The National Trend: Life Science Sector is a Focus of Investor Attention

The year 2020 has been a formative one for life science real estate, as the COVID-19 pandemic has accelerated the institutional demand for lab and incubator space, biomanufacturing, R&D, and “innovation” spaces. The global vaccine effort, from R&D to production and distribution, has reinforced the importance of pharmaceutical, bio-engineering and therapeutics companies, as well as the need to have a domestic vaccine infrastructure to safeguard against future pandemics. The pandemic has also limited the scope of institutional real estate groups’ investment options, with market uncertainty impacting retail, hospitality, and some segments of office. While the most established life science real estate firms—namely Alexandria and Blackstone’s BioMed Realty—continue to hold the largest share of the market, competitors from traditional healthcare REITs to specialty players and large institutional groups are actively developing life science campuses, converting existing properties to life science use,

and/or acquiring life science properties in an attempt to meet future demand.

Even before COVID-19, the life science sector was considered a secular growth opportunity, with innovation in biotechnology, medical device technology, and genetics all occurring at a rapid pace. This growth was supported by record amounts of venture capital funding, which reached an all-time high of $9.1 billion for biotechnology startups and $21.8 billion overall for healthcare companies in 2019. The repercussions of COVID-19 have merely accelerated this trend and added tailwinds for pharmaceutical and health care companies that are active in vaccine development and distribution. Additionally, many life science employees cannot do their lab and R&D work from home and therefore must occupy physical space, circumventing work-from-home disruption being experienced by regular office-using tenants.

