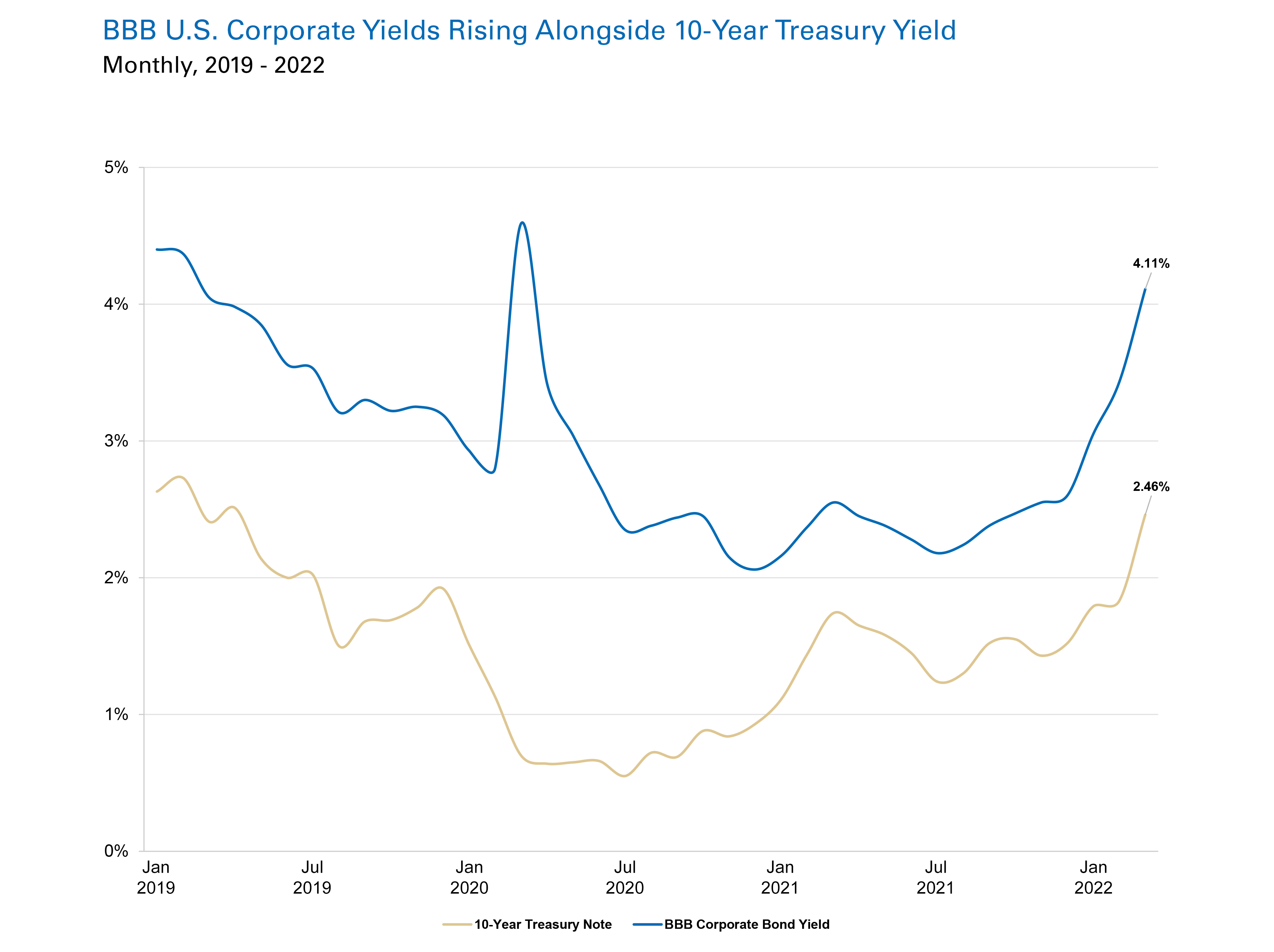

This news came as the Fed approved a 25-basis point rate hike at the latest FOMC meeting on March 15-16th, the first in three years. The yield on the 10-year treasury note has continued to increase since, reaching 2.46% as of the end of March, while BBB-rated U.S. corporate yields have increased by nearly 90% since July 2021, to 4.11%.

While interest rates have immediate impacts on bonds, the impact on commercial real estate is less straightforward. Theoretically higher benchmark rates will put upward pressure on debt costs via higher mortgage rates, which will consequently impact levered IRRs and undermine levered returns achieved by real estate investors. If debt costs rise substantially, it is possible certain investors may experience “negative leverage”, wherein mortgage costs exceed capitalization rates.

However, due to the underlying complexity and operational components of commercial real estate, higher costs of debt will not necessarily dissuade all investors from considering investments. In fact, investors eschewing leverage when acquiring real estate may achieve an advantage. Various factors at the property level will have greater impacts on property performance and returns, such as property management, tenant demand, competitive supply, insurance and property taxes, and required capital expenditures. Additionally, the competitiveness of the debt markets and the ability for lenders to pass on rate increases to borrowers is a substantial factor.

