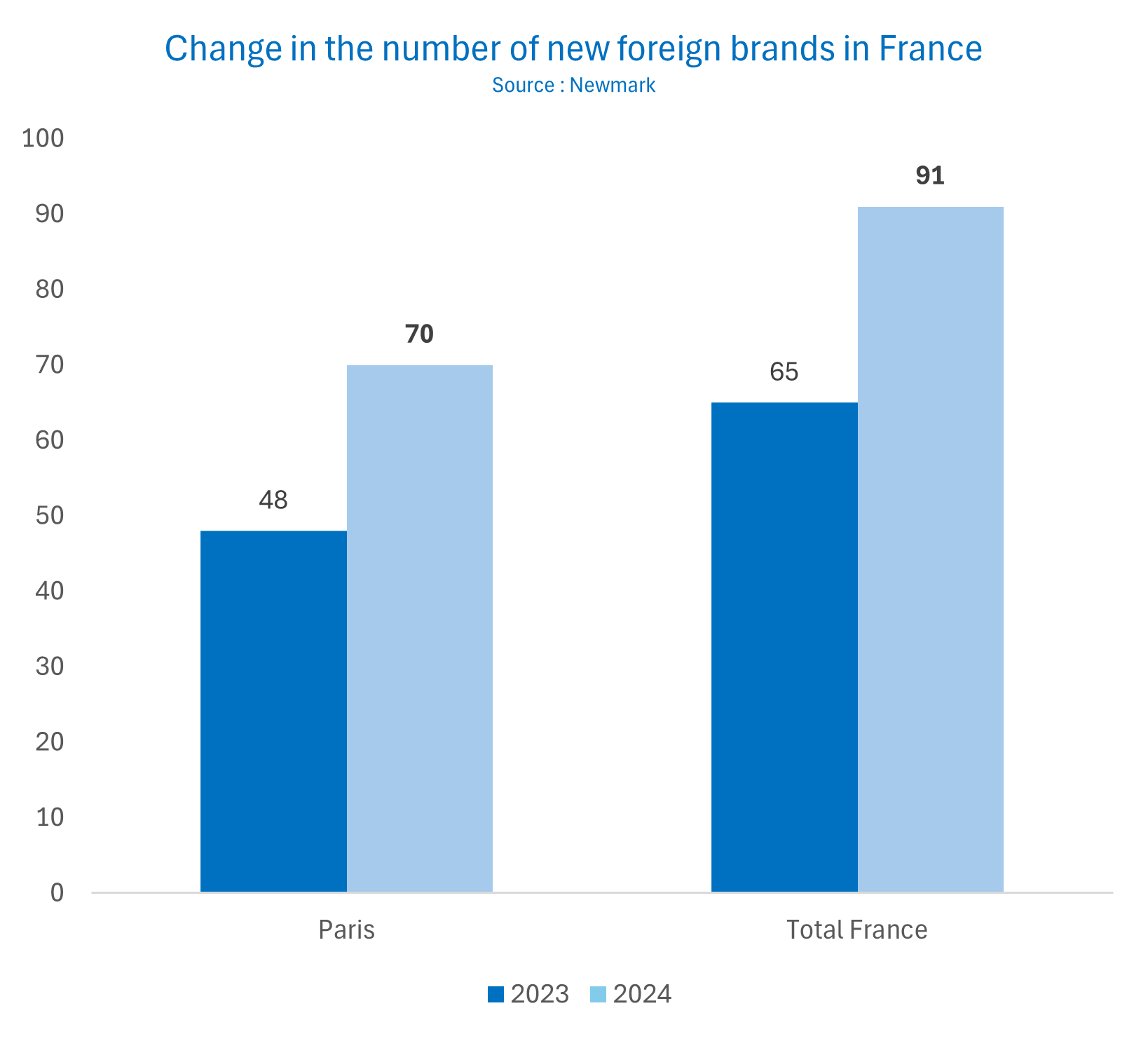

Almost 100 new brands in 2024 in France, including 70 in Paris

2024 will go down as an exceptional year in terms of the number of foreign retailers opening their first shop in France. Newmark identified 91 in 2024, compared with 65 in 2023 and fewer than 60 the previous year. “While the number of new arrivals has remained stable in the regions, it has risen sharply in Paris, with 70 arrivals in 2024 compared with 48 in 2023. This is indicative of the dynamism of the capital’s retail market, which is benefiting notably from the upturn in international tourism which has almost returned to its pre-Covid level,” explains Antoine Salmon, Co-Head of Retail Leasing at Newmark.

