The National Trend: Investor Allocation to Industrial and Multifamily Product Has Increased During the Current Cycle

U.S. investment volume for industrial and multifamily assets is expected to reach all-time highs in 2019, with the property types attracting $80 billion and $120 billion, respectively, as of the third quarter. These investment milestones reflect a substantial shift in investor preferences for commercial real estate, with investor allocations moving away from the once-dominant office market and from the retail market, which is undergoing disruption. The change in allocations is being driven by several factors, including a shift toward institutional ownership; stronger risk-adjusted returns in the favored sectors; and growth opportunities in both rental housing and the e-commerce/logistics space.

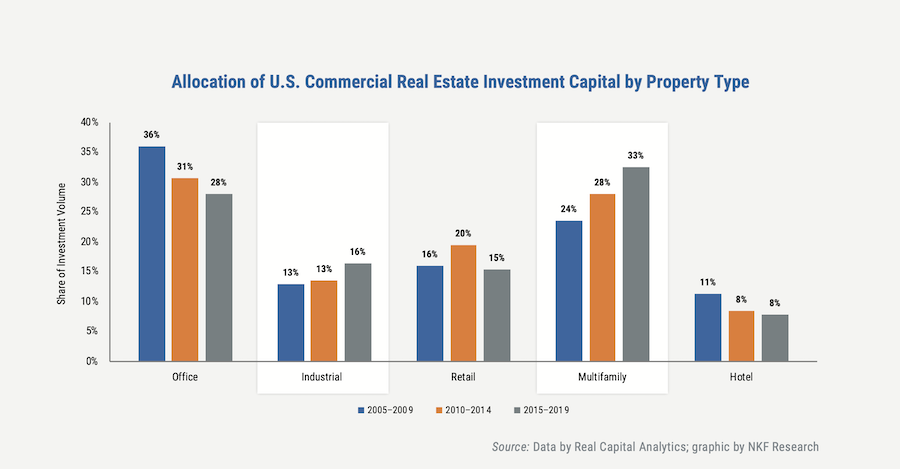

The impact of these trends is apparent; investors’ allocation of capital across the major property types has shifted significantly in the past 15 years, with the office sector recording an average loss in market share of eight percentage points over the past five years compared with the 2005-2009 period (as shown in the adjacent graph). Over the same time period, allocation to multifamily assets increased by nine percentage points on average, reaching 33% of the overall U.S. investment volume in the past five years—and surpassing the office sector as the largest recipient of capital. Investors’ allocation to industrial product remained relatively consistent at 13% in the years immediately following the Great Recession compared with the years immediately before it. However, the allocation to the industrial sector increased materially in the past five years to an average of 16%, as investors have chased higher returns in a lower-yield environment.

While the industrial market has historically been dominated by real estate investment trusts (REITs), large corporate owner-users, and regional developers, large-scale institutional groups have increasingly entered the space during the current cycle. The most prolific of these groups is Blackstone—which is currently the largest owner of industrial space, with a portfolio of more than 300 million square feet—as well as Blackstone’s private REIT (BREIT), whose portfolio contains 106 million square feet of industrial space. Other institutional groups that have become major landlords include Exeter, Clarion Partners, and pension funds such as CalPERS and TIAA/Nuveen; these firms collectively own nearly 400 million square feet of industrial product. To achieve scale quickly and efficiently, these groups have increasingly targeted large portfolio acquisitions, such as Blackstone and BREIT’s $18.7 billion purchase of GLP’s logistics assets. They also have utilized entity-level purchases of entire industrial real estate platforms, as well as industrial REITs.

Similarly, the multifamily market has also managed to attract a greater amount of institutional capital in the current cycle from groups such as Blackstone, Starwood and Brookfield, which have joined REITs and regional owner-operators as the dominant source of capital. According to Real Capital Analytics, $54.6 billion in investment volume was recorded from institutional groups in 2018 alone, representing 30% of the overall multifamily volume. This compares to $42.9 billion in institutional investment at the last cycle’s peak in 2007, which represented 20% of overall multifamily volume.

