June 2018

The Office Construction Pipeline: Factors Shaping the Future of Development

By Jonathan Sullivan

The National Trend: Office Construction Accelerating Again, With Greater Attention on Downtowns

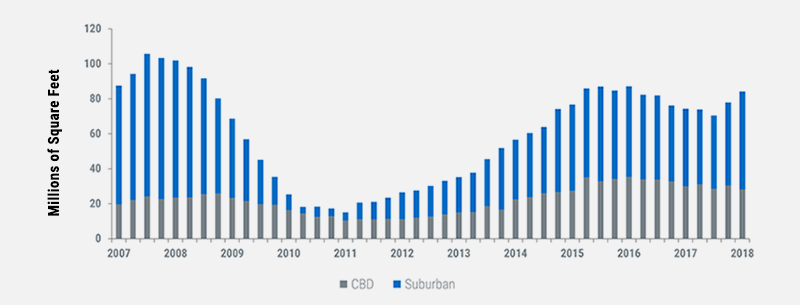

Office development across the country continues at an accelerating rate, with construction levels in most major markets – including New York, Los Angeles, Chicago and San Francisco – still above their recent averages. Steady U.S. employment growth of 1.6% during the past 12 months serves as a major catalyst for new development; other factors, including tenants’ increased desire for urbanization and proximity to transit, are influencing the location of new construction. Despite the prolonged national economic expansion – now completing its ninth year and the second longest on record – new office construction in the current cycle never eclipsed the pre-recession peak of 105 million square feet. This is a function of the shift of development downtown, the post-recession emphasis on office space densification, and more disciplined decision making by both owners and tenants.

Since 2013, approximately 40% of office construction has been located in downtown or Central Business District (CBD) locations. Prior to the economic downturn of 2008-2009, less than 25% of office construction was in downtown locations. Suburban office parks were long the focus of development, as many tenants favored campus settings that drew from the surrounding population. The recent increase in downtown office development has been sustained by tenants who are seeking to prelease new, efficient trophy buildings that offer robust amenity packages and easy access to public transit. Much of this activity is talent-driven, with many companies moving to or expanding downtown to cater to the desires of younger professionals – often the largest demographic group among a typical tenant’s staff.

CBD AND SUBURBAN OFFICE SPACE UNDER CONSTRUCTION

UNITED STATES 2007 – 1Q 2018

Note: As of the end of each quarter

Note: As of the end of each quarterSource: Newmark Research; June 2018

Featured Market: Boston’s Success with New Construction Could Extend Its Building Boom

Greater Boston, like many metropolitan markets, has seen new development accelerate in its urban submarkets. Office construction, including buildings able to accommodate life sciences tenants, totals 5.1 million square feet. More than two-thirds of new development underway is located in Boston’s CBD and Cambridge, with both locations pre-leasing space at unprecedented rates; 79% of their 3.5-million-square-foot combined pipeline is pre-leased. In particular, the CBD’s 96% pre-commitment rate has been driven by TAMI (technology, advertising, media, and information) tenant demand, and by tenants relocating from the suburbs.

Office vacancy rates in the Boston CBD and Cambridge markets are below pre-recession lows, further encouraging new development. Boston’s Seaport District, the focus of new construction downtown, recently saw Amazon commit to a 430,000-square-foot proposed building, supporting plans to add 2,000 new tech jobs in the city. The company also has the option to construct an even larger building on an adjacent parcel by 2025. MassMutual more recently affirmed plans to develop a nearby parcel it jointly owns, and the firm will shift more jobs to the city. In the suburbs, developers have begun speculative office projects that will appeal to life sciences tenants, and have introduced additional flex properties with the infrastructure and features to accommodate multiple uses, including laboratory, R&D and traditional office functions. Overall, during the past 12 months, many new construction opportunities were seized swiftly, attesting to the trajectory of Greater Boston’s high-growth technology and life sciences sectors and to the popular tenant view that accommodating employees in new, well-located, amenity-rich space is a powerful recruiting tool.

What Are the Implications for Our Clients?

Office construction on a national level is likely to decelerate over the next few years despite the still-positive economic outlook and steady employment growth in office-using sectors. Office absorption has started to trail new completions, and prominent markets like New York, San Francisco, Washington, Dallas, and Seattle still have robust pipelines. The ten largest U.S. office markets have an average of 2.2% of inventory under construction. Nationally, the share is 1.7% of inventory. Certain macroeconomic factors also may curtail development, including rising interest rates. Further, high construction costs – potentially exacerbated by new tariffs – make speculative development a challenge for many investors.

Implications for tenants: The influence of younger workers on where a company locates its offices has never been greater. The influx of tenants leasing space in downtown locations is a trend throughout the U.S. office market, and it will continue to influence plans for office development. The demand for space in America’s CBDs is fueling average rent growth. However, with downtown housing costs in many markets at all-time highs, many young workers are having a difficult time securing housing close to their vibrant, downtown office locations. Occupiers need to formulate their real estate plans accordingly. For some, this may mean an inner suburban location with a walkable, active environment. For others, the office amenities in new construction will help employers attract and retain top talent, even in central locations with a higher cost of living.

Implications for investors: The inner suburbs in Greater Boston and many other major U.S. office markets offer available land or redevelopment plays that may appeal to larger tenants than can be accommodated in some land-constrained, downtown locations. However, if investors can identify value-add opportunities or have the financing to build speculative office projects in urban centers, those investments still warrant strong consideration given their recent leasing success.