July 2018

Obsolete Office Properties Are Being Successfully Converted into Multihousing

By Alex Shirokow-Louden

The National Trend: Accelerating Office Obsolescence Creates Conversion Opportunities

As the national office market evolves, a trend proliferating in cities nationwide has been the conversion of office buildings to multihousing use. In a recent study, Newmark found that approximately 8% of the current U.S. office inventory is obsolete. With so much older, less-amenitized office product not meeting the needs of today’s tenants, property owners have found converting an undesired office building to another use can be a profitable course of action.

While older office space tends to see less tenant demand, city dwellers nationwide have placed a premium on multihousing options located in submarkets offering a walkable, pedestrian-friendly amenity base. Well located but noncompetitive office product can be ripe for conversion to meet this demand for downtown housing. From an investor’s perspective, an increase in income from such a conversion can be significant, particularly at challenging points in the real estate cycle. In the immediate aftermath of the Great Recession, from 2010 through 2015, apartment rent growth exceeded rent growth for office product nationally. This disparity, driven in part by changes in how office space was being used and a tenant focus on controlling occupancy costs, guided some office owners to convert their properties into multihousing units. As the cycle matured, office rent growth surpassed that of the multihousing market nationally, making the case for conversions a more nuanced one.Featured Market: Baltimore’s CBD Active for Office-to-Multihousing Conversions

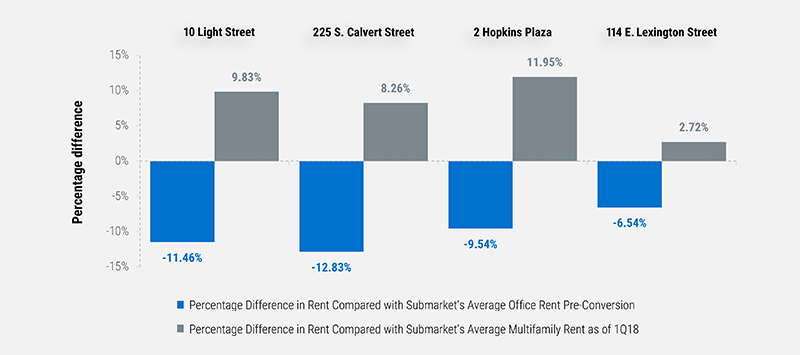

In general, office properties that are no longer competitive within their specific submarkets are an investor’s best target for conversion to multihousing. The City of Baltimore has used tax credits for several years to incentivize office-to-apartment conversions in portions of downtown that had a glut of underperforming office assets and an undersupply of residential units. Newmark analyzed a sample of four office buildings located in Baltimore’s Central Business District submarket that were underperforming the submarket’s average office rent at the time of conversion. Following conversion, each property outperformed the submarket’s average multihousing rental rate, as shown in the adjacent graph. On average, the four properties Newmark examined posted rents 8.19% higher than the submarket’s average effective apartment rent as of the first quarter of 2018. Immediately before undergoing conversions, the properties were averaging 10.09% below the average effective rental rate for the Baltimore CBD office submarket. It is worth noting that the four properties examined were converted to luxury apartment uses, meaning effective rents naturally would fall on the high end of the spectrum. However, the majority of multifamily product within the Baltimore CBD submarket is classified as luxury units, making for a fair comparison. Further, most office-to-residential adaptive reuse on a national scale involves conversion to luxury residential units.OFFICE-TO-APARTMENT CONVERSIONS HAVING RENTAL RATE SUCCESS

SELECTED OBSOLETE OFFICE PROPERTIES CONVERTED TO MULTIHOUSING

BALTIMORE CBD SUBMARKET

Source: Newmark Research, Axiometrics; July 2018

Downtown Baltimore’s office market has seen multiple recent office-to-residential conversions, particularly within the older sections of downtown along the Baltimore Street and Charles Street corridors. The Baltimore CBD submarket consists primarily

of office product—there are 148 office buildings within its boundaries, versus 72 properties classified as multifamily. Since 2014, the Baltimore CBD submarket’s office inventory declined by 435,153 square feet, or 19%. This reduction

in overall space was in part due to conversions such as 2 Hopkins Plaza, formerly a 404,089-square-foot Class B office building that was transformed into a mixed-use residential tower. Developer Berman Enterprises converted the upper half of the

building into luxury apartments, retaining the lower ten floors as 179,181 square feet of office space now leased to the U.S. Army Corps of Engineers. Over the past four years, office vacancy for the Baltimore CBD submarket has declined by 155

basis points, and now measures 14.8%. A reduction in obsolete inventory can benefit the perception of an office market as well as its fundamentals, although that progress tends to be incremental.