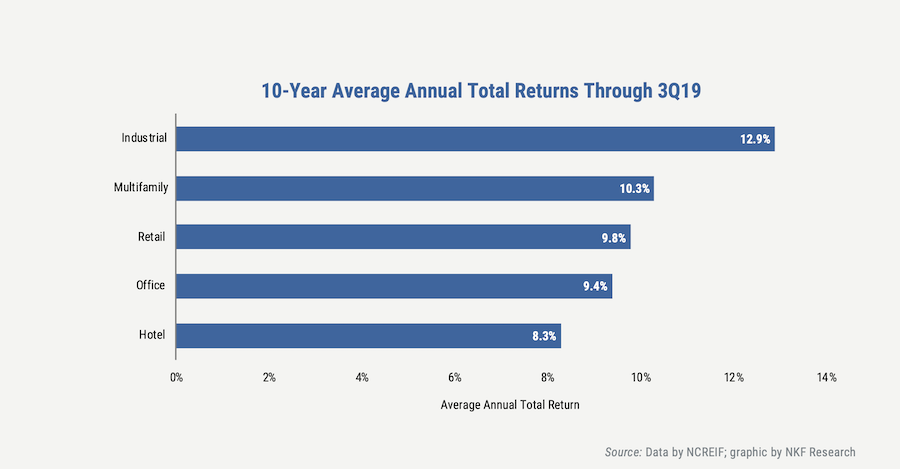

Underscoring the surge in investment volume for both industrial and multifamily assets has been consistently higher risk-adjusted returns, which have become more important as yields have compressed across all asset classes. Industrial properties have recorded the highest total returns, averaging 12.9% across showroom, warehouse, manufacturing and flex subtypes over the past 10 years (as shown in the adjacent graph). These returns have been driven by high levels of rental and net operating income (NOI) growth, particularly in the largest gateway markets, where tenant demand for last-mile product in service of e-commerce is the strongest. Multifamily returns were the second-highest, at 10.3% across garden, low-rise and high-rise properties nationally. While high levels of NOI growth also are responsible for multifamily returns, employment and population growth in secondary markets—particularly in the Sunbelt—have helped support high total returns. Additionally, younger age cohorts are more transient than in previous cycles and are willing to move to secondary markets for better economic opportunities and lower costs of living.

Featured Market: Phoenix

Few metro areas in the United States compare to Phoenix in terms of the strength of underlying industrial and multifamily market fundamentals, and the rate at which the buyer pool has become more institutionalized. In addition to population-driven demand that has supported the logistics and distribution warehouse product types, Phoenix has become one of the largest markets for flex/industrial and data center properties catering to the largest technology firms. This has helped propel investment sales volume to $2.4 billion in the past 12 months—a 16.5% increase over the prior 12 months—and rental rates by 31.3% over the past five years.

Population and employment growth also have given a boost to the Phoenix multifamily market, which recorded effective rental growth of 8.0% year-over-year, one of the highest rates in the country. Employment growth in particular is tied to Phoenix’s becoming a regional hub for mid-wage, back-office finance jobs as well as technology roles, thanks to lower business and recruiting costs. This growth has not only attracted institutional investors but also has translated into total multifamily returns of 12.7% for the 12 months ending in 3Q19, well above the 10-year national average

What Are the Implications for Our Clients?

Both industrial and multifamily product are well positioned for continued investment volume growth, supported by increased allocations from large-scale institutional investors, sturdy fundamentals relative to other asset classes, positive long-term macroeconomic trends, and higher total returns at present. An increasing preference to rent among seniors and the financial challenges of entering the for-sale housing market for millennials will continue to drive demand for multifamily units. Multifamily investors also are attracted to strong risk-adjusted returns and outperformance relative to NOI growth, after having been less allocated to this sector in prior cycles. Increasing consumer demand for e-commerce services and shorter delivery times for goods bought online will bolster tenant demand for industrial product. As the current prolonged cycle continues, investors will not only look for property types with a recent track record of success, but also ones with a clear path for future growth.