The Marais attracts the largest number of foreign brands opening their first shop in France. The district’s share of all new entrants in France has risen sharply from one year to the next, from 17% in 2023 to 41% in 2024, with more than 30 brands identified. “The Marais district is very popular with tourists and Parisians alike and is undoubtedly one of the most dynamic areas in the capital. In the retail property market, this is reflected in very low vacancy rates, averaging around 4% on the main streets, and rental values that are under pressure due to strong demand from retailers,” explains Antoine Salmon.

Continued expansion of premium fashion and sportswear brands

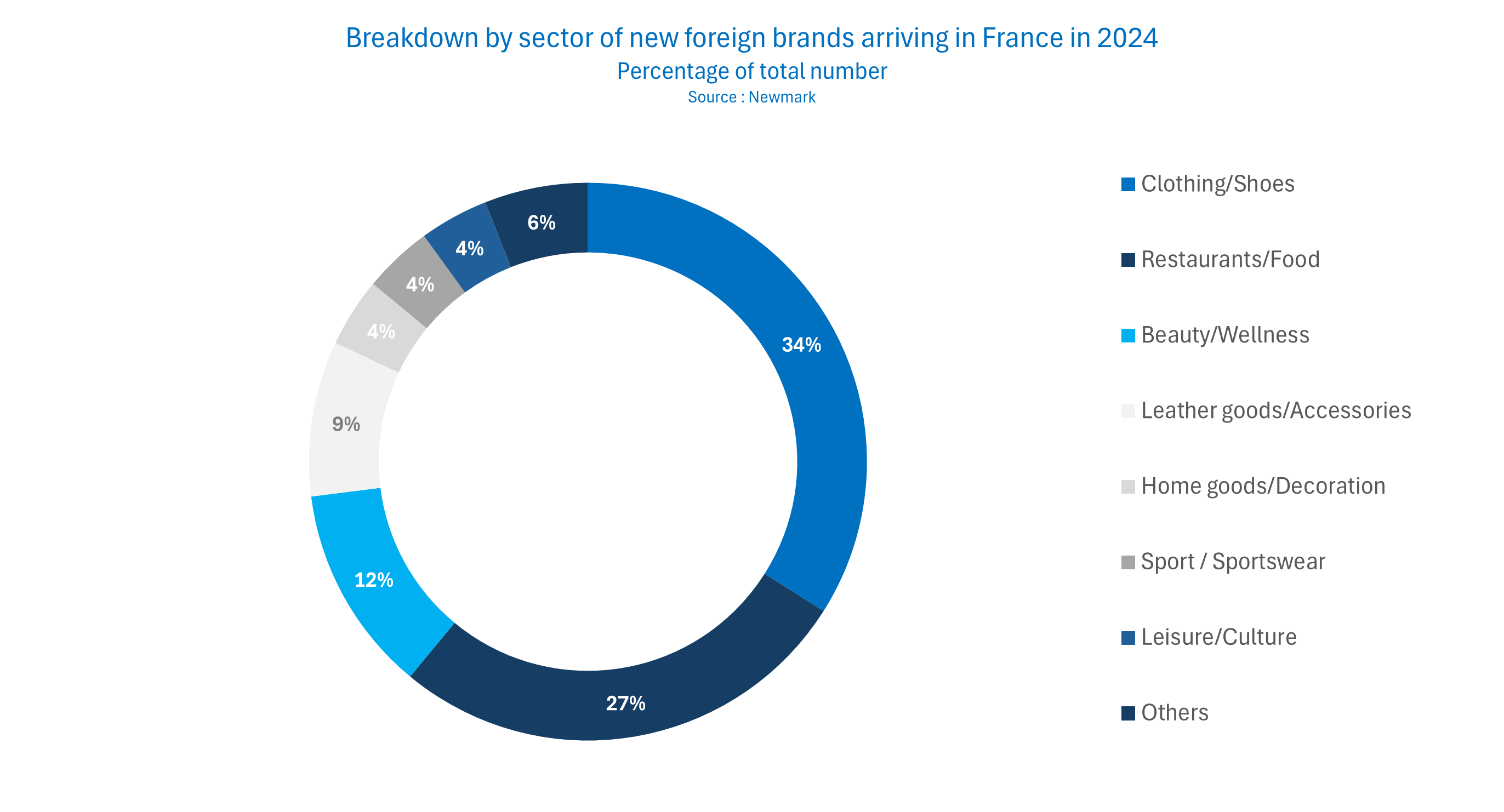

Fashion is the most strongly represented sector, accounting for 34% of the number of new arrivals in France in 2024, compared with 20% the previous year. “Around thirty new foreign fashion brands were identified in France in 2024, an impressive figure that contrasts with the difficulties of the clothing industry. However, most of these brands are relatively cutting-edge or high-end. While some of them may open other shops, they are unlikely to multiply the number of stores in France,” explains Vianney d’Ersu, Co-Head of Retail Leasing at Newmark. In 2024, most of these new fashion brands opened in just a few Parisian districts, starting with the Marais (FARM RIO, ALOHAS), followed by the Rue Saint-Honoré area and the most upmarket Left Bank streets (THE ROW, LIVIANA CONTI, FLABELUS, POMANDERE, etc.).

Whilst many premium fashion brands have made their debut, streetwear, sportswear and outdoor players are also continuing to expand. After ON in 2023, HOKA, KLATTERMUSEN, NAKED COPENHAGEN, SOLEBOX and ARTE ANTWERP all opened their first shops in France in 2024.

Asia’s breakthrough

The fashion sector was very dynamic in 2024, taking the lead from the food/restaurant sector. Even so, the food/restaurant sector still accounts for a significant proportion of the new foreign retailers in France (27%, compared with 34% in 2023). The concepts are varied, but several trends are emerging, confirming the rapid growth of coffee shops and, above all, the boom in ethnic catering, particularly Asian and Asian-inspired (BENIHANA). This trend is not new, but it is growing and involves more than just gastronomy.