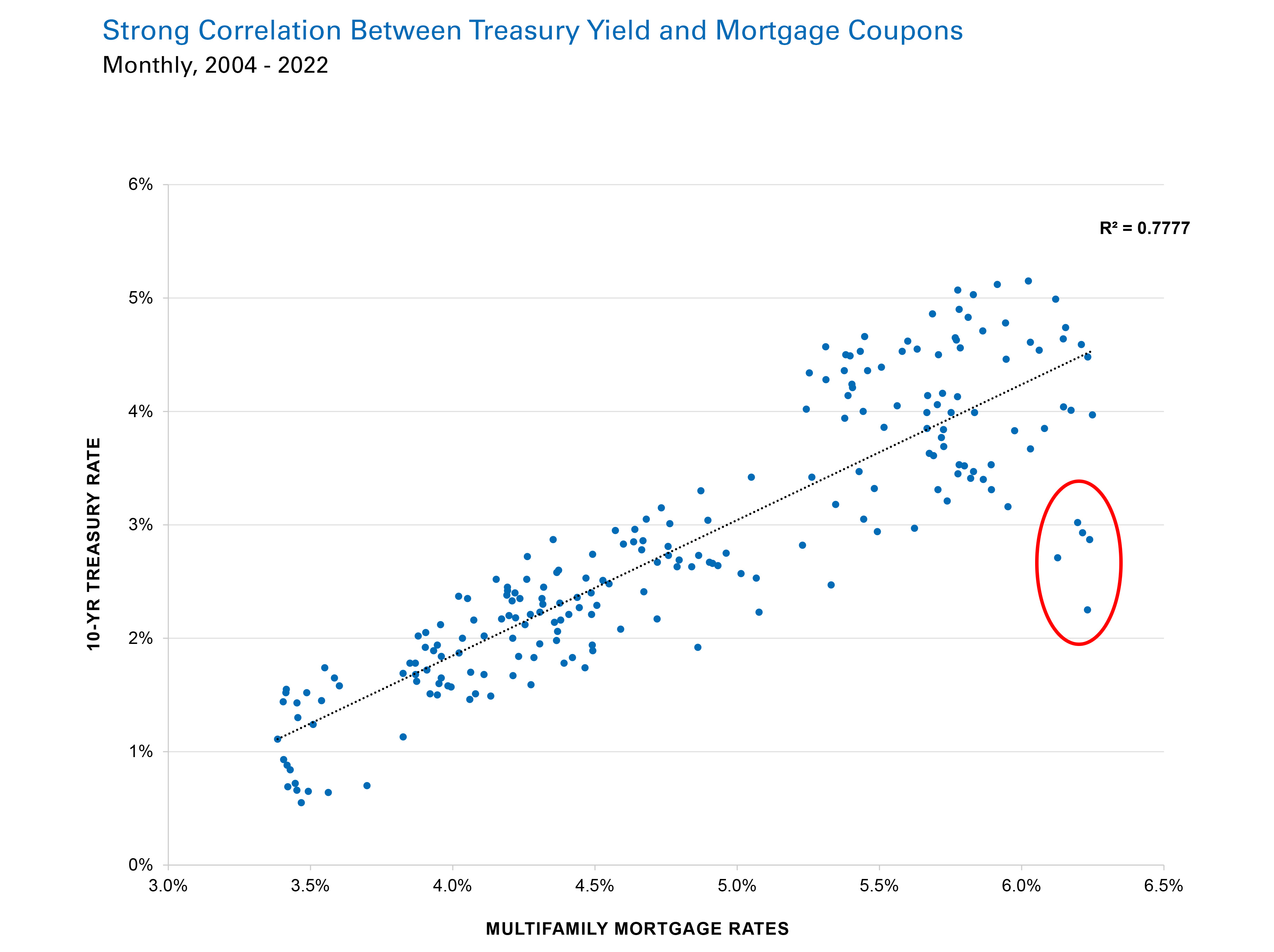

The below graph shows the monthly historical correlation between the 10-year Treasury yield and multifamily mortgage rates (fixed rate mortgages with a 7-10 year loan term) between 2004 and 2022. The positive correlation is undeniably high, with an r-squared of .78, and it is clear that mortgage rates generally rise with interest rates. However, there are periods of time where the relationship breaks down, such as in the final months of 2008 where treasury yields plummeted below 3% and mortgage rates remained above 6%, leading to the cluster of outliers highlighted below.

