February 2019

Short-Term Housing is Shaping the Multifamily and Hospitality Markets

By Kevin Sweeney

The National Trend: Innovative Solutions are Redefining Short-Term Housing

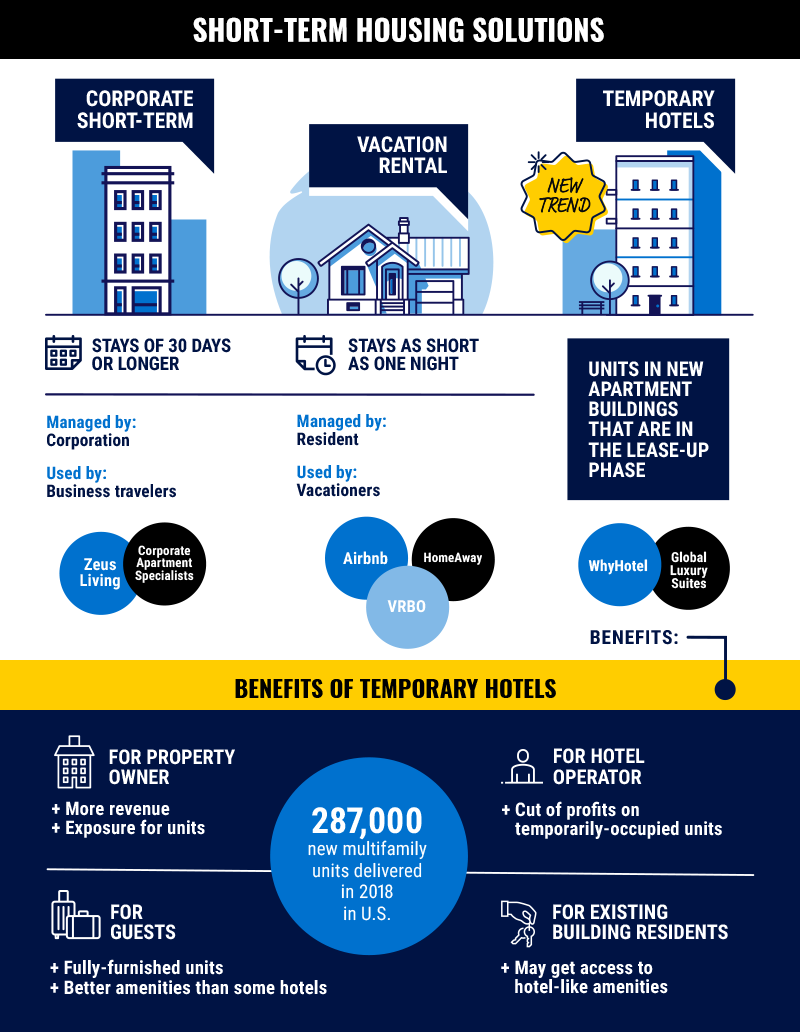

Short-term housing options have been a mainstay in many U.S. cities for decades. Corporate housing has appealed to companies that host seasonal or temporary workers, and vacation rentals may be less expensive and better appointed than hotels for some families and other visitors. However, with the rise of the internet have come new options, beyond the familiar hotel model. Short-term housing needs take many forms, from 30-day stays to overnight trips. Those needs often are met with fully furnished apartments that include kitchens, supplies, and access to amenities. Further, innovative solutions that temporarily repurpose underutilized real estate are gaining traction.

Focused on short-term housing, Zeus Living and Corporate Apartment Specialists provide guests with furnished apartment units for stays of 30 days or longer in buildings that are typically close to full. Guests using Zeus Living’s services could be travelers, locals in between leases, seasonal workers, or traveling corporate executives and staff. Corporate Apartment Specialists’ services are tailored to the business traveler. Corporate Apartment Specialists typically caters to companies looking to lodge contract or temporary workers, relocating employees, executives, and expatriates. According to the Corporate Housing Providers Association, corporate housing inventory in the United States in 2017 was more than 70,000 units, and the average stay was 78 nights.

Going beyond corporate functions, Airbnb and vacation rental companies such as VRBO and HomeAway allow residents in multifamily buildings or single-family homes the ability to rent their own spaces for stays as short as one night. Guests using these services are usually visiting a location for leisure, and prefer a home-like environment rather than a hotel room. Recently, a blended category—temporary hoteling—has emerged. As shown in the adjacent graphic, companies such as WhyHotel and Global Luxury Suites rent out units in new apartment projects that are in their lease-up phase and offer them as hotel rooms. These units are fully furnished and offer guests space and access to amenities that a typical hotel room does not. The apartment units serving as hotel accommodations are managed separately from the apartment units available for lease. As a property’s lease-up cycle progresses, the number of units offered as hotel rooms dwindles until it no longer makes sense to continue the temporary revenue program. These companies are looking to take advantage of a competitive multifamily market that delivered more than 287,000 units in the United States in 2018, providing plentiful inventory.

