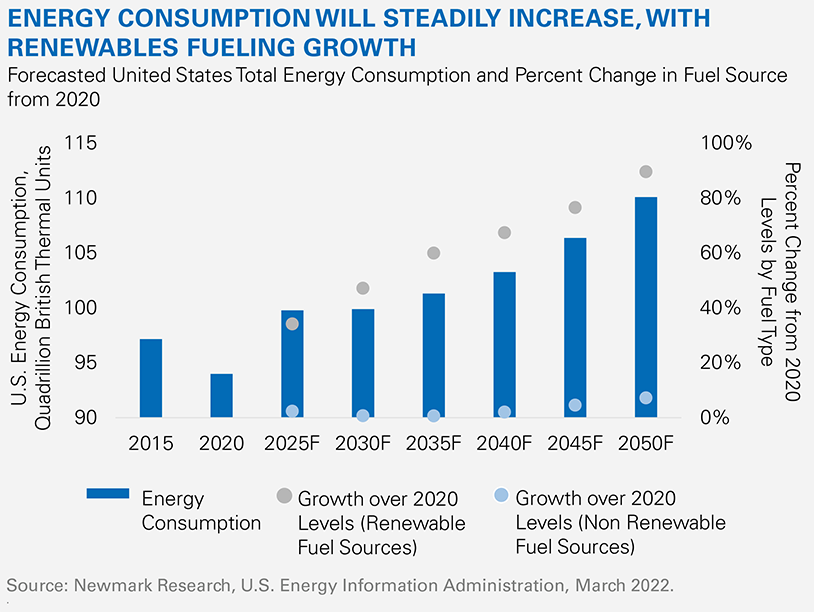

The nation’s industrial sector is a primary consumer of energy, from the power-intensive processes of manufacturing, to fueling the storage and movement of goods through the supply chain. Industrial energy demand will increase over the coming decades due to multiple factors:

- Growth of established and emerging industrial sectors. Established industrial sectors (cold storage, advanced manufacturing) and emerging sectors (vertical farming, crypto-mining) require significant amounts of power, and are expanding domestically and competing for industrial sites.

- Automation adoption within industrial facilities. Investment in robotics/automation to optimize industrial operations is forecast to accelerate¹, and new development is built with agile automation solutions in mind. The use of automation, which supports overall net efficiencies and cost savings, requires more power than traditional industrial and logistics operations with legacy technologies.

- On-site infrastructure to support electrified fleets. Fleet electrification is a rapidly growing trend in line with current federal and corporate policy goals. Electric vehicle (EVs) sales doubled from 2020 to 2021, and are forecast to reach a market share of 29.5% of total vehicle sales in the United States by 2030. It is estimated that charging a single electric truck on-site requires at minimum an additional 20 kW of power². Recent geopolitical events have injected greater volatility into global energy markets, which may expedite public-sector and private-industry green initiatives.

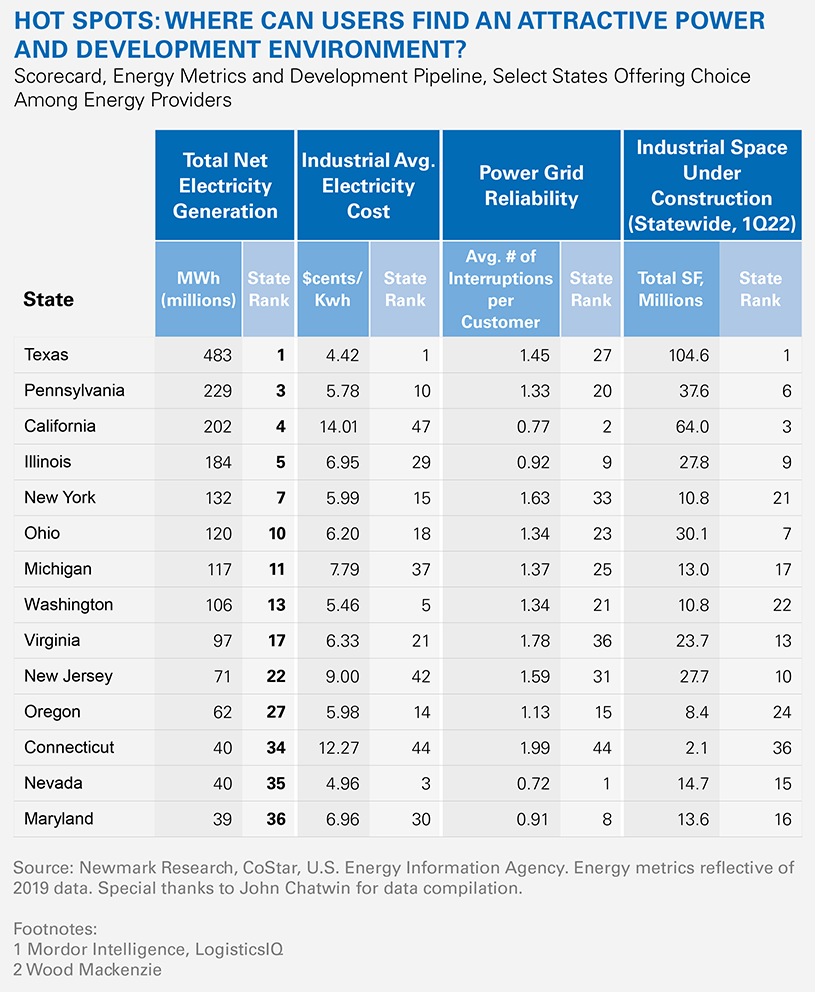

Greater energy use brings a heightened focus to energy conservation and the type of energy being consumed. Energy consumption is increasingly considered a key element in corporate Environmental, Social, and Governance (ESG) strategy. The confluence of growing power requirements and accelerating adoption of renewable energy sources will shape industrial facility design, location selection, and the deployment of capital. Investing in sustainable solutions, such as solar panels on a warehouse roof or EV charging infrastructure on-site, has the potential to maximize returns and revenue for developers and investors. Business models between landlords and tenants in mutually-beneficial renewable energy investment are evolving. States with deregulated energy markets, or in which consumers have retail choice among energy providers, offer more options for industrial occupiers considering heavy power needs and ESG strategy. A robust and accommodating industrial development landscape will also be a differentiator for some industrial occupiers in site selection, as many secondary markets are able to offer greater flexibility in land use planning than population-dense, land-constrained gateway markets. The future of industrial energy consumption poses infrastructure and grid resiliency challenges, but great opportunity resides in the solutions.