The National Trend: Sale-Leasebacks Present Opportunities for Owner-Occupiers and Investors

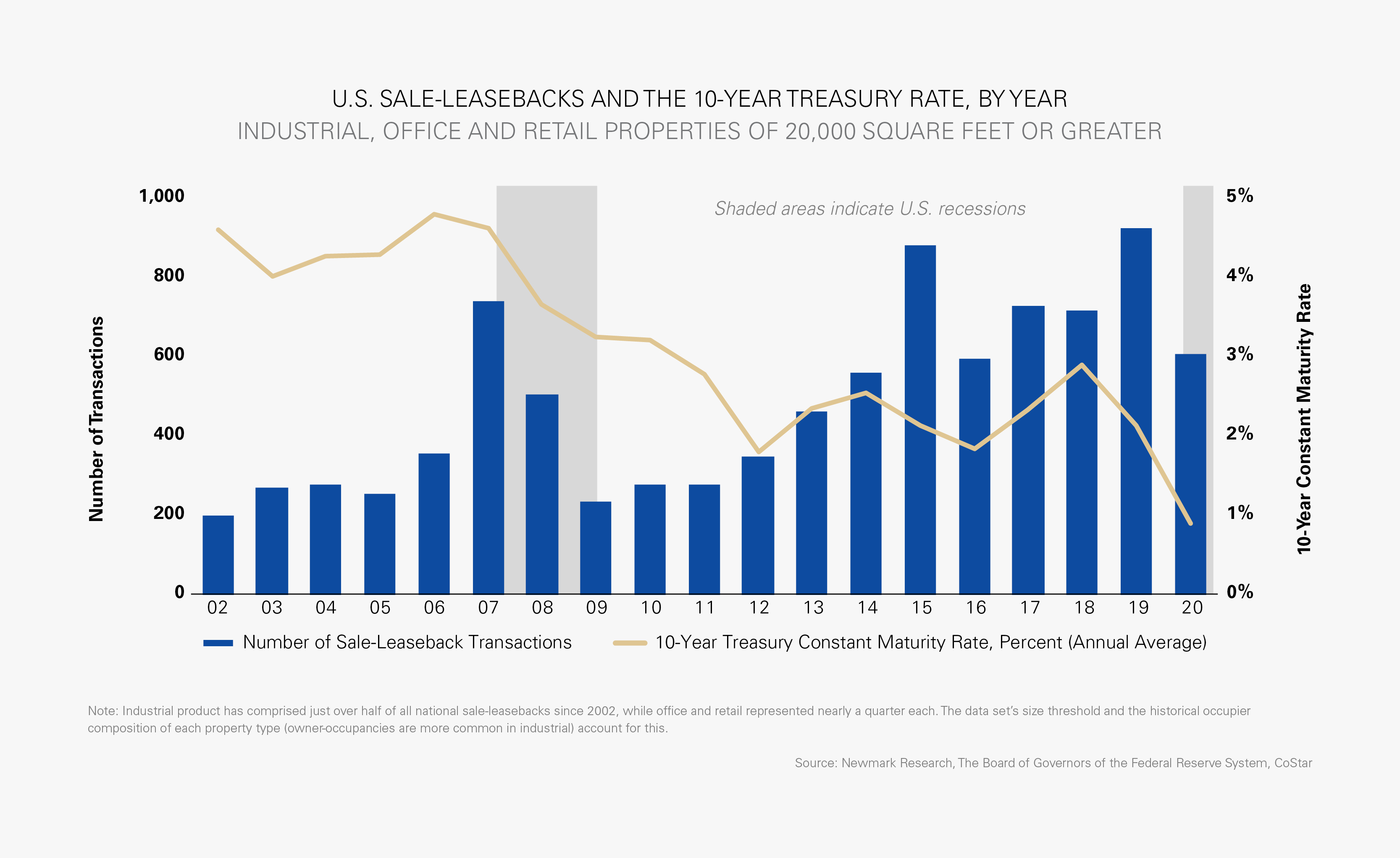

A sale-leaseback occurs when an owner-occupier sells its facility and retains its operations by signing a lease with the building’s new owner. The sale provides the now-tenant with a swift infusion of capital to pay down existing debt or reinvest into its business, while the buyer/investor grows its real estate portfolio with a paying tenant in tow. Sales of this nature are more common during the peak years of a real estate cycle (when property values are high) and generally persist into the first year of a cyclical downturn (when pricing is still relatively high, but more businesses are struggling and are seeking operating capital). Sale-leasebacks are also common in a low interest rate environment since rising rates generally lead to higher capital costs and lower sale prices.