The Impact of Short-Term Housing Solutions on the Multifamily Market

Short-term housing supply affects the multifamily market in various ways. The steadiness of corporate housing demand provides some stability for apartment property managers. The newer temporary hotel model that operates in recently delivered multifamily and mixed-use projects turns vacant units into short-term hotel rooms, allowing property owners to generate revenue during a lease-up period that can last anywhere from 8-24 months. This alleviates some risk for developers who may be over-leveraged in a competitive market, and helps to activate retail and other commercial uses in and around a project. Rather than allow vacant units to sit empty, investors are seizing on revenue-producing concepts such as temporary hotels.

These innovations have some drawbacks as well. Multifamily property owners are hesitant to view short-term rentals, such as Airbnb, as sustainable long-term options; owners run the risk of alienating residents who are concerned about frequent turnover of guests, crowded common and amenity spaces, and security. Many tenants lease apartments long-term for a stable and calm environment, and loud or disruptive overnight guests can become a nuisance. There is also the concern that property owners only use these services as a last resort; tenants often are not permitted to sublease units, leading to complaints that ownership or a third-party manager is able to monetize empty space when residents cannot.

The Impact of Short-Term Housing Solutions on the Hospitality Market

Short-term rentals have certainly been a challenge to the hospitality industry as hotel guests increasingly consider the value of amenities that multifamily units provide, such as full kitchens, more storage space, and a more intimate environment. Approximately 65% of short-term Airbnb bookings in 2017 were in multifamily buildings. Each of these guests likely opted for these accommodations over a hotel room nearby. Airbnb also estimates about 660,000 listings in the United States, with average pricing for an entire home 6% to 17% cheaper than a hotel room in the top 25 markets, leading to lower nightly hotel rate growth nationwide. Short-term operators can offer lower rates because they are not covering major infrastructure or construction costs associated with building a hotel or multifamily building, and travelers are well aware of this. However, with a glut of options for business and leisure travelers, oversaturation of these newer formats could become an issue. Further, established hotel chains are pushing back by expanding their amenity offerings and emphasizing the value of energizing, social environments that private rentals do not offer.Featured Market: Washington, DC Metro Area

As the nation’s capital, Washington, DC has long had steady job growth and a robust tourism industry, yielding strong multifamily and hospitality markets. In the fourth quarter of 2018, the multifamily occupancy rate in the Washington, DC metro area was 95.5%, and average hotel occupancy in the metro area has been in the low-to-mid 70% range over the last few years. In 2017, the Washington, DC region drew 22.8 million visitors, with 59% visiting for leisure and 41% visiting for business purposes. Corporate housing is important in the region, as the federal government attracts guests year-round. Tourism itself contributed over $800 million in tax revenue from $7.5 billion in visitor spending in 2017. Hotel occupancy was down, however, due in part to increased use of short-term options such as Airbnb.

The Washington market served as a catalyst for innovation in the short-term lodging space. WhyHotel tested its format in the Washington market with a pop-up hotel in 2017, and has since expanded to Baltimore. The company offers hotel amenities to the full-time residents of the apartment buildings in which it is located, such as linen cleaning services. The hotel function also provides an opportunity for the apartment property to showcase itself to potential residents.

What Are the Implications for Our Clients?

Short-term housing options can benefit multifamily investors while acting as more of a challenge to traditional hospitality investments. The newest housing solutions offer multifamily developers and owners immediate income opportunities during the lease-up phase of a project’s life cycle—a notable advantage that can make it easier to pencil a project and cover debt. Although these accommodations appeal to certain types of travelers, the risk of oversaturation or disruption in the hospitality industry exists. Extended-stay or suite-style hotel accommodations specifically seem to be the most vulnerable to the corporate housing business, while companies like Airbnb and WhyHotel can siphon occupancy and revenue from standard hotels. Pop-up hotel companies benefit from limited infrastructure and construction costs while reaping the rewards of lower staffing and management costs. Established hospitality companies may find an acquisition opportunity or replicable model in this sector, while apartment developers may be able to take advantage of reduced risk during the lease-up phases for new projects.