The largest impediment to the flow of global shipping since the pandemic has been unfolding in the Red Sea. Houthi attacks are prompting container ships bound for the Suez Canal to be diverted around South Africa’s Cape of Good Hope, adding extra days and expense to typical transit time. Acting under a strongly worded U.N. Security Council resolution on January 10th, a U.S.-led coalition has taken strategic, direct action to address this disruption, although the timeframe for the reinstatement of safe passage is unknown. Coalition naval forces continue to urge commercial shippers to avoid the Red Sea shipping routes responsible for directly supporting approximately 12% of global trade. Shippers regularly using this route have been growing in volume: Amid the evolving trend of sourcing diversification into Southeast Asia, more freight bound for the U.S. has been coming via countries like India and, therefore, through the Suez Canal. While 2023 was a softer year for U.S. imports in comparison to 2022, Chinese imports were 5.5% below volumes five years ago; imports from India were up 38% over the same period1.

The Suez Canal isn’t the only major artery of global trade facing challenges: the Panama Canal enacted reduced movement in 2023 due to drought conditions, restricting the number of ships and how much cargo per ship can be carried through the canal. While those restrictions have eased somewhat in January 2024, water levels are still well below typical levels – again, causing delays and additional expense (albeit with less of an impact to ships containing finished goods which book passage well in advance). The short-term impact is exacerbated by the fact that investment in transportation infrastructure requires time. Some shippers that diverted services away from the Panama Canal in favor of the Suez Canal in response to these delays now may consider again bringing services back. While the Panama Canal supports approximately 5% of global trade, it facilitates 72% of all transits heading to or from U. S. ports2.

Implications for the North American Industrial Market:

