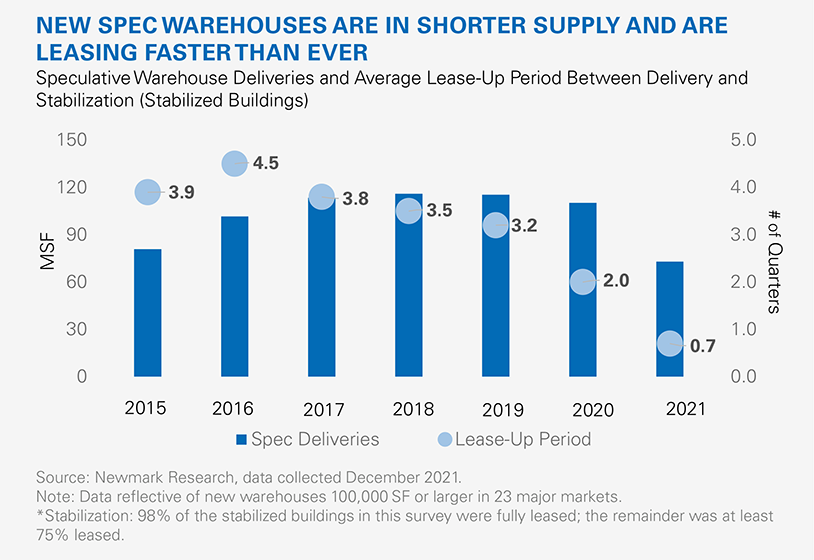

The sharp imbalance between supply and demand in the U.S. industrial sector is driving insatiable tenant interest in new-construction availabilities, which are in short supply. A survey of 23 key industrial markets found:

- Speculative construction deliveries fell significantly in 2021 with developers citing pandemic-related labor disruptions, sourcing materials, lengthening entitlement periods, and community pushback to warehouse development as the primary causes.

- Demand for modern warehouse space to improve supply chain efficiency and meet evolving consumption habits has never been higher, particularly from third-party logistics, consumer goods and e-commerce companies, which represented the majority of new-construction leasing.

- Developers are attuned to occupier needs and design specs for new warehouses are quite uniform across the country: new speculative construction offers tenants with immediate-occupancy requirements the agility to move in swiftly, contributing to quicker leasing decisions.

These dynamics are reflected in the shortened duration between warehouse delivery and stabilization*. For buildings that have reached stabilization, the average length of time between a speculative warehouse delivering to the market and being fully leased was less than a single quarter in 2021, with many preleasing well before delivery. This duration is down from an average of 3.9 quarters in 2015. Across the markets surveyed, 25% of spec space delivered in 2021 had yet to reach stabilization by year-end, the majority of which delivered in the second half of the year. Some landlords of newly-delivered properties are delaying leasing decisions to achieve the most current market rents – in some regions with extremely tight vacancy and high demand, the velocity of rent growth is such that a moment after a lease signs, the contract rate is already under-market.

The construction pipeline rose to half a billion square feet underway in Q4 2021, the most on record. Speculative warehouses account for approximately 77% of that volume, in line with the 5-year average share. As disruption to construction timelines subsides and speculative deliveries increase, experts expect the average lease-up period to gradually lengthen over the next few years as tenants are presented with more options. Tenants with move-in requirements this year will face a continuing environment of scarcity and competition in most markets, as supply-chain and labor challenges persistently impact delivery timelines.