The ongoing pandemic is severely affecting many businesses’ revenue, working capital is limited, lending guidelines are more stringent than in prior years and M&A activity likely will increase. In addition, interest rates are low. These conditions represent a strong environment for sale-leasebacks.

The Fed plans to retain low interest rates through 2023, and as of the end of 2020 the 10-Year Treasury Constant Maturity Rate was 0.94%. A hypothetical sale-leaseback of a 100,000-square-foot industrial facility with a 4.6% cap rate and a 15-year lease in place may be more enticing from a return standpoint than a fixed, sub-1.0% bond yield.

Featured Market: Inland Empire

The department store chain Kohl’s has demonstrated the value of the sale-leaseback proposition in the current environment. Kohl’s sold two San Bernardino warehouse facilities in Southern California’s Inland Empire market to Brookfield Asset Management for $195 million in May 2020. The buildings, totaling 1.5 million square feet, are second-generation Class A space, collectively situated on 60.8 acres and, from a national industrial perspective, are located in a Tier I market where vacancy has remained below 5.0% for 34 consecutive quarters.

The Wisconsin-based retailer has its share of financial challenges, after posting net income of $47 million for the three-month period ended August 1, 2020—an 80% decline from the same period one year earlier. Results for the first six months of fiscal 2020 were weaker, with a net loss of $494 million—down 263% from the same period in 2019. The company’s CEO cited extraordinary change and uncertainty presented by the COVID-19 crisis, and, following moves earlier to streamline management and reduce overall costs, is focused on e-commerce growth.

Kohl’s hired more than 2,500 seasonal workers at its San Bernardino facilities during the 2020 holiday season to keep up with its e-commerce sales. The company also has a strategic partnership with Amazon, where an Amazon customer can pick up or return their parcel at a Kohl’s brick-and-mortar store; Amazon benefits from a larger network of delivery and return locations, while Kohl’s nets more in-store foot traffic. The sale-leaseback opportunity better positioned Kohl’s to do business in the evolving retail environment.

What Are the Implications for Our Clients?

A sale-leaseback gives an owner-occupier the flexibility to retain its space and operations, while also allowing time to restructure, which can range from staying in the facility, working to consolidate operations to another location or seeking bankruptcy protection. The building’s sale boosts a company’s financial reserves, and more cash on the balance sheet can be useful as companies reassess their approach to a post-pandemic world. It is also worth noting that investors are more motivated to increase their offering price if the seller is willing to lease more space at longer lease terms.

Sellers should look for a well-capitalized and seasoned investor with sale-leaseback experience, while being aware of potential downsides. One potential downside for the seller is if the existing facility is integral to the company’s operations and is difficult to replace; a tenant may lose its space when the lease expires. Another is if the property has a physical or geographic challenge that downgrades the purchase price. Data centers are one example since technological needs change quickly; substantial infrastructure investment eight years ago runs the risk of being outmoded and devalued today.

Some markets have high barriers to entry, and sale-leasebacks provide investors the opportunity to build scale in a new region. Notably, buyers with a development background may also have other plans for a site beyond the existing use. In the case of infill markets, for instance, some buyers may agree to a short-term lease with the tenant, which gives them time to work through site entitlements before redeveloping.

Like all investments, real estate has numerous risks and rewards, suggesting up-to-date market intelligence is paramount to help guide decision making. Occupiers need full buy-in from their organization’s stakeholders to factor in optimal and worst-case scenarios before committing to a sale-leaseback, as do investors with their committees. Aligning the expectations of the two is essential.

Sources: Newmark Research, The Board of Governors of the Federal Reserve System, CoStar, Kohl’s, The New York Times, The San Bernardino Sun