Inflation, Interest Rates

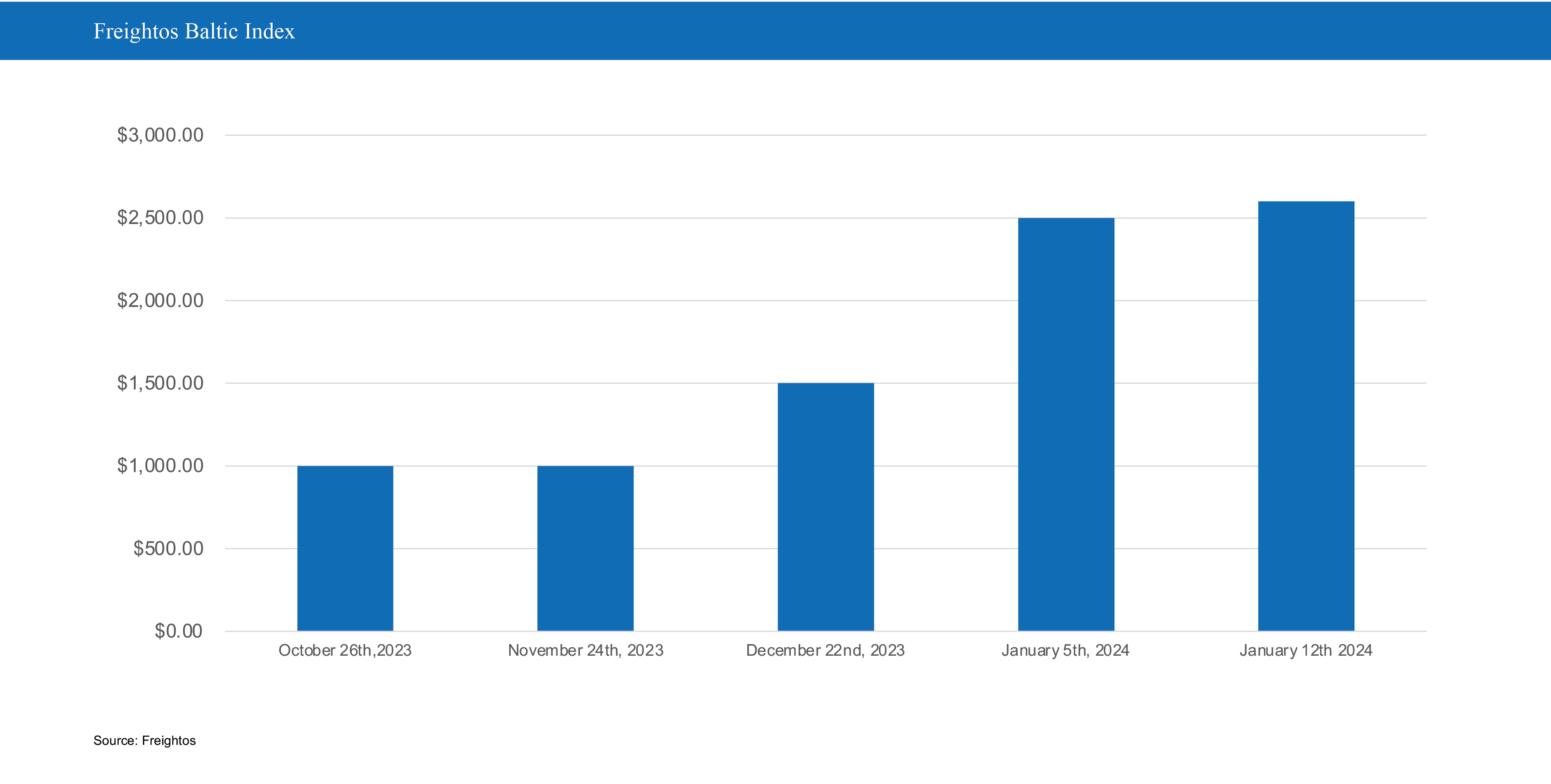

The result of global logistics disruptions is an increase in maritime transit times and cost. There is excess capacity to redeploy in the freight market as consumption has normalized, but rates for ocean freight bound to the U.S. have still been impacted. The Freightos Baltic Index (a measure for overall global shipping costs) was up 139% from the end of October to mid-January 2024.

For time-sensitive goods, firms may have to pivot to air freight, which could be five to 10 times more expensive than container shipping. Retailers and manufacturers will likely pass on the higher costs to consumers. This would not help the Fed’s mandate of returning overall inflation to 2% on a sustained basis, which could influence the Fed’s posture on timing and scale of rate cuts. However, because of global instability, foreign capital is already flocking to U.S. treasury bonds as a safe haven, helping to push down treasury yields. October 2023 - the most recent month of available data - saw the second consecutive month of decline in treasury securities volume held by foreign investors as well as the peak in the 10 year treasury yield at a hair under 5% – which has subsequently declined from that peak to under 4% by mid-January. Availability and abundance of capital is manifesting as increasing appetite for foreign direct investment (FDI) in North American assets directly related to infrastructure and supply chain investment as well.

Industrial Market Fundamentals

The result of a tumultuous stretch of years for the supply chain is that unpredictability will drive demand for more industrial space due to the need for diversified sourcing and ports of entry to control cost and speed. The immediate impact of these global developments on leased industrial space is likely to be a mild but net positive. Inventories are primarily driven by demand from consumers, manufacturers, private and public capital investment, all of which are unlikely to spike up in the first half of the year. The outlier is potentially FDI, another tool for those investing in manufacturing and transportation infrastructure, alongside a continued U.S. commitment to infrastructure and manufacturing spending via the Inflation Reduction Act, Infrastructure Investment and Jobs Act and the CHIPS Act. However, businesses carefully managed inventories throughout 2023, keeping a lean inventory-to sales-ratio below pre-pandemic measures, and there is appetite in some segments to restock as well as invest in safety stock to mitigate any potential congestion and delay (note: this practice did exacerbate supply chain issues in 2020 and 2021). It is too early to tell how canal disruptions will impact import volume. SoCal ports recorded substantial year-over-year increases in imports in September, October and November, according to the most recent ports data available, but preliminary data indicates notable month-over-month gains in imports during December at East Coast ports, according to Descartes. For shippers looking at diversion reactively and diversification proactively, West Coast ports have attractive attributes: the Shanghai to SoCal trade route is clear, and while ocean rates have increased across the board, costs for shipping from China to West Coast ports are far less than in the height of rate hikes 2021-2022. East and Gulf Coast union labor contracts are also up for renewal this year, another reason to expect some imports to be preemptively diverted to the West Coast ports on top of market share returning from diversions that occurred during the height of West Coast delays, congestion, and labor issues in 2021-22.

In the longer term, these canal crises are a tailwind to domestic industrial leasing, absorption, and development in that there is greater impetus for sourcing, manufacturing, and distributing in North America, as well as investing in alternate channels of global trade that will benefit existing and emerging U.S. and partner-country markets. With an unclear timeline for the resolution of current chokepoints and an understanding that other potential conflicts may emerge in the months and years to come as a part of the ‘new normal,’ there is further justification for companies selling to the U.S. to invest in building out safe and secure paths to their consumer. Subsidized manufacturing growth on a large scale is spreading over North America, and as AI and automation progress to amplify existing labor, the calculus of where companies source and produce in relation to where they sell will continue to drive greater volumes of industrial development and absorption in North American markets.

U.S. leadership and global partners are aligned in solving these current challenges to the Suez and Panama Canals but these will not be the last major upsets to global trade. Trends around managing macro risks, the interplay of U.S. port markets, and manufacturing growth in the Americas will be further explored in upcoming Newmark Industrial research output.

1 Newmark Research, Trademo

2 U.S. Department of State