought out trophy office assets in supply-constrained major markets, recent activity indicates a greater interest in diversified holdings. For instance, in 2015, Global Logistics Partners and China Life acquired a nationwide industrial portfolio comprising nearly 58 million square feet for $4.5 billion. Earlier this year, the Canada Pension Plan Investment Board and joint venture partner GIC acquired three student housing portfolios for $1.6 billion. In 2017, nearly one quarter of sales volume has been in the multihousing sector; office sales have constituted less than half of overall volume, as shown in the accompanying graph.

ACQUISITIONS OF U.S. COMMERCIAL REAL ESTATE BY INTERNATIONAL BUYERS

Volume Analysis by Property Type — January Through September 2017

In the period ahead, look for additional large first-time entries and increased diversification beyond the six gateway markets. Also, we expect greater demand for U.S. multihousing assets from major institutions across parts of Asia/Pacific and the Middle East, as international capital continues to seek out well-positioned, income-producing assets across the U.S.