The National Trend: Divergence in Office-Using Employment Recovery Driving Bifurcation of Office Market Performance

The rapid onset of the coronavirus pandemic sent global markets, including real estate, into an unexpected period of contraction. Dramatic changes to daily life and widespread business interruptions put some corporate balance sheets under downward pressure, resulting in employee furloughs, layoffs and sometimes business closures. Nationwide, 20.5 million nonfarm jobs were lost in April, of which 3.1 million were private sector office-using jobs. Real estate investment activity slowed as logistical hurdles, unemployment concerns, and economic uncertainty kept investors on the sidelines.

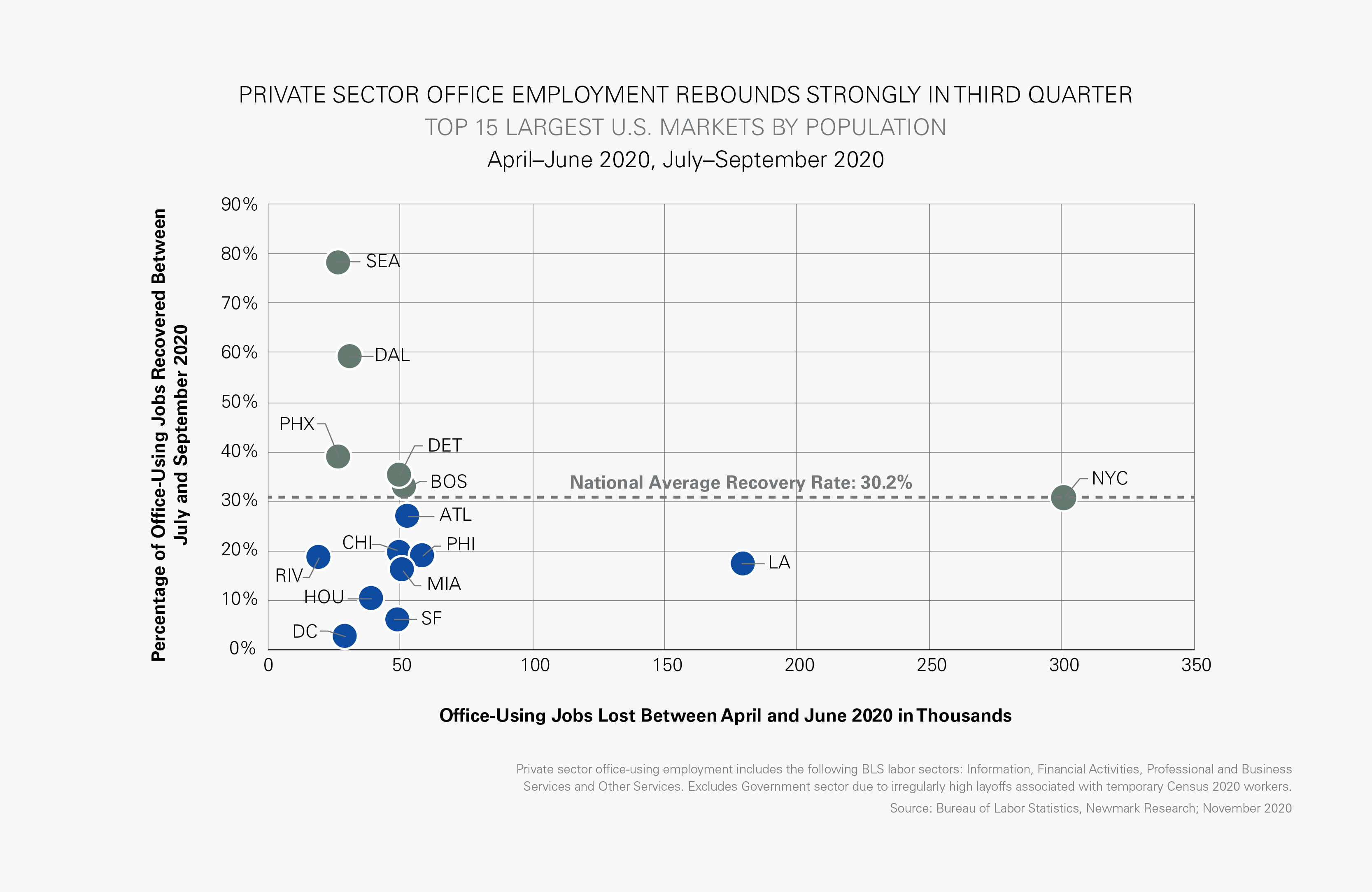

However, during the third quarter of 2020, office-using employment among the 15 largest U.S. markets rebounded swiftly (see the first exhibit following). Nationally, 30.2% of the private sector office-using jobs lost in the second quarter were recovered by the third quarter. Relative to past economic crises, the speed of this rehiring is encouraging for office and multifamily markets, which rely on high-wage employment as a key demand driver.

