The National Trend: The Scope of New Taxes and Regulations That Affect U.S. Commercial Real Estate Values May Be Extended by the Coronavirus Pandemic

After a ten-year economic expansion cycle ended abruptly as a result of the coronavirus pandemic, the nation faces growing challenges. On top of immediate health and economic concerns related to the coronavirus, the nation continues to seek ways to combat climate change and address social inequities including housing affordability issues. To tackle these growing challenges, national and local politicians have increasingly turned to new taxes and regulations—many of which impact commercial real estate investment.

Populous states including New York and California have recently implemented new regulations that target commercial real estate. For example, in 2019, New York State passed the Housing Stability and Tenant Protection Act— sweeping legislation aimed at addressing rental affordability. Also last year, the New York City Council passed Local Law 97, aimed at reducing building emissions to combat climate change. Similar actions are being taken in other jurisdictions. Five U.S. states and the District of Columbia now have some form of residential rent control in place, and with the economic crisis brought on by the coronavirus, it is possible more jurisdictions will follow suit. While housing affordability is certainly a challenging policy issue that needs to be addressed, there has been substantial opposition from the commercial real estate industry to the new laws, as the industry reasonably questions whether those regulations are the best way to accomplish the stated goals—especially since most academic studies of the issue show that residential rent control reduces potential housing supply and increases rents for nearby tenants.

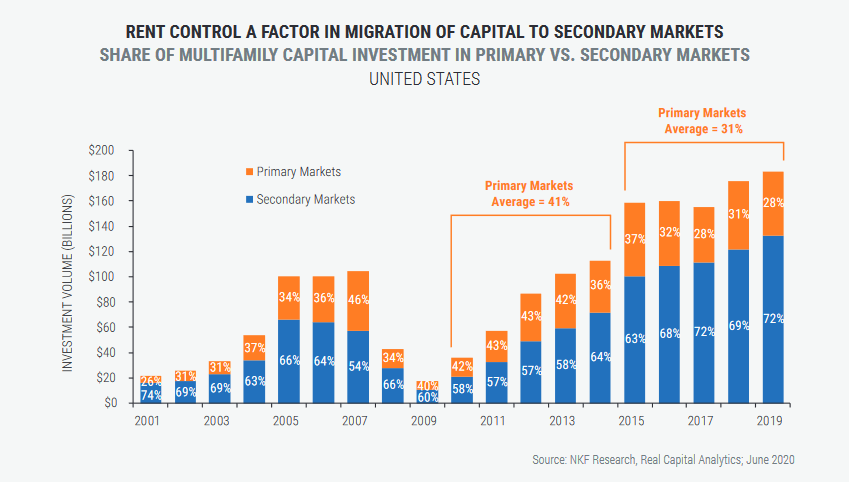

One effect of increased regulation in major markets could be the migration of capital to secondary markets, a trend already occurring in the multifamily sector. Between 2010 and 2014, the share of multifamily investment to primary U.S. markets averaged 41%. Over the past five years, as rent regulation has increased, that share has declined to an average of 31%. This decline is illustrated in the adjacent graph.

Of course, some migration of capital to secondary markets can be attributed to long-term growth in the U.S. economy, with investors more willing to bet on emerging markets further into an economic cycle, particularly as they search for yield. However, a significant factor contributing to reduced investment in primary markets is very likely a result of the increased regulations—and particularly rent control—in major markets including Los Angeles, New York and San Francisco. As the beneficiaries of this trend, less regulated markets such as Phoenix, Raleigh-Durham, and Dallas have received more multifamily investment capital. In the current environment, concern about the spread of disease in densely-populated cities could further the migration of capital to less populous investment markets, although New York is now seeing a reduced incidence of coronavirus infections and that market is reopening for business, while some smaller markets continue to see COVID-19 infection rates increase.

In addition to stricter regulations around commercial real estate, many U.S. jurisdictions seeking to address housing affordability are increasingly looking to high-end commercial property as a source for more tax revenue, especially as state and local budgets are crunched in the current economic crisis. Even before the coronavirus pandemic, real estate transfer tax increases were passed in the State of Washington and in the District of Columbia in 2019. However, raising taxes may have unintended consequences. Increased tax rates can slow or stall investment in a particular market as buyers may seek alternatives in other nearby jurisdictions with more favorable tax rates. In turn, a reduction in investor interest can reduce asset values and the tax revenue they generate.

Some legislative initiatives are beneficial to the commercial real estate industry, including municipal investment incentives and development incentives such as the federal Opportunity Zones program. While some of these incentives may be curtailed in the short-term as states and localities seek to patch strapped budgets, in the longer term they may help generate needed activity in jurisdictions sharply impacted by the economic crisis.

Featured Market: Cleveland/State of Ohio

One example of legislation that is beneficial to commercial real estate is Ohio’s Substitute Senate Bill 39. The bill has yet to become law but could kickstart several proposed real estate mega-projects in the state. It would authorize an insurance premiums tax credit for capital improvements to transformational mixed-use development (TMUD) projects that meet certain criteria. The law, if passed, could assist the completion of a highly-anticipated mixed-use project such as Cleveland’s $350 million nuCLEus, which could transform the surrounding area by adding a mix of high-end residential, office, hotel and retail users as the economy recovers—plus their tax revenue. One goal would be to attract other nearby developments that could add to the economic activity.

What Are the Implications for Our Clients?

In light of recent changes to the tax and regulatory environment—with more potentially forthcoming—how can owners, investors and tenants prepare for the years ahead?

- While new tax laws and regulations are putting pressure on the commercial real estate industry in some major markets, secondary markets with fewer regulations may benefit. A diverse investment strategy, which includes both primary and secondary markets, may be an especially productive and perhaps necessary approach in the current environment.

- One solution to America’s housing affordability challenges may be upzoning, in which new supply is created that is complementary to adjacent inventory, such as multi-unit townhouses next to single-family homes. Commercial real estate developers and investors who are concerned about implementation of rent control may wish to put their political capital behind advocating for upzoning, which also could accrue to the long-term benefit of tenants and enhance the diversity of communities.

Sources: National Multifamily Housing Council, Newmark Research, The Ohio State Legislature, Real Capital Analytics