Over the past 20 years, the U.S. experienced a 25% increase in domestic freight volume, driven by economic and population growth, as well as the rise of e-commerce, which has empowered consumers to expect choice and speed in delivery.[1] This dynamic has fueled a 35% expansion of the nation’s logistics inventory since 2003.[2] For the supply chain to function optimally, infrastructure improvements are essential to connect goods flowing through the nation’s transportation network with the facilities that warehouse and distribute products to end-consumers. Newmark Research analysis shows a strong correlation between investment in transportation infrastructure and expanding industrial occupancy, with implications for different markets as demand increases and freight flows shift.

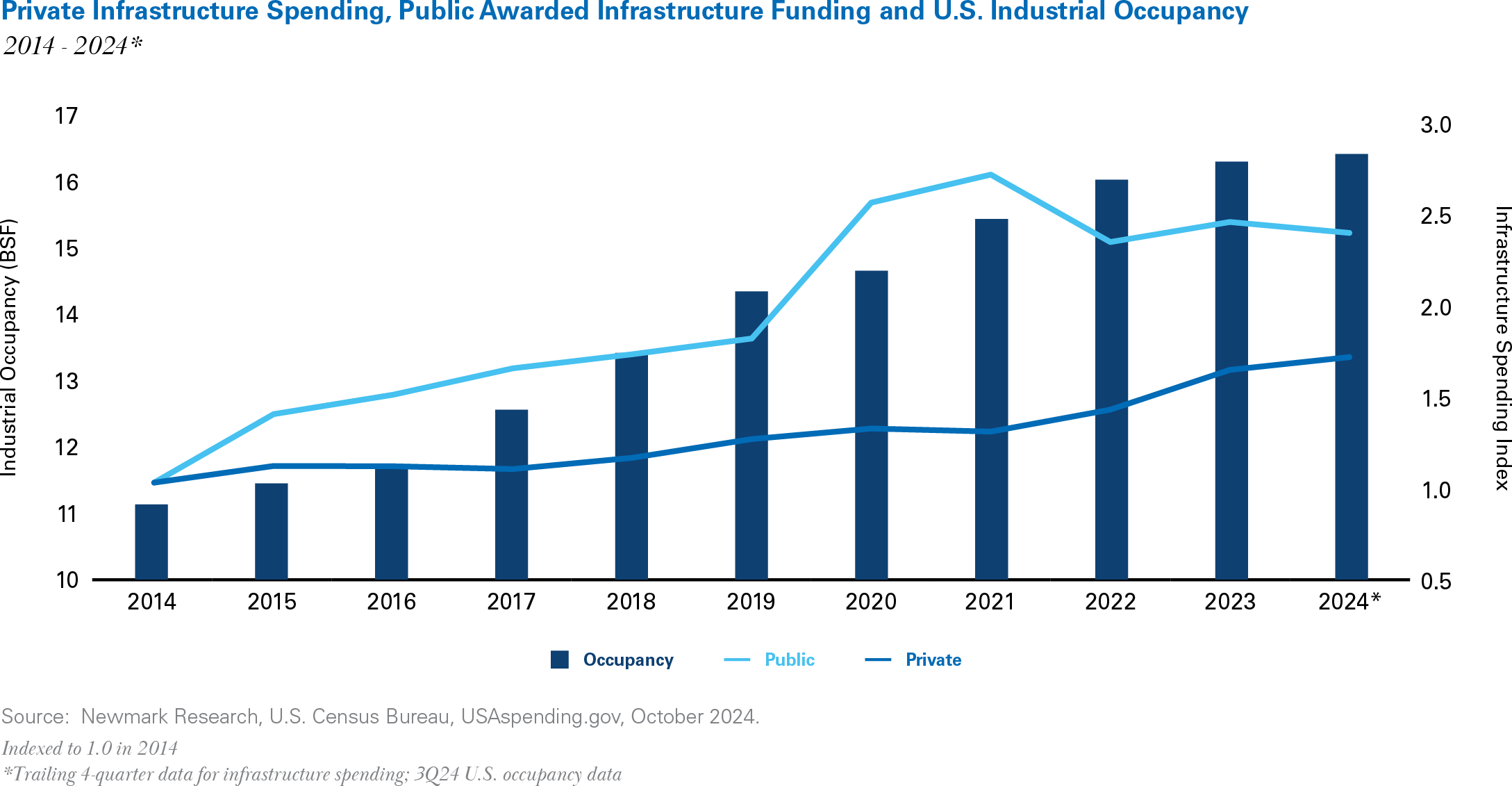

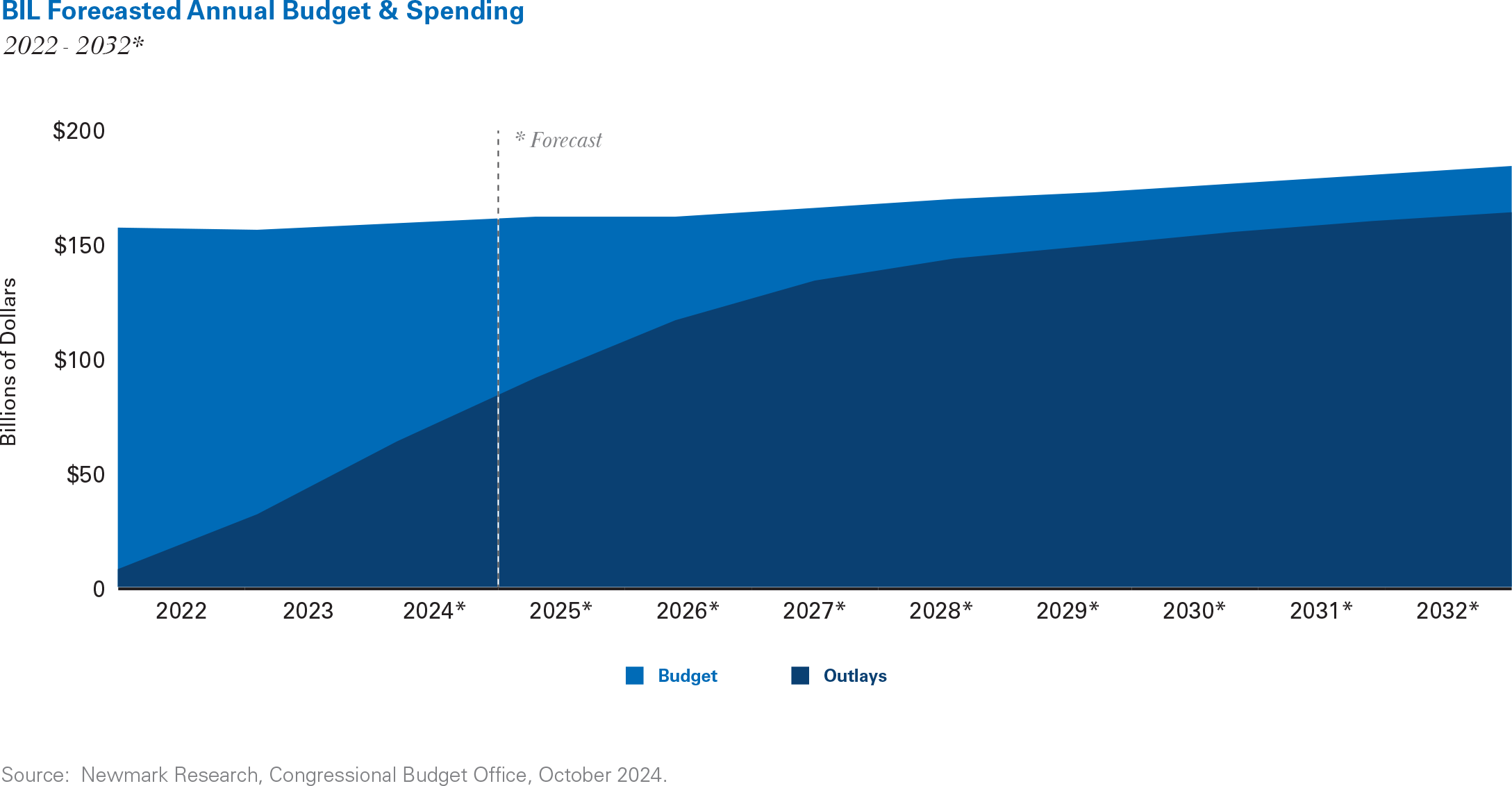

Transportation infrastructure spending has grown significantly over the past five years, driven by both public and private sector investments. Federal government budgetary proposals have prioritized investments in transportation infrastructure during this period—for roads and highways, in particular—to boost job creation, modernize outdated systems, and improve connectivity. The largest portion of the $1.2 trillion Bipartisan Infrastructure Law (BIL), enacted in 2021, is designated for transportation construction, and Department of Transportation (DOT) spending has been historically elevated since 2020. Private sector participation has also been substantial, with private transportation infrastructure construction spending rising 32% since mid-2019.[3] Historically, infrastructure spending has closely tracked industrial construction activity, an integral contributor to expanding industrial occupancy. Although, since 2020, the relationship has become dislocated due to abnormal economic and market conditions pushing industrial development to all-time highs, and a high-interest-rate environment putting pressure on private infrastructure fundraising.[4] While speculative industrial development will moderate into 2025, total occupied industrial space is forecasted to continue growing due to sustained positive net absorption and a shift in the pipeline to build-to-suit and owner-built deliveries.[5] Infrastructure spending is also forecasted to grow: BIL outlays are set to accelerate, particularly between 2024 and 2027, and interest rate relief will help unlock liquidity in private spending.