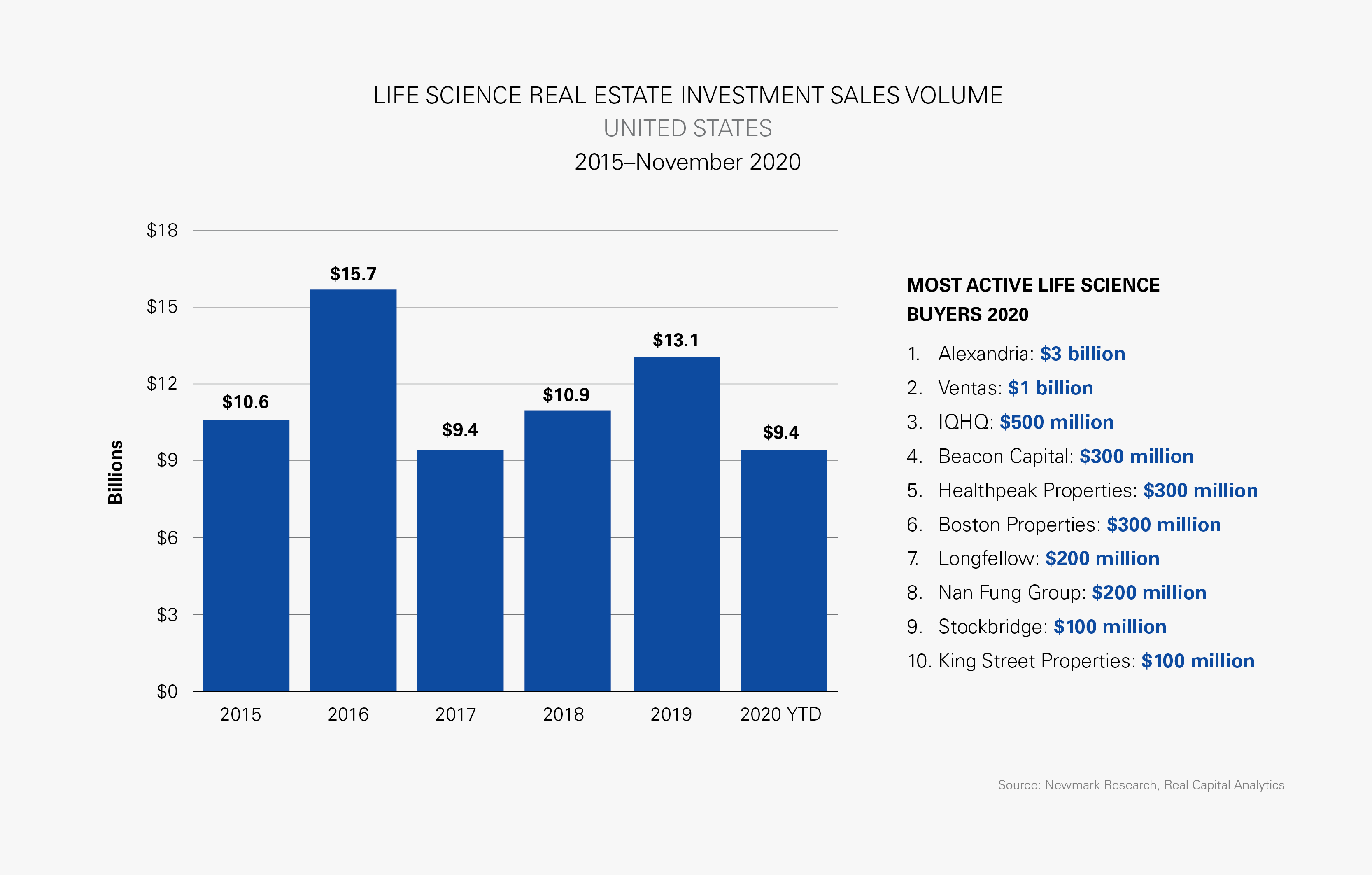

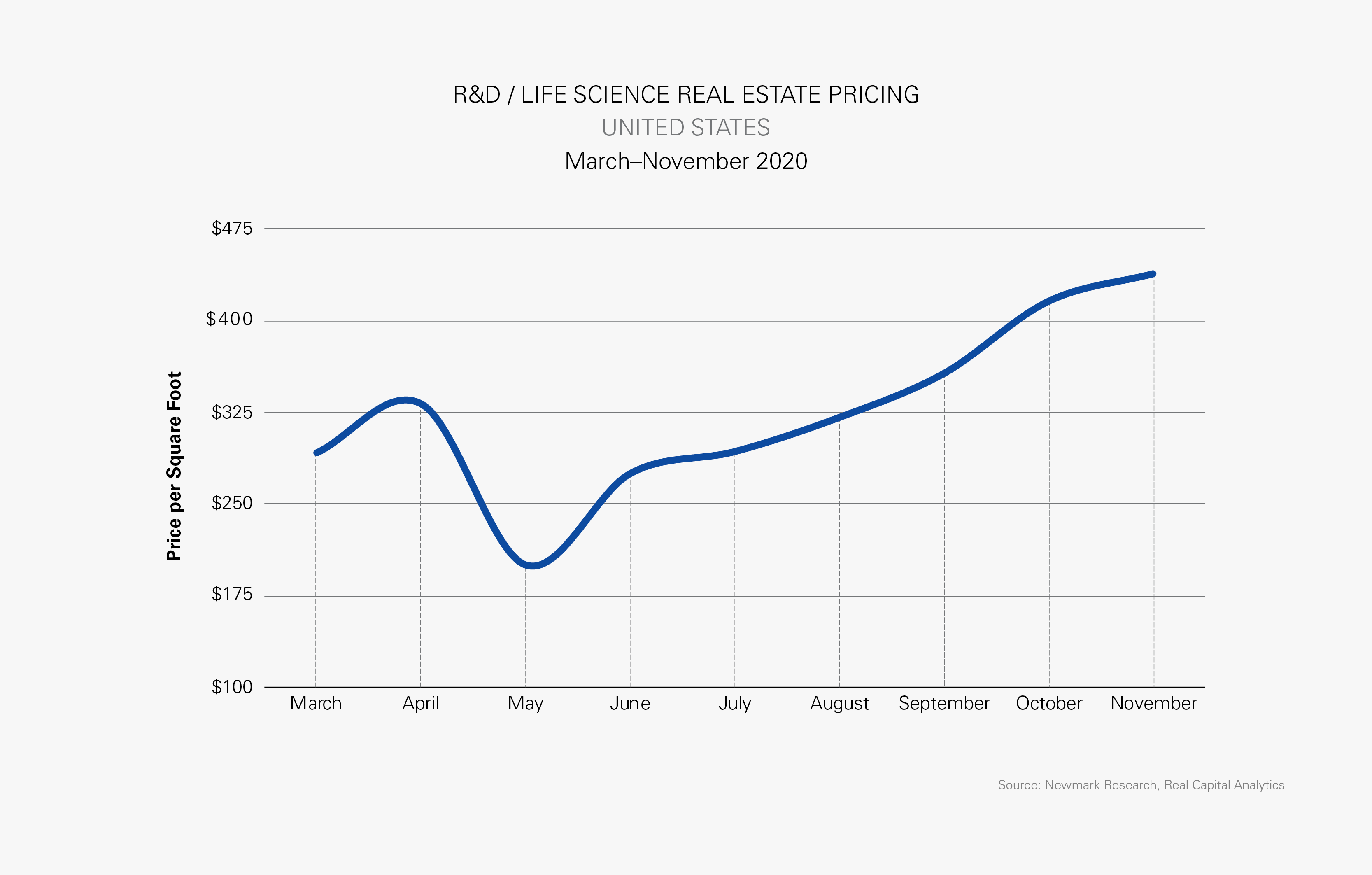

U.S. life science investment sales volume has reached an estimated $9.4 billion year-to-date (see first exhibit), down only 28.1% from a near-record full-year 2019 volume; this compares to a nearly 50% decline in overall investment volume (for all property types) over the same period. Life science capital markets activity was not immune to early COVID-19 disruption in the second quarter, but investors quickly pivoted in the third quarter, increasing volume more than 100% quarter-over-quarter to $2.9 billion. Similarly, pricing for life science and R&D product hit its lowest point in May but has since rebounded and surpassed pre-COVID-19 levels, reaching an average of $439 per square foot in November (see second exhibit). In the top markets the limited amount of life science space, particularly lab space, has created an investment bottleneck, further exacerbated by ample institutional dry powder and fundraising activity. Boston, San Francisco and San Diego have recorded average pricing in excess of $900 per square foot for top quality product. Additionally, high-water-mark pricing in those three markets over the past 24 months reached nearly $1,900 per square foot, up from $1,000 per square foot in 2015.

While the largest healthcare REITs such as Ventas and Healthpeak have traditionally targeted medical office buildings, seniors housing, and specialty care and hospital assets, 2020 has offered an opportunity to pivot toward life science and innovation assets. Ventas in particular has been active in 2020, with the initial close of its perpetual life science and healthcare real estate fund, and a $1 billion purchase of the three-property South San Francisco Genesis portfolio in October. Similarly, Healthpeak has made major investments in life sciences in 2020, closing on the Post building in Waltham, Massachusetts and going under contract for an estimated $700 million three-property portfolio in Cambridge.

While Blackstone has led fundraising activity in 2020, with an estimated $7.5 billion raised for their life science real estate perpetual fund, other players focused on life science real estate have gained momentum. IQHQ, a San Diego-based private REIT, has raised $1.7 billion in equity in 2020 and has become one of the fastest-emerging players in Boston, San