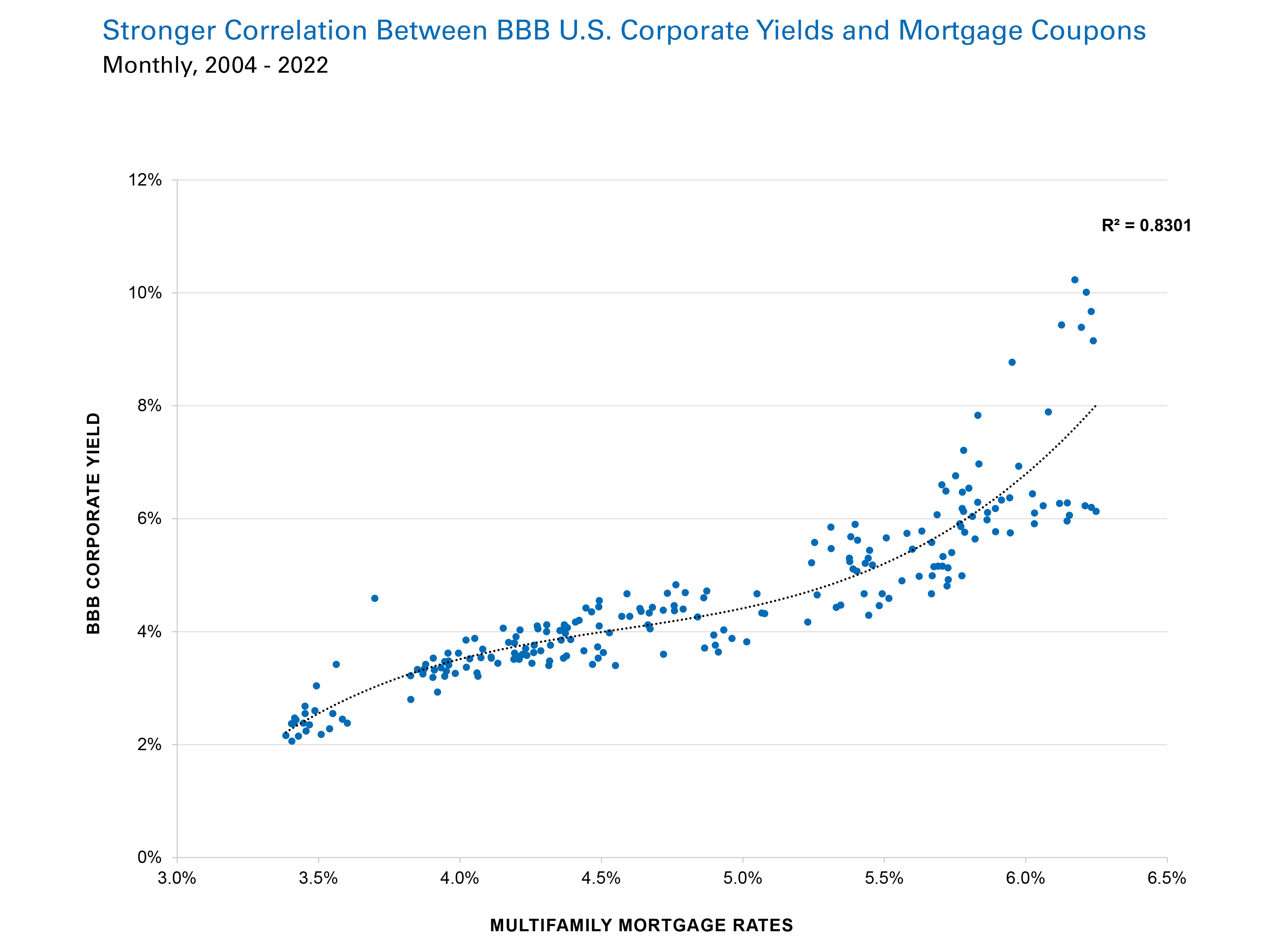

Substituting 10-Year Treasury rates with BBB-rated U.S. corporate bond yields improves the correlation substantially, as real estate and corporate debt are considered to have similar risk and investment characteristics to investors. BBB-rated U.S. corporate bonds are also tied more closely to the perceived health of the economy in which the issuing companies participate, which drives employment, population and economic growth contributing to property fundamentals.

The below graph shows the improved correlation, particularly when a non-linear fit is applied – the below model shape implies that there are minimum and maximum boundaries for residential mortgage rates when corporate credit yields rise above and decline below certain thresholds. Therefore, even in times of deep economic crisis when BBB-rated U.S. corporate yields exceed 10%, like they did in the final months of 2008, residential mortgage rates did not surpass 6.5%.

Implications for Clients and Investors

Given recent volatility in equity and bond markets, it is even more important to understand the impact of interest rates and U.S. corporate credit yields on commercial real estate and the cost of mortgages. So far, interest rate volatility has delayed several CMBS offerings, such as an offering tied to Deutsche Bank’s New York HQ and is having an impact on commercial real estate in real-time. Rising pressure on debt costs has also impacted investor underwriting, leading certain groups to either drop or renegotiate deals, particularly those with tight margins and high levels of leverage.

However, certain investors will stand to benefit from the volatility. Groups using limited or no leverage could have a considerable advantage bidding on and winning deals, particularly in negative leverage situations. Large institutional investors with preferred borrowing status with lenders could also stand to benefit and secure debt for properties that otherwise would not be financed. Additionally, investors that managed to secure low rate fixed-rate debt in 2020 and 2021 can likely count on even greater demand for their portfolio properties.

Sources: Newmark Research, Real Capital Analytics, The Federal Reserve Bank of St. Louis, CNBC