The National Trend: Multifamily Investment Market Reaches New Milestone

Investment sales volume in the U.S. multifamily market has exceeded that of all other property types this cycle, with more than $1 trillion in transactions since 2010. This historic level of investment and the cycle’s extended duration are due to several factors, including a shift toward more institutional ownership, increased allocations from investors as they seek strong risk-adjusted returns, and a surge of renters as housing preferences shifted away from homeownership.

Regional owner-operators and real estate investment trusts (REITs) were the dominant investors in the multifamily sector following the construction boom of the 1980s. Since the Great Recession, institutions have penetrated the multifamily sector at record rates, with many of the largest domestic private equity firms—such as Blackstone and Starwood Capital Group—now represented among the top owners in the country, acquiring in excess of $35 billion of multifamily product since 2010. International capital sources also have been attracted to multifamily product, with Canada’s Brookfield Asset Management acquiring nearly $11.5 billion over the same time span. Institutional groups bring with them greater sophistication, boosting efficiencies through vertical integration and in-house property management. The concentration of institutional groups has led to greater market liquidity and a deeper pool of capital.

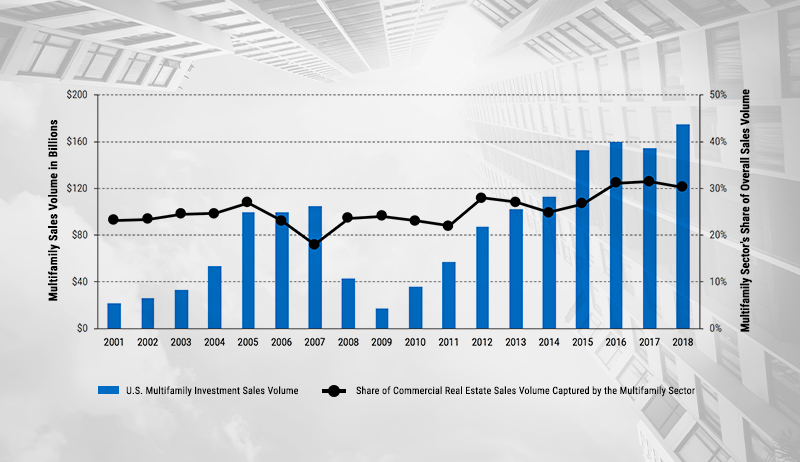

Greater institutional ownership is supported by a shift in allocations toward multifamily product. From 2001-2009, multifamily volume represented just 23.5% of the total investment into U.S. commercial real estate. By 2018, its share had risen to 30.3%, as shown in the adjacent graph. In fact, 2018 saw record levels of investment into multifamily assets, with the sector’s $174.6 billion in transactions outpacing the office sector’s $136.2 billion—the fourth consecutive year the multifamily asset class was the largest recipient of capital. In lock step, government-sponsored enterprise (GSE) lending has increased 350% since 2010, with strong underlying fundamentals and net operating income (NOI) growth supporting this increase. Perhaps the most significant driver of the multifamily sector’s appeal and staying power is the proliferation of demand for rental housing. This is due in part to the rising demand for urban infill product throughout the Sunbelt, in comparison to the suburban product that previously dominated the region.

U.S. MULTIFAMILY INVESTMENT SALES VOLUME AND SHARE OF COMMERCIAL REAL ESTATE

SALES VOLUME CAPTURED BY THE MULTIFAMILY SECTOR

2001 – 2018

Source: Data compiled by Real Capital Analytics; analysis by Newmark Research

National multihousing supply and demand fundamentals reflect a systemic shift in the value of rental housing, supporting increased investment into the multifamily sector. Approximately 2.3 million units have been absorbed nationally since 2010, outpacing new supply by nearly 330,000 units. Homeownership declined from 2005-2016, given the soaring prices for entry-levels homes, a slowdown in new single-family deliveries, and a lack of resources among the millennial generation. While the homeownership rate has edged up recently as some older millennials enter the for-sale housing market, the S&P/Case-Shiller U.S. National Price Index has risen 89.2% since 2000—reinforcing the value of multifamily assets.

Although transitional housing is the preference among younger Americans, such housing is not limited to millennials. Baby boomers and seniors also have contributed significantly to rental housing demand during this cycle. Over the past decade, demand for rental apartments from the 65-and-older demographic has increased by 44.7%, highlighting changing generational preferences. The lack of required maintenance on rental units and the appeal of walkable communities is accelerating apartment demand among older Americans.

Featured Market: Southeast Florida Sales Volume Hits Cyclical High

Southeast Florida—comprised of the Miami, Fort Lauderdale and Palm Beach areas—is consistently ranked as one of the top metros for institutional multifamily product due to strong demographic tailwinds, accelerating population growth, high effective rent growth relative to the national market, low unemployment and an absence of a state income tax. Average annual effective rent growth in particular was strong in 2018 at 2.9%—ten basis points greater than the national average—and it is projected to accelerate to 3.7% in 2019. While 22,863 apartment units are likely to be delivered between 2019 and 2022, demand is projected to be sturdy, and there will be enough new product to support high levels of financing and sales activity.

In tandem with the underlying fundamentals, the Southeast Florida multifamily investment sales market has shown continued growth despite reaching the mature phase of the cycle, with sales volume surpassing $4 billion in each of the past four years—a cyclical high. Since 2010, annual investment sales volume has increased 188.5%. Several institutional groups and national owner-operators have recognized the value proposition of Southeast Florida, and thus have become some of the largest asset owners in the metro area. These owners include Starwood Capital Group, Related Companies, Carroll Organization, PGIM Real Estate and Greystar – who own a combined 30,000 units.

What Are the Implications for Our Clients?

While the extended investment cycle is evident across all major property types, multifamily product remains uniquely positioned to benefit. A combination of macro drivers, such as evolving tastes and increased urbanization, have contributed to robust multifamily investment demand. These demand drivers, coupled with institutional groups increasing investment allocation to multifamily product, have resulted in greater levels of liquidity and efficiencies. As large-scale institutional groups expand further into multifamily investment, sales volume likely will continue to increase, extending this cycle’s record streak.

Sources: Newmark Research, Axiometrics, Federal Reserve, Real Capital Analytics, S&P/Case-Shiller