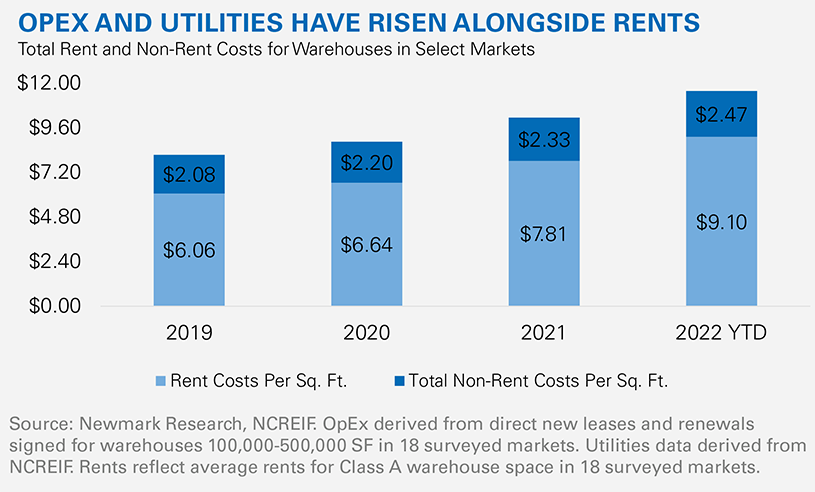

Over the last few years, warehouse rent growth soared amid an acute supply/demand imbalance and increasing construction costs. Yet, for a sector in which tenants are predominantly on triple-net leases, rent growth is only one part of the story: nearly all occupancy costs are increasing, not just at lease signature, but over the lifetime of the lease. Rents and lease escalations, as well as non-rent occupancy costs – operating expenses (OpEx) and utilities – have risen significantly, exacerbated by the current inflationary environment. The total cost to occupy warehouse space has increased 42.2% since 2019. Rent has been the biggest driver, but rent and non-rent expenses alike contributed significantly to the growth.