PUBLIC AND PRIVATE INFRASTRUCTURE INVESTMENT SHOW STRONG CORRELATION WITH INDUSTRIAL OCCUPANCY GROWTH

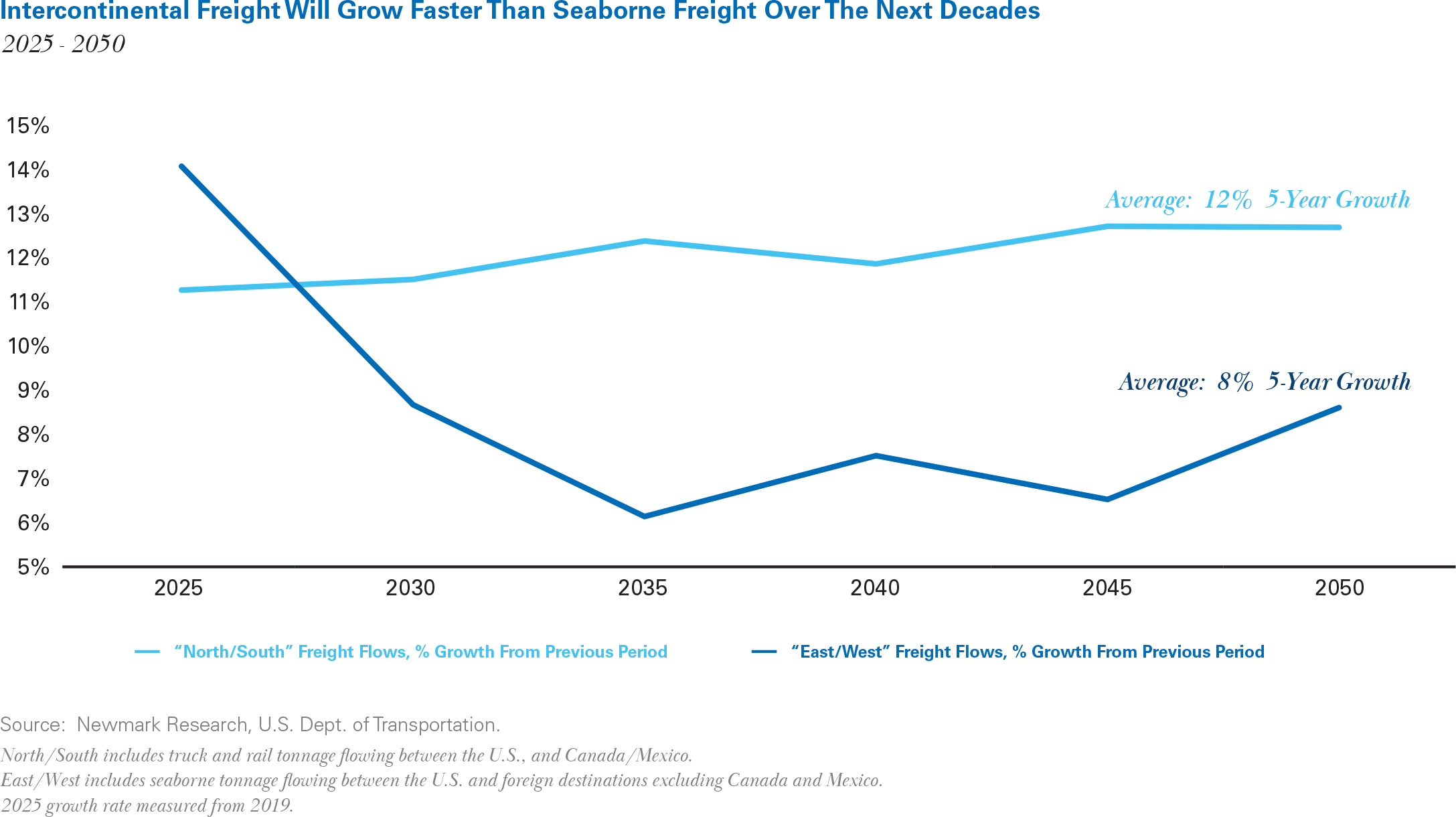

U.S. freight tonnage is projected to grow by 42% from 2023 to 2050, as firms onshore and nearshore production and e-commerce continues to mature.[6]

