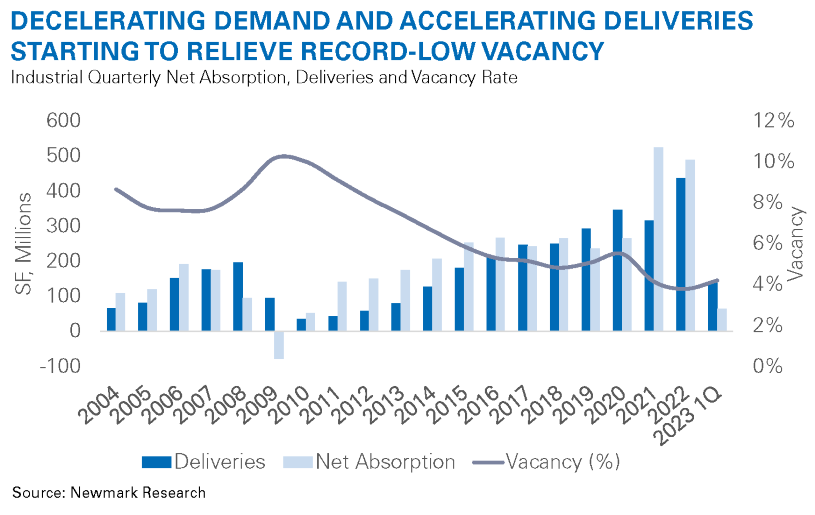

In the first quarter of 2023, demand for industrial space decelerated while still registering as remarkably healthy. Approximately 65.0 MSF were absorbed in the first three months of the year, the best first-quarter total on record compared to pre-pandemic history. However, this figure also represents a 40.4% decline from the fourth quarter of 2022, a larger drop than the typical 5% to 10% decrease from the fourth to the first quarter. Leasing activity year-to-date indicates quarterly absorption totals will hover near the 65.0 MSF range in 2023 – a return to pre-pandemic levels of demand. A notable difference between now and “then” is the volume of new supply coming online. A record 138.0 MSF delivered in the first quarter of 2023, with more to come throughout the rest of the year. Many markets will encounter rising vacancy as the pipeline delivers into an environment of normalized demand, with an attendant increase in sublease availability. However, new construction starts continue to ease amid further tightening of overall credit conditions as liquidity concerns remain pronounced following the takeover of First Republic Bank in early May 2023. If demand picks up with strengthening economic conditions and predicted Federal Reserve action in line with historical recessionary monetary policy, vacancy could begin to tighten again in some markets starting in 2024 as the pipeline empties.

