The National Trend: Pandemic-Accelerated Shifts

One of the enduring lessons to emerge from the coronavirus crisis is that of the pandemic as accelerant. Arguably the clearest example of this is the impact that the COVID-19 pandemic has had on eCommerce. While much has been written about the evolution of physical retail that eCommerce has driven over the past two decades, what is often overlooked is that eCommerce itself continues to evolve radically. This transformation has resulted in shifting real estate strategies by users of commercial space.

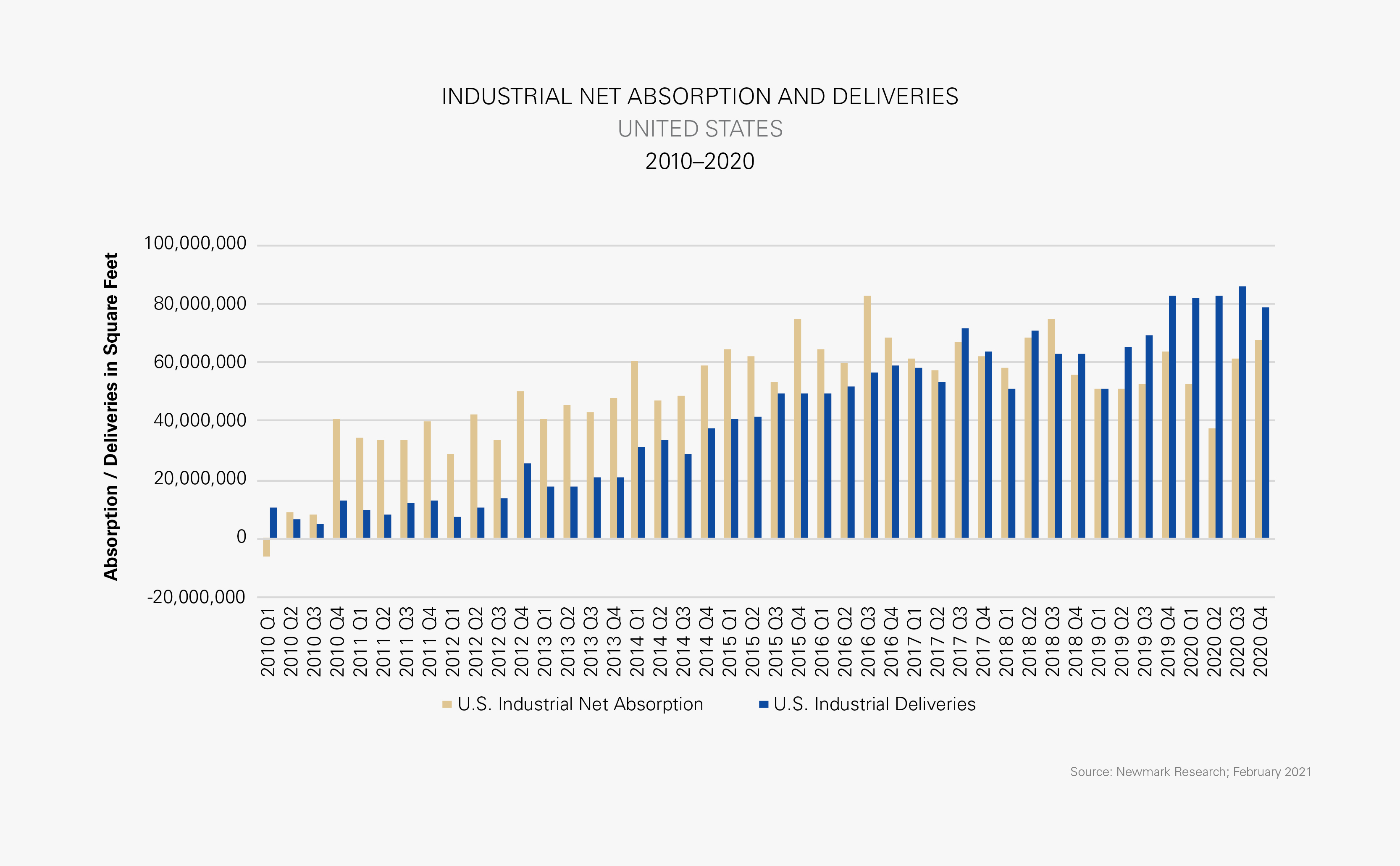

Industrial already was arguably the strongest commercial real estate asset type before the pandemic. Since 2010, the U.S. industrial market has absorbed more than 2.2 billion square feet of industrial space, significantly outpacing the 1.8 billion square feet of space that was delivered during that time (see the adjacent graph). Vacancy during this period fell from 10.7% to the current rate of 5.7% (as of Q4 2020). While not all of this activity was driven by eCommerce users, those firms were a driving force in these occupancy gains, from the online retailers themselves to logistics firms and other suppliers critical to eCommerce infrastructure. For most of this period, demand was focused on mega-fulfillment center spaces of 500,000 square feet or more.

