The National Trend: Not All Sublease Markets are Created Equal

An increase in available sublease space in the U.S. office market is a typical response to an economic downturn. While the cause of each market correction differs, layoffs, bankruptcies and other economic challenges historically have driven tenants to market excess office space during times of uncertainty. Current conditions are no exception, with work-from-home policies influencing tenant decisions regarding potential consolidations. The coronavirus pandemic and the recession it catalyzed have depressed office space demand and leasing velocity over the past year. National office market fundamentals continue to face downward pressure from sublease space, which are adding to vacancy and generating negative net absorption in many major markets. However, not every metro area is facing comparable sublease conditions.

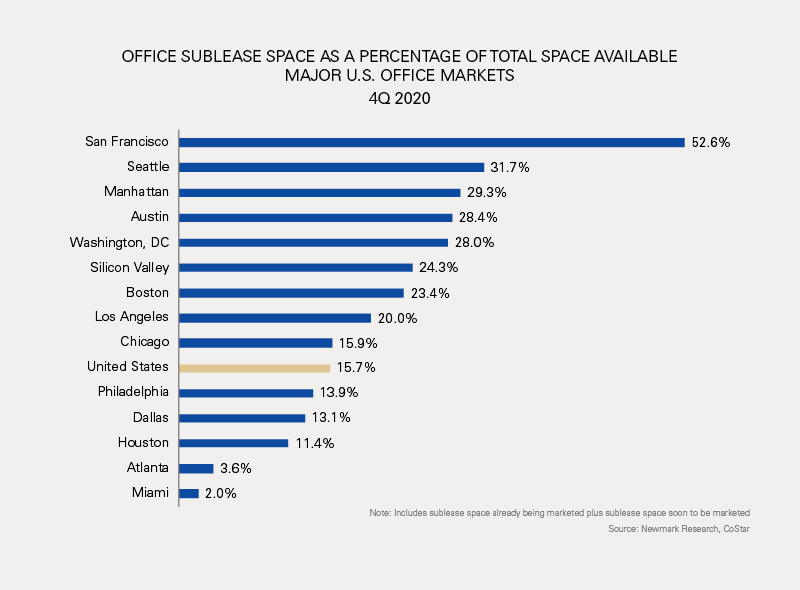

At the close of 2020, available sublease space reached 154.0 million square feet nationally—representing 3.1% of total office inventory and 15.7% of all availabilities. Over the past year, available sublease space expanded by 53.0% across the 56 markets tracked by Newmark. Accordingly, the sublease rate is 1.1 percentage points higher than it was at the end of 2019. Comparatively, sublease rates topped out at 2.7% following the Great Recession and 3.2% during the dot-com crash of the early 2000s. In short, sublease space is elevated, but not at unprecedented levels.

Many tech-centered, gateway markets experienced above-average growth in sublease availability during 2020, with sublease listings accounting for a greater share of vacated spaces in large urban centers. The sublease availability rate in Chicago more than doubled in 2020; in San Francisco, the rate more than tripled. Boston, Manhattan and Los Angeles have posted outsized increases of sublease space as well. As a result, several markets are facing more excess office space than at any time since the early 2000s. San Francisco, Seattle and Manhattan lead major markets in terms of sublease space as a percentage of total availabilities. In each of these three metros, sublets now represent more than 29% of all available space (see the adjacent graph).

While preliminary first-quarter 2021 data points to ongoing weakness

in the national office market as corporate users continue to re-examine

their real estate footprints, pockets of strength are emerging. More

sublet spaces were returned to the market in Manhattan, Chicago, Los

Angeles and Atlanta in the early months of 2021. Importantly, though,

the growth of sublet space availability in Boston, San Francisco and

Washington D.C. has plateaued in recent months, even experiencing modest

declines compared to fourth-quarter 2020 levels. A slight uptick in

tenant activity in the sublease market, combined with some leases

expiring and some sublease opportunities being withdrawn, has

contributed to the stabilization in these markets. Notably, some

sublease spaces were listed on a speculative basis, largely by tech

companies “testing the waters” to see if a potential subtenant would

materialize and subsidize their occupancy costs, rather than due to the

primary tenant no longer expecting to need the space. Some of these

sublease opportunities are now being pulled off the market.