Francisco, and San Diego. Tishman Speyer and Bellco Capital-backed Breakthrough Properties have raised $1 billion in their debut “Life Science Property Fund.” The fund will target value-add investments, such as their first development at 105 West First Street in Boston’s Seaport District, which will be fully leased to genetics company CRISPR and is slated to deliver in 2022.

Featured Market: San Diego

San Diego is considered one of the most established life science clusters in the country, and only trails Boston and San Francisco in size. However, it has recently attracted record amounts of investment volume, nearly $2 billion in the past 24 months, and continues to grow at a rapid pace. Traditionally, the majority of the life science activity has been concentrated in the Torrey Pines, University Town Center and Sorrento Valley submarkets, where University of California, San Diego and Scripps have driven innovation. However, downtown San Diego has been a recent target for life science developers and real estate groups. In an effort to appeal to biotech tenants that favor urban locations, IQHQ acquired two-and-a-half downtown city blocks surrounding the U.S. Navy’s new headquarters building for $230 million and are developing up to 1.6 million square feet of lab and office space in the renamed Research and Development District (RaDD). Additionally, Kilroy Realty, Stockdale Capital Partners and Phase 3 have all closed on life science deals in the past 24 months and are also committed to bringing life science to the downtown market.

Implications for Our Clients

The strong performance of this sector, the lack of available lab product, and the anticipated future need for lab space in a post-COVID-19 economy will all continue to drive life science capital markets activity. In and around urban and suburban clusters, office landlords and developers will continue to reconsider “highest and best use,” particularly as some office-using tenants reevaluate their future expansion plans and rework their existing office footprints based on their updated work-from-home policies. A robust development pipeline in Boston, San Francisco, San Diego, and Raleigh Durham/Research Triangle Park likely will support higher pricing and greater investment sales volume in the intermediate term.

Sources: Newmark Research, PERE News, Preqin, Real Capital Analytics