The COVID-19 pandemic has clearly favored industrial real estate even while posing challenges to many other sectors. Industrial demand continues to rise. Development pipelines are expanding, as most markets report a shortage of modern industrial facilities. Rents are rising. Investor demand is up. Prices are escalating and cap rates are compressing.

Against this backdrop, it would be easy to assume that the pandemic has merely accelerated all the trends that shaped industrial demand over the past decade. However, what it has really done is significantly accelerate a new trend that had just been emerging: filling holes in hub-and-spoke networks due to the need for even greater speed of delivery. That evolution is about achieving same-day delivery—an important goal for online sellers because consumers are demanding it. This need to focus on the “final mile” has profound implications for users’ real estate strategies.

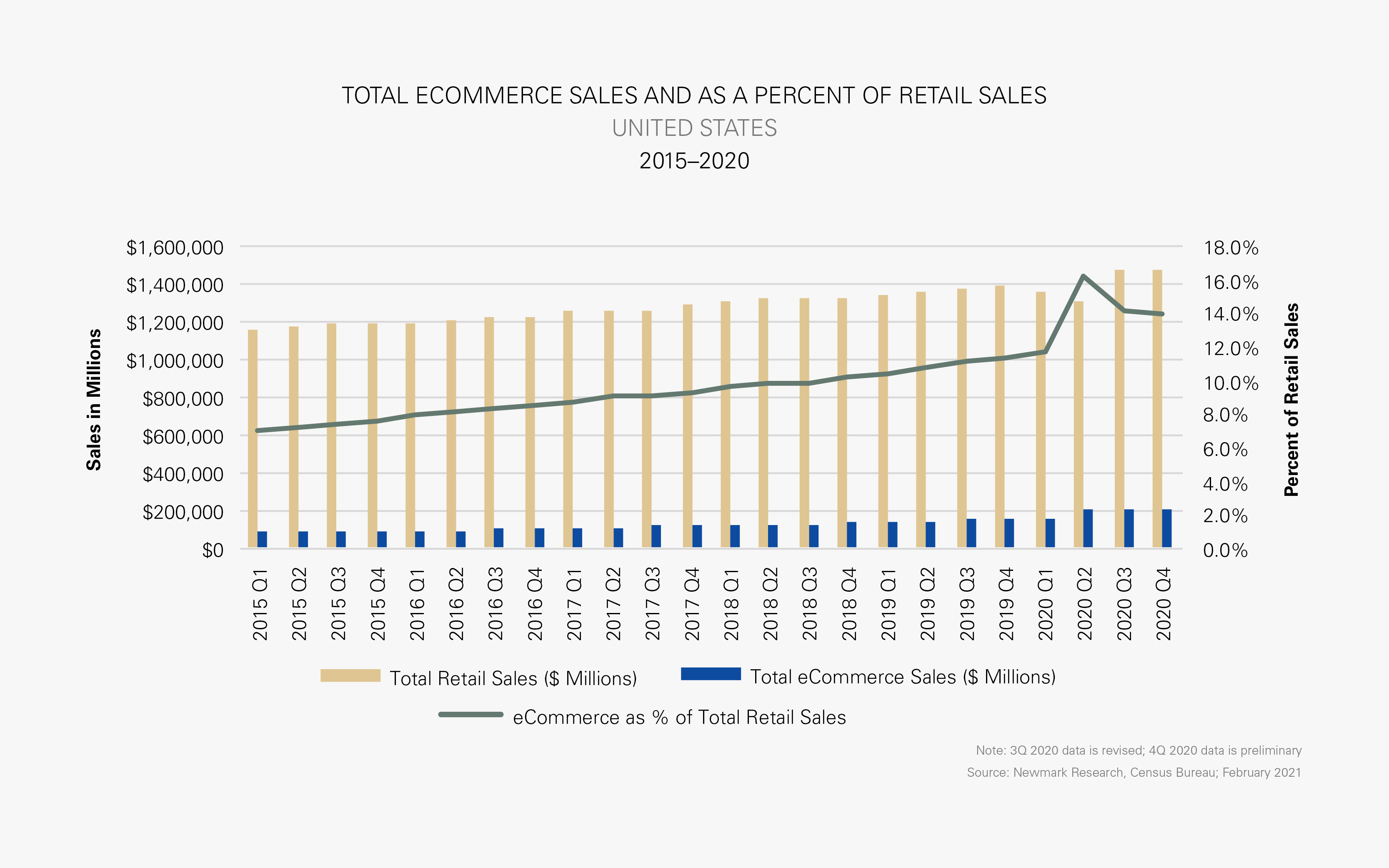

In the early days of eCommerce, sellers were focused on value; they wanted lower occupancy and operating costs. However, by 2010, the promise of eCommerce to consumers wasn’t price or value; it was convenience and speed—which required considerably more warehouse space in order to be close to population centers. COVID-19 has ramped up this shift. As of Q4 2019, eCommerce in the U.S. accounted for 11.3% of all retail sales. Over the previous five years, eCommerce sales had been growing annually at an average rate of 14.6%. This compares to total overall retail sales growth during that same period of 3.3%. However, by the close of Q2 2020, eCommerce accounted for 16.1% of all sales. In real dollars, the six-month difference was more than $55.2 billion. To put this in perspective, during this six-month period eCommerce expanded at a rate roughly equivalent to the total amount of growth that had been recorded over the entirety of the previous three years. Annual growth for the category, which had consistently measured in the +/- 15% range, suddenly stood at 44.5%.

Featured Market: San Francisco Bay Area

Amazon, the eCommerce segment’s largest player, is increasingly incorporating urban and suburban infill redevelopments into its inventory mix. Perhaps nowhere is this more evident than in the San Francisco Bay Area, where the company has executed at least five major deals since March 2020. While one was a traditional land development play (the August 2020 purchase of a 66-acre industrial site in San Jose’s outlying suburb of Gilroy), all others are redevelopment plays in denser suburban and urban areas.

These included the March 2020 purchase of a 202,000-square-foot industrial facility for redevelopment in the East Bay suburb of Dublin (for a reported $119 million), the June acquisition of a 216,000-square-foot industrial facility (also a rehab) in San Bruno for $96 million and the October purchase of a 280,000-square-foot warehouse property in San Jose for $59 million that Amazon plans to redevelop.

