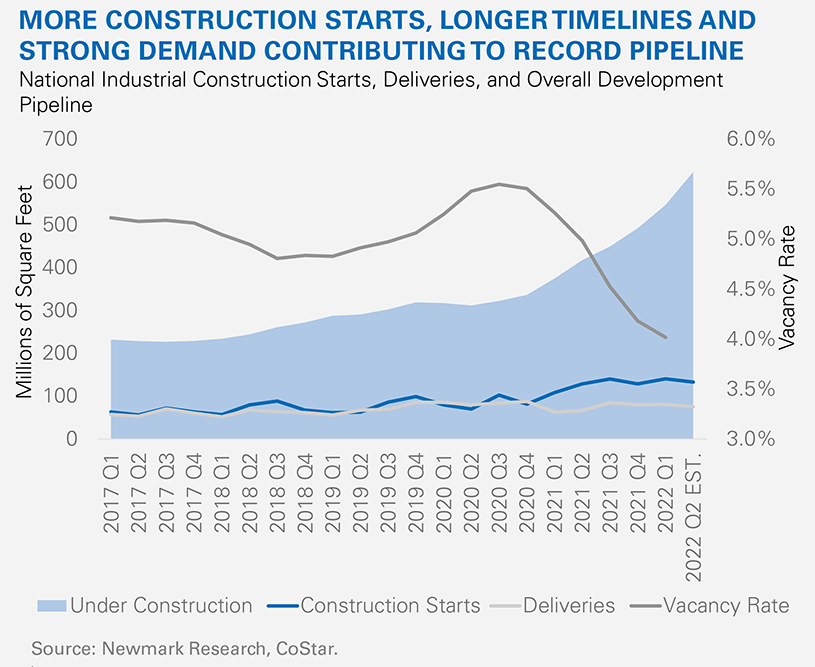

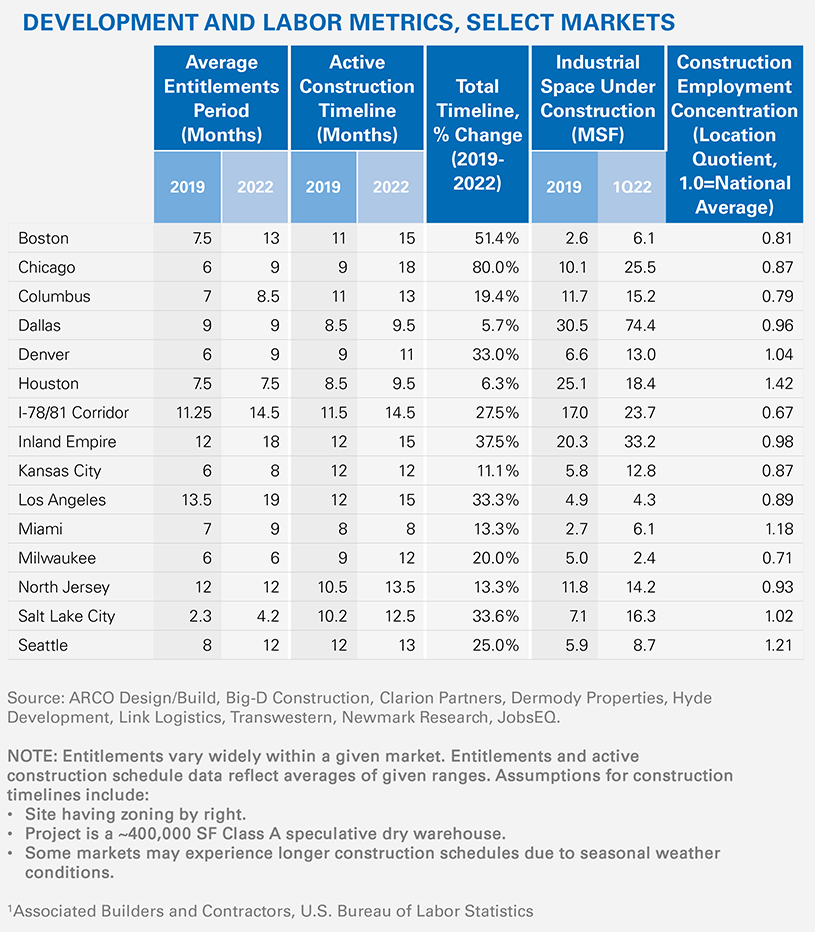

The entitlement and construction process for new industrial projects is now taking five months longer on average across the country than in 2019. This delay impacts both developers, who are working in an inflationary-cost environment, and tenants who have quick occupancy requirements amid record-low vacancy. It has also caused a significant backlog of facilities in the pipeline. Construction starts increased 64.0% between 2019 and 2021 to meet a whopping 120.0% jump in tenant demand, yet deliveries have only increased 5.7% during the same period. Every stage of the construction timeline from the entitlements process to the active construction schedule has been hampered by two years of challenges that are unlikely to subside during the balance of 2022, inclusive of:

- Supply chain and sourcing pains. Well-documented volatility still reigns in the construction materials supply chain, exacerbated by geopolitical conflict and pandemic-related shutdowns in Asia. Lead times for roofing materials, for example, are still 30-to-50 weeks out on average.

- Labor constraints and community opposition. A web of labor shortages, from understaffed local governments to a lack of skilled construction workers, is undermining timely entitlements processes and building schedules alike. Furthermore, many markets face mounting community opposition to continued warehouse expansion, a factor that is delaying – or scuttling – new project proposals.

- High inflation and interest rates. Some developers are no longer willing or able to accept skyrocketing construction costs (22.0% year-over-year increase as of May 2022¹) amid strong but decelerating industrial demand and increased cost of capital. Construction starts slowed by mid-year 2022, while remaining historically elevated. Anecdotally, some developers are temporarily pausing new project plans; others are selling development sites.

The impact of the above challenges on construction timelines varies by market and within market jurisdictions. Chicago has seen the sharpest impact, with the entitlements-to-completion journey approximately 80.0% longer now than in 2019. This is due in large part to the cold-weather market’s reliance on local precast manufacturers for warehouse construction materials and the severe labor shortages coupled with high demand faced by that local industry. Secondary, less land-constrained markets, particularly in southern and central states, often pose fewer hurdles to development with quicker entitlement processes and greater concentrations of construction labor. However, all markets surveyed experienced a lengthening of total construction timelines.

Tenants with move-in requirements this year will likely continue to face competition for limited supply in most markets, particularly those with a low volume of speculative development relative to the existing inventory. Some occupiers wishing to build and own their facilities rather than lease may find increased opportunity with development sites put up for sale. Deliveries will substantially increase into 2023 and are projected to exceed demand, offering tenants some respite after nearly two years of extreme space scarcity. Despite the historic expansion of tenant demand for industrial space decelerating in the mid-term, some expected developer pullback in the next six-to-12 months may precipitate tight supply conditions further down the road, especially on the tailwinds of continued structural demand for new warehouse space.