Professional and Business Services (PBS) represents the largest and most diverse share of office-using labor. Among the top 15 largest U.S. metros, PBS represents 56.5% of office-using jobs. Most markets lost between 4–7% of PBS jobs in the second quarter, however almost all recorded PBS job growth in the third quarter. Seattle and Dallas led all markets in PBS recapture rates, at 94.1% and 71.8%, respectively. Given the diversity of PBS jobs as well as the strong third-quarter recovery rates, markets with above-average concentrations of PBS jobs may see office-using employment recover more rapidly. While employment growth in all office-using sectors is beneficial for demand, PBS’s size makes it critical for rebuilding office market confidence.

Though smaller in size, the Financial Activities sector has exhibited the fastest national recovery rate among office-using sectors at 55.0%. Recovery rates among Financial Activities jobs were exceptionally high in Dallas, Seattle, and Riverside (CA), where third quarter job gains exceeded second quarter losses. Despite this rapid recovery, these three markets collectively added just 9,000 Financial Activities jobs to the market, which highlights the sector’s relatively small impact on office demand.

Recovery of the Information sector has been more volatile. Economies of scale are important in supporting the recovery of this sector, which includes jobs in software, communications, publishing and motion picture/sound recording. The largest Information markets (New York City, Los Angeles, Seattle) exhibited the highest recovery rates, however only one market recovered more than 25% of jobs lost. Seven of the top U.S. markets continued to lose Information jobs in the third quarter. Additionally, while technology companies have generally performed well during the pandemic, some have embraced remote working and plan to continue it in some fashion in the long-term. For these companies, office-using employment will be at least modestly decoupled from office demand.

