What is the National Trend?

The U.S. has seen strong job growth over the past several years, although the rate of growth has begun to decelerate now that the current economic cycle has entered its mature phase. Job growth in office-using sectors—which include Professional and Business Services, Financial Activities, Information, Other Services and Government—is of particular importance to the commercial real estate industry, since these jobs drive the absorption of office space.

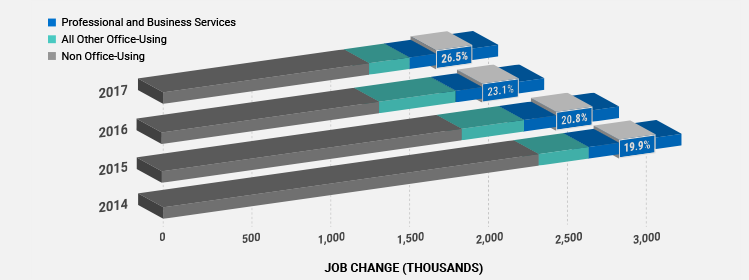

The Professional and Business Services (PBS) sector has been the largest private-sector employer among office-using industries, growing at a rate of 500,000 to 600,000 jobs each year from 2014 through 2017. More importantly, the PBS sector has seen its share of the total number of jobs added increase each year, from 19.9% of the nation’s jobs added in 2014 to 26.5% in 2017. These are high-wage positions that drive demand for office space—and Class A apartment units—and which have supported strong national office market fundamentals during the current expansion cycle, including 19 million square feet of net absorption during the first three quarters of 2017. As overall job growth slows, including in some other office-using sectors, these office-intensive PBS positions have represented a larger share of the new jobs created.

NEW PROFESSIONAL AND BUSINESS SERVICES JOBS ARE DRIVING DEMAND FOR OFFICE SPACE

Job change — United States: 12 months ending October 2014 vs. 2015 vs. 2016 vs. 2017

Featured Market: Where Is this Trend Notable?

The trend of PBS employment increasing its share of job growth has been especially notable in the Washington, DC, metro area. While most think of Washington as a government town, the region’s economy has increasingly diversified over the past four decades. In 1975, the federal government represented 23% of the region’s employment, while PBS constituted 11%. By 2017, that ratio had flipped, with PBS jobs representing 23% of area employment, and the federal government just 11%. Similar to the national trend, the percentage of PBS as a share of total job growth in the Washington metro area has increased significantly, from 26.0% of jobs added in the 12 months ending September 2015 to 37.3% of the jobs added in the 12 months ending September 2017. Strong PBS job growth at the national and local levels bodes well for the continued strength of U.S. office market fundamentals, even as the economic cycle decelerates.

What Are the Implications for Our Clients?

The job growth occurring nationally in office-using employment sectors is a positive indicator for the continued health of the commercial real estate industry, especially considering tenants’ demonstrated preference for top-quality, well-located office space. The Professional and Business Services sector is a large user of premier office space, and tenants in that category likely will continue to demand premium space in order to attract and retain top talent in a competitive labor market. Both foreign and domestic real estate investors continue to focus on acquiring trophy office space in urban areas of gateway markets, in part because of tenants’ flight to quality.