One of the largest deals of 2020 to occur in the region was Amazon’s purchase of a 5.9-acre site in San Francisco’s Showplace Square neighborhood for a reported $202 million. The site, which had housed a waste maintenance facility, will be redeveloped as a 510,000-square-foot, three-story, final-mile distribution facility and marks Amazon’s first eCommerce play within the city limits.

This pattern is playing out across multiple U.S. markets and is likely to accelerate. Amazon has made roughly 60 major acquisitions in the past 12 months. Approximately 25% of these are traditional ground-up development sites, while more than half are redevelopment plays. The geographies are roughly split between rural or exurban sites and new projects within denser suburban and urban markets in metropolitan areas as diverse as New York, Chicago, Honolulu, Houston, Miami, Orange County (CA), Phoenix, Tampa, and Washington (DC).

What are the Implications for Our Clients?

What does eCommerce’s rapid growth mean for industrial real estate? Clearly, the pandemic’s eCommerce surge will lengthen and intensify the industrial market’s already record growth run. But we see emerging signs that it will further accelerate an evolution in real estate strategy that was already beginning to occur prior to the pandemic. Even with the reopening of stores, eCommerce has retained most of its gains from the early days of the pandemic. Preliminary data from the Census Department for Q4 2020 indicates that eCommerce accounted for 14.0% of all retail sales, with an annual increase in real dollars in excess of $50.2 billion and a year-over-year growth rate of 32.1% (see the adjacent graph).

Moving beyond the pandemic, eCommerce may return to being more of a convenience than the necessity that it has become for many housebound consumers. However, while a moderating growth rate for online shopping is likely, the long-term behavior of many consumers has likely already been permanently altered. New habits have become ingrained.

While large fulfillment center transactions will continue to occur in the post-pandemic environment, the greatest demand likely will come from mature players in the space that were already shifting toward network buildouts. The movement to fill voids in hub-and-spoke delivery networks to speed same-day delivery of high-volume items to consumers is one driven by proximity to those consumers. Geographic focus will increasingly shift away from large tracts of available land in exurban environments and toward infill locations in urban and suburban markets. Land and redevelopment plays ranging from the conversion of vacant former retail space (particularly standalone big box space) to rehabs of obsolete product (especially former manufacturing space) will play a central role in this trend.