Featured Market: Boston

Greater Boston sublet trends have mirrored many of the nation’s largest office markets during the pandemic, with tech-related layoffs and remote work strategies leading to escalating availabilities. Boston’s CBD and Cambridge are bearing the most fallout from the pandemic’s impact on the market, and sublease listings had surpassed 5.2 million square feet or 6.8% of office inventory across the two submarkets by the end of 2020. Both faced near-historic levels of sublet space in the fourth quarter as a result, although the metro’s suburban office submarkets are contending with less disruption. Despite these challenges, while leasing activity in Boston is still a fraction of pre-pandemic levels, velocity is beginning to gain momentum. In the metro’s CBD, notably, a disproportionately high share of that leasing velocity has come in the sublease market.

Over the course of 2020, roughly 480,000 square feet of subleases—or 25.4% of total CBD leasing volume, excluding renewals and extensions—were executed by Boston tenants. On a percentage basis, this ranks Boston third behind only San Francisco and Manhattan. Activity ticked up during the second half of 2020, with sublets accounting for more than 37.0% of executed leases in Boston’s CBD office market on a square foot basis. Momentum persists, as the majority of leasing velocity in the first two months of 2021—save for Amazon’s 630,000-square-foot build-to-suit expansion in the Seaport—was also sublets. Combined with several large blocks of space being reabsorbed or slated for lab conversion, total sublease availabilities in the CBD are down by more than 11.0% since peaking in December of last year.

Why are many Boston office users considering sublease options? Shorter terms, minimal capital output, more favorable economics and flexibility are key factors. Tenants seeking high-quality sublease space, however, are facing a competitive landscape. Nominally, active office requirements focused on sublease space have risen by 37.1% from June 2020 to February 2021 in Boston’s CBD and now account for 10.5% of total requirements. Just eight months ago, sublease requirements were only 6.0% of the total. Moreover, the average months-on-market for subleases signed since the beginning of 2020 is less than six months and the most desirable spaces are moving quickly.

The quick signing of sublease spaces is enhancing market momentum, although tenants continue to reassess their space needs for a post-pandemic environment. If more companies decide to reduce their office footprints, sublease availability could increase again in Boston.

What are the Implications for Our Clients?

Elevated sublease availabilities within the U.S. office market remain a key factor in the sector’s rent outlook and overall recovery. Much uncertainty still surrounds the near-term forecast as corporations will continue to re-evaluate their space needs in the coming quarters and sublease space may rise further, although some tenants who placed sublease space on the market for opportunistic reasons may choose to retain that space. Sublet offerings with extended term, high-quality build-outs and credit sublessors will continue to compete directly with asset owners for tenant requirements. Consequently, asset owners may need to bring more spec suites to market in order to compete with plug-and-play sublease options.

However, some large markets have fewer long-term sublease availabilities than others, meaning asset owners in those markets have less direct competition for tenants. Newmark Research examined sublease availabilities that have more than three years of term left. These sublets are more likely to compete with direct availabilities. Across all major metros, 44% of total U.S. sublease availabilities have 37 months or more of term remaining. Many of the major markets, including Boston, San Francisco, Los Angeles, Seattle, and Philadelphia, have a below average percentage of sublets that meet this criterion. Asset owners seeking to fill space with long-term tenants may face less of a challenge in these markets, notwithstanding their presently elevated sublease availability rates.

Although most asset owners have been able to hold face rents in the direct market, persistently high vacancies, driven largely by subleases, are weighing down effective rents due to expanded concession packages. While downward pressure on asking rates may intensify during the first half of this year, building owners who wish to maintain occupancy rates will use elevated tenant improvement allowances and free rent to sign tenants.

For tenants, the balance of power has shifted in their favor. Limited office demand and leasing activity, coupled with rising sublease availability, have given tenants in some gateway markets like San Francisco and Boston more bargaining power than they’ve had in years. With that said, the bid-ask spread between occupiers and asset owners is often sizeable, as many tenants with expiring long-term leases are being asked to pay significantly higher lease rates than they had been. Office users focused on sublets in more competitive markets such as Boston may need to act quickly in order to secure top quality spaces.