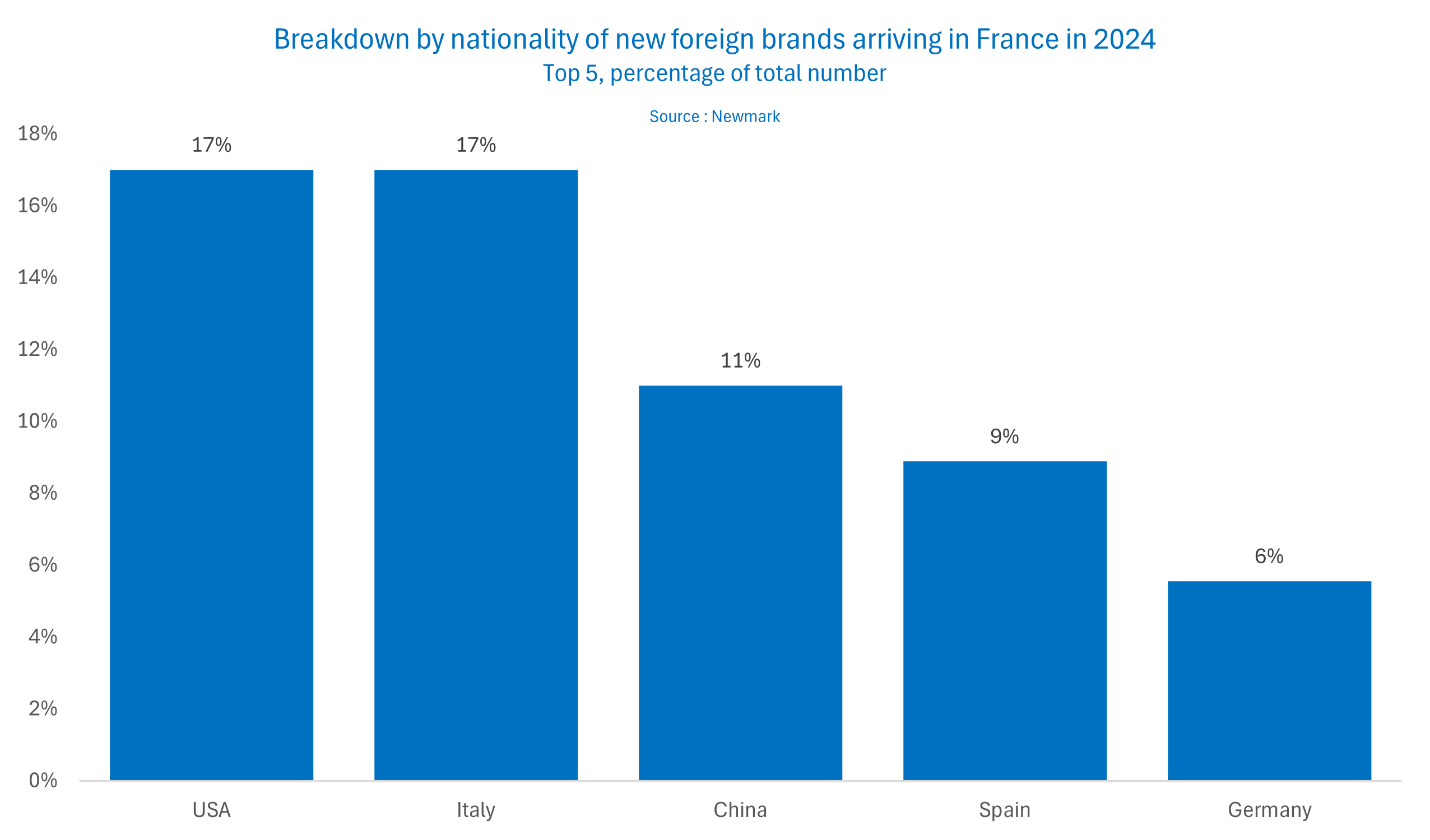

“Traditionally, new brands setting up in France, across all sectors, are mainly Italian, American or Spanish. But there is a growing number of new brands from Asia, a significant proportion of which are pop-up stores,” comments Vianney d’Ersu. In 2024, Asian brands accounted for 22% of the number of new entrants in France, including several Chinese players in the restaurant and new mobility sectors (YANG GUO FU, SEVENBUS, XPENG) and several Korean fashion brands (SONGZIO, OSOI).

What is the outlook for 2025?

The context remains favorable for the Paris retail market. “As the number of foreign visitors continues to rise, the positive impact of the Olympic Games and the reopening of Notre-Dame on the capital’s image will further consolidate its status as a major tourist destination. This will only make it more attractive to foreign brands looking to grow outside their domestic market,” says Antoine Salmon. As a result, the number of new entrants will remain high in France in 2025. Nearly forty projects have already been identified, with the emphasis still on the restaurant and fashion sectors, with a mainly premium positioning (the Spanish brand UNFEIGNED in the Marais) and in sectors such as streetwear, sportswear and activewear (the Italian sneaker brand AUTRY). Significant new arrivals are also expected in other areas, such as high-end furnishings with the American RESTORATION HARDWARE on the Champs-Elysées and the British leisure concept TOCA SOCIAL in the WESTFIELD CNIT in La Défense.

All these arrivals are increasing competition in certain sectors. This is particularly true in the fashion and fast-food sectors, where the offer is already very dense and growing. One year after its arrival, the American doughnut chain Krispy Kreme has nearly twenty stores in France.

Whilst this can increase competitive pressure, the arrival of new foreign brands also contributes to enriching the retail offer, and therefore making the French market more attractive to local and foreign consumers. “Fashion cycles are becoming increasingly rapid, particularly under the influence of social networks. Just as it’s vital for a brand to constantly renew itself, it’s also crucial for a city and a retail location to regularly renew their offer to remain attractive,” concludes Antoine Salmon.