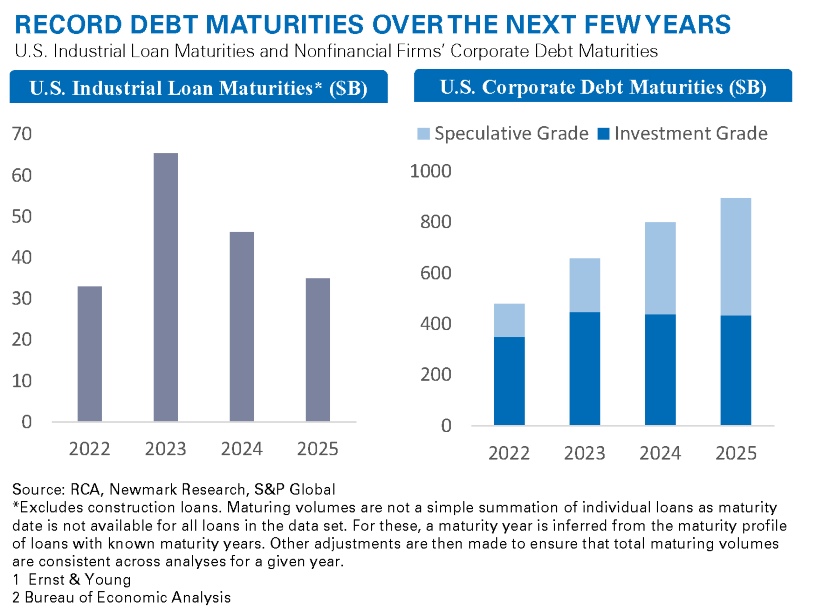

Market fundamentals are normalizing while debt costs have markedly increased. While most property debt and values discussion is focused on office defaults, industrial is not entirely immune to challenges. The largest amount of real estate backed mortgage debt in history is maturing between 2023 and 2024, most of which was originally issued since 2020 at record low interest rates, potentially impacting some industrial property values as debt comes due. Most pre-2021 loan vintages have organically deleveraged due to robust net operating income (NOI) growth and asset appreciation, even when accounting for the recent reduction in market values visible in rising industrial cap rates. Based upon the health of the sector and long-term demand for space, owners who do not need to sell or reposition will likely retain their assets. Negative impacts to values will be most predominant in markets facing potential oversupply or less stable fundamentals, as lenders are more likely to act aggressively to protect collateralized positions. Some borrowers will choose to either pay down debt, refinance, pursue a loan modification/source rescue equity or return the keys. There is a great deal of bridge capital available that, while expensive, may be used by owners that can withstand a short period of negative leverage while debt markets begin re-pricing.

Maturing corporate debt may have a larger impact on the overall industrial market, influencing occupier and operating company real estate decisions. Companies in the S&P 500 are estimated to boost capital spending by 6.0% in 2023, compared with a 20.0% increase in 2022¹, but companies with maturing debt, particularly sourced since 2020 amid extremely attractive financing conditions, may focus on expending capital to pay down that debt/repurchase stock, or in avenues other than real estate. Leases longer than one year in duration are treated as balance sheet capital obligations and require capital allocation, according to FASB accounting standards, and require further capital investment in equipment to make such spaces operational. Real private capital expenditures on structures and equipment combined slowed by year-end 2022², supporting anecdotal evidence observed by market participants that many major occupiers are pausing and reevaluating leasing decisions. A prominent exception is the extraordinary volume of expenditures going into construction of new manufacturing facilities, particularly in the EV, battery and chip sectors, albeit heavily subsidized by federal legislation and state incentives.

The volume of near-term maturities for speculative grade loans is significant, with $1.0 trillion maturing in the next three years into a very different financing world. According to Pitchbook, 12.0% of leveraged debt due before 2024 is in the industrials sector with an additional 11.0% maturing in 2025. Operating companies and their subsidiaries facing more aggressively leveraged debt maturities could provoke greater levels of M&A activity as firms navigate strategies, potentially creating opportunities such as sale-leasebacks but also, challenges for rent rolls. The latter is a concern for both sublease availability and credit loss via tenant default that may tilt the scale of market vacancy abnormally.

Large corporates and well-capitalized private equity firms are well positioned to weather shorter term disruption as corporate profits soared during the pandemic. In fact, there is a great deal of capital patiently waiting for near-term opportunity. The segment of the occupier market reliant on operating lines and credit facilities issued by small and regional banks could experience the most turmoil. As of year-end 2022, 39 banks were on the FDIC’s “Problem Bank List,” with data from the first quarter of 2023 due out later in May.

This Time It’s Different: The Market and the Asset Have Changed.

While debt may drag on industrial demand in the latter half of the year and impact the market in myriad ways, the hoary phrase, “this time it’s different” does have meaningful weight. With e-commerce forecasted to grow by 6.0% CAGR over the next five years, reliance on modern warehouse space for e-commerce fulfilment is fundamentally different today than in 2008. While market activity is returning to pre-pandemic volumes, there is broad recognition in the supply chain community that inventory levels were running too lean in 2019, and it is unlikely that occupiers return to pre-pandemic inventory models. Forward-looking shifts in supply chains due to near/re-shoring of manufacturing to North America allow for both efficiency and cost savings in the production and movement of inventories. All of this bodes well for long-term industrial demand growth in the U.S. While there is a record amount of supply delivering to the market this year, barriers to overdevelopment will deepen. The current financing environment will continue to constrict new construction starts in the near term, but community pushback, legislation and a dearth of available, well positioned land all pose increasing challenges to expansion in the long term.

Some market segments are expected to slow over the next 12 months, and market participants able to leverage opportunities that are created by the challenges will be well rewarded, given the ultimate strength and importance of industrial real estate in the current and future economy.