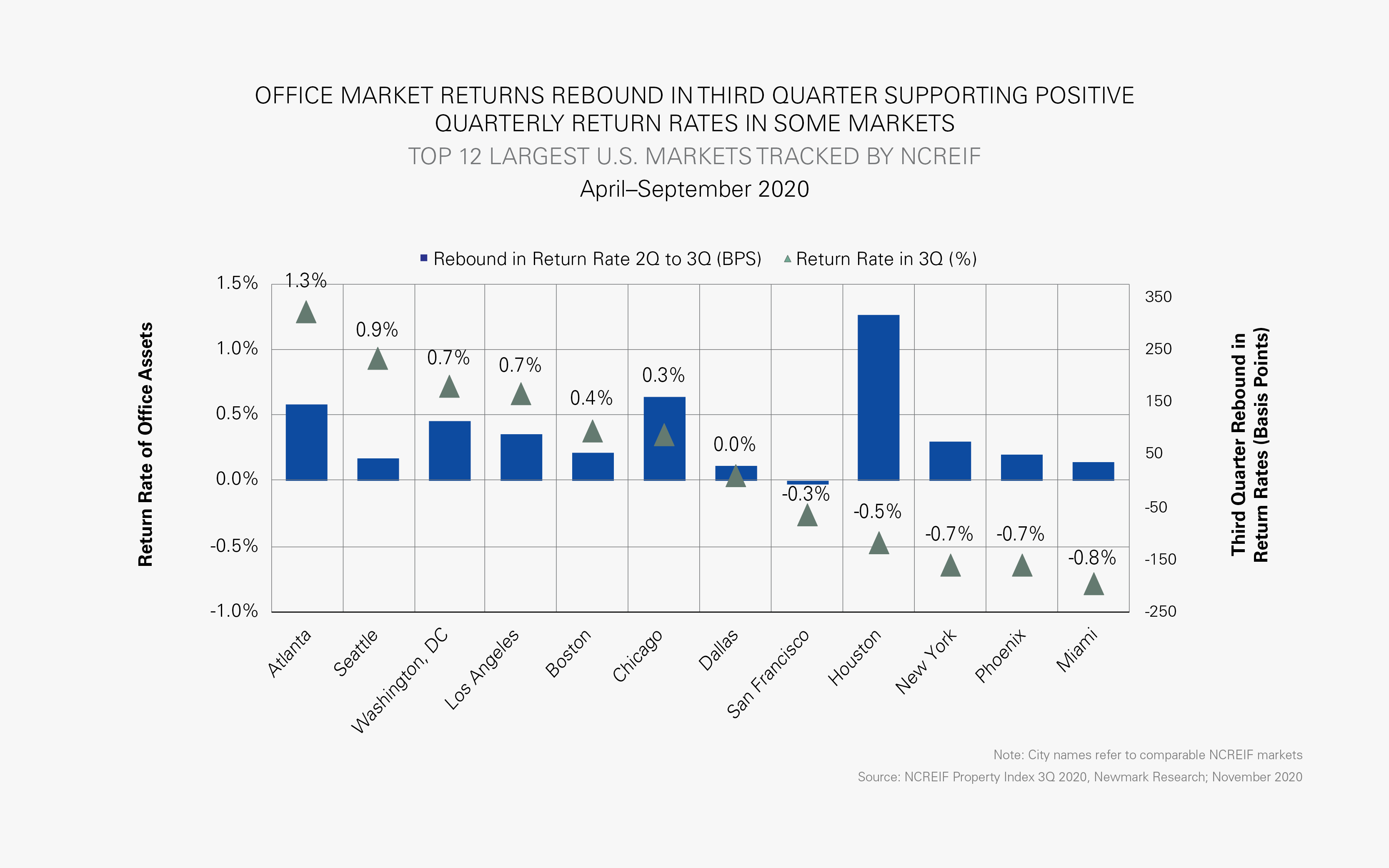

Key real estate sectors appear to be recovering in the third quarter as well. While office and multifamily investment markets were slowed after the pandemic, both rebounded in the third quarter. Office assets have been operating at a structural disadvantage during the pandemic however, as occupiers extend their remote working timelines and buildings remain underutilized. Despite the hurdles, market indicators show asset value strength and growth. According to the NCREIF Property Index (NPI), national office index values contracted by 0.5% between the first and second quarters, which was less than multifamily, which fell 0.6%. While multifamily rebounded faster in the third quarter, annual growth rates modestly favor office assets, which recorded 2.8% growth to 2.3% for multifamily.

Also promising for investors, office return rates measured by NCREIF show recovery in nearly all top markets (see the second exhibit). While not all markets with positive return rates exhibited strong office-using employment growth, some did, including Seattle and Boston. Markets recording negative office returns were more likely to exhibit below-average office-using job recovery rates, including Miami and Houston. While many factors can influence institutional office return rates, office-using employment is essential in supporting demand and therefore long-term growth of office returns.

Featured Market: Seattle

Seattle stands out among major U.S. markets due to the speed of its labor recovery and its sturdy real estate investment market. Seattle was one of the few office markets to record investment activity growth in the third quarter, up $604.2 million to $781.9 million. The average cap rate fell 10 basis points to 5.4% and the average quarterly office return rate was second only to Atlanta’s, measuring 0.9%.

Seattle recorded a loss of 26,900 private sector office-using jobs from April to June 2020 but recaptured 21,000 jobs from July to September 2020. This 78.1% recovery rate ranks first among top U.S. markets. Seattle’s concentration of consumer technology headquarters makes it well-suited to recover from the immediate shocks of the coronavirus, although some tech firms are placing sublease space on the market in an effort to reduce occupancy costs.

Amazon has benefitted from increased demand for e-commerce services during the pandemic and has been aggressively hiring to meet demand. Since the beginning of the pandemic, Amazon has announced the hiring of 225,000 new full-time workers to support global operations. While most of these hires are based outside of Seattle, Amazon’s headquarters will inevitably absorb a share of these workers. Other large firms such as Microsoft are similarly growing headcount to meet increased demand for technology services. Small and mid-sized firms such as Axon, Ziply Fiber, Seagen and Remitly have also boosted hiring levels.

Although the tech industry has bolstered Seattle’s recovery from the pandemic, the financial struggles of Boeing may slow the city’s economic expansion. In late 2020, Boeing announced that it will lay off 31,000 employees by year-end and aims to shed one-third of its real estate portfolio. The economic ramifications of this move will prove challenging for the market, as Boeing is Seattle’s largest private employer and seventh-largest owner of office real estate. In short, Seattle features a mix of employers and a focus on tech that is well-suited for growth in 2021, but ongoing limitations on air travel and Boeing’s importance to the area will remain a hurdle.

Implications for Our Clients

While the pandemic has forced many office occupiers to temporarily work remotely, office-using employment growth may support stronger office demand once firms begin “re-boarding.” Even as tenants face pressure to reduce occupancy costs, they also are recognizing during this forced remote work experiment that building corporate culture and mentoring staff without face-to-face interaction is a challenge. In particular, turnover is expensive for most office-using organizations, and the lack of loyalty bred by remote work is likely to lead to more turnover.

Once the pandemic has been controlled and office re-boarding occurs in earnest, the most likely outcome is an increase in flexible scheduling, with some employees working from home regularly but many others returning to the office full-time, depending on their functions. The markets that have seen the strongest rebound in office-using employment during the pandemic are well positioned to lead the recovery of demand for space.

Sources: Amazon, Bureau of Labor Statistics, CoStar, NCREIF, Real Capital Analytics, Newmark Research