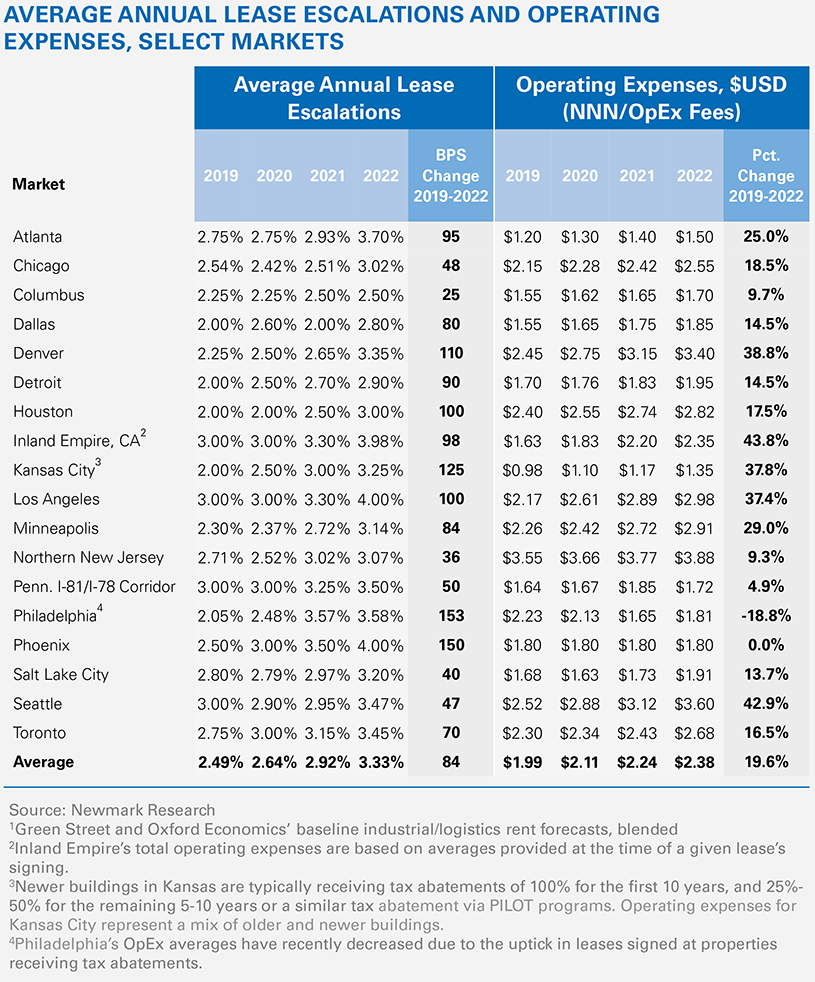

OpEx, around a quarter of total occupancy costs on average, broadly falls into three categories: property taxes, insurance and common area maintenance (CAM). These costs can vary significantly from market to market. Generally speaking, property taxes constitute the largest component of OpEx, averaging 60.0%. CAM accounts for 33.0%, and insurance 7.0%. According to lease data analyzed by Newmark, OpEx rose 19.6% from 2019 to 2022, with all three components registering increases. Insurance registered the largest percentage growth, 45.0%, amid a rising number of natural disasters nationwide. Utility costs have also increased since 2019, with the largest increase occurring from 2021 to 2022 (5.3%), according to a survey of National Council of Real Estate Investment Fiduciaries (NCREIF) data.

Industrial occupier business expenses are rising, and while total occupancy costs make up a small portion of overall outlays, increased expenses are driving some firms to control costs via supply chain optimization and consolidation. In this price-conscious setting, markets offering lower occupancy costs or competitive tax abatements on new facilities likely stand to benefit from increased tenant demand.

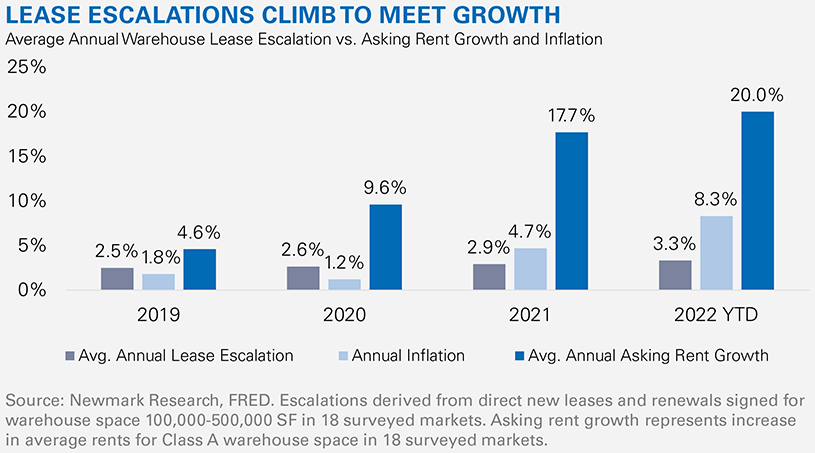

Annual fixed-rate lease escalations are traditionally inflation-sensitive, designed to keep rents apace with market conditions throughout the term of the lease. From 2019 to 2020, fixed-rate escalations for warehouse leases in most markets were in the 2.0% to 3.0% range with Consumer Price Index (CPI) in the 0.3% to 2.5% range during that time. Persistently high demand for industrial space coupled with persistently high inflation has yielded an environment in which new leases are increasingly struck with escalations greater than 3.0%. In 2019, leases with escalations of 3.0% or below represented 92.2% of all leases surveyed, but that share decreased drastically in 2022, down to 60.4%. Now, several markets are reporting average annual escalations of 4.0%. Still, this is much lower than the 8.3% average annual CPI increase observed through August 2022, or the pace of annual Class A warehouse rent growth charted in 2Q 2022 (20.0%), ensuring many leases have below-market rates essentially upon signature.

Higher annual lease escalations will likely continue to be the norm until the market finds greater equilibrium between supply and demand, and rampant inflation is checked. National rent forecasts signal that greater equilibrium is coming, with annual rent growth averaging 4.0% between 2023 and 2027. Therefore, at the national level, neither tenants nor landlords signing a hypothetical 5-year lease today at current rental rates with a 4.0% annual lease escalation would be at a disadvantage to the market. At the local level, the majority of the markets surveyed have a current average lease escalation lower than the projected average rent growth from 2023 to 2027.1