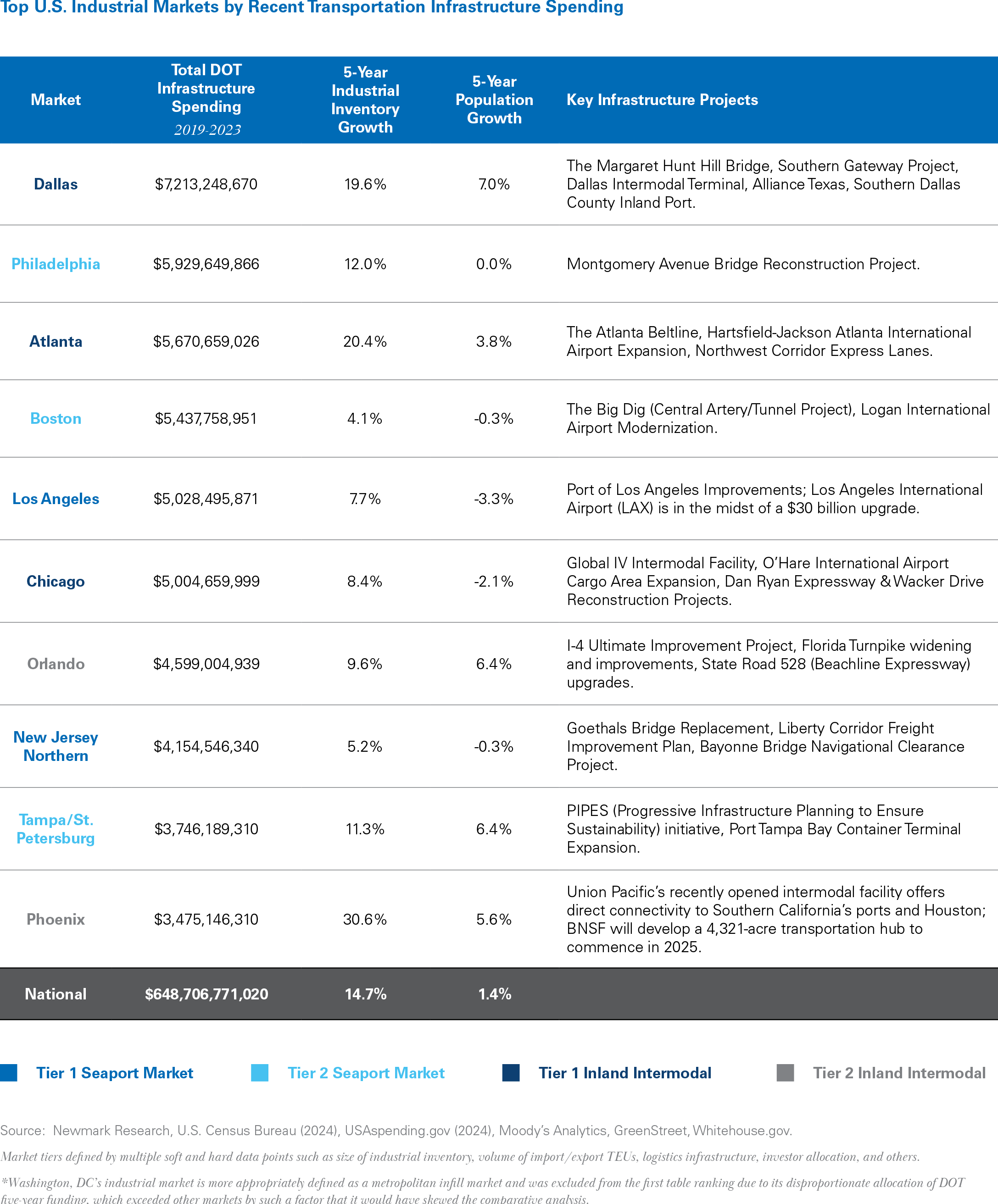

Global trade patterns over the past few decades have benefitted ocean port volume growth over intercontinental freight growth, creating a domestic “east/west” paradigm for freight flows as maritime import volumes move to end consumers across the country via road and rail. This paradigm has driven the expansion of key maritime gateways such as Los Angeles and Northern New Jersey into super-regional Tier 1 industrial markets to support port operations and large population basins. As such, port markets have generally received more infrastructure investment, as have Tier 1 intermodal markets such as Chicago, Atlanta and Dallas. Looking ahead, a “north/south” shift in freight flows is ascendant, as the growth of land-based goods transport is expected to surpass the growth of sea-bound goods due to nearshoring of production. However, seaborne volumes will remain larger in absolute tonnage and are of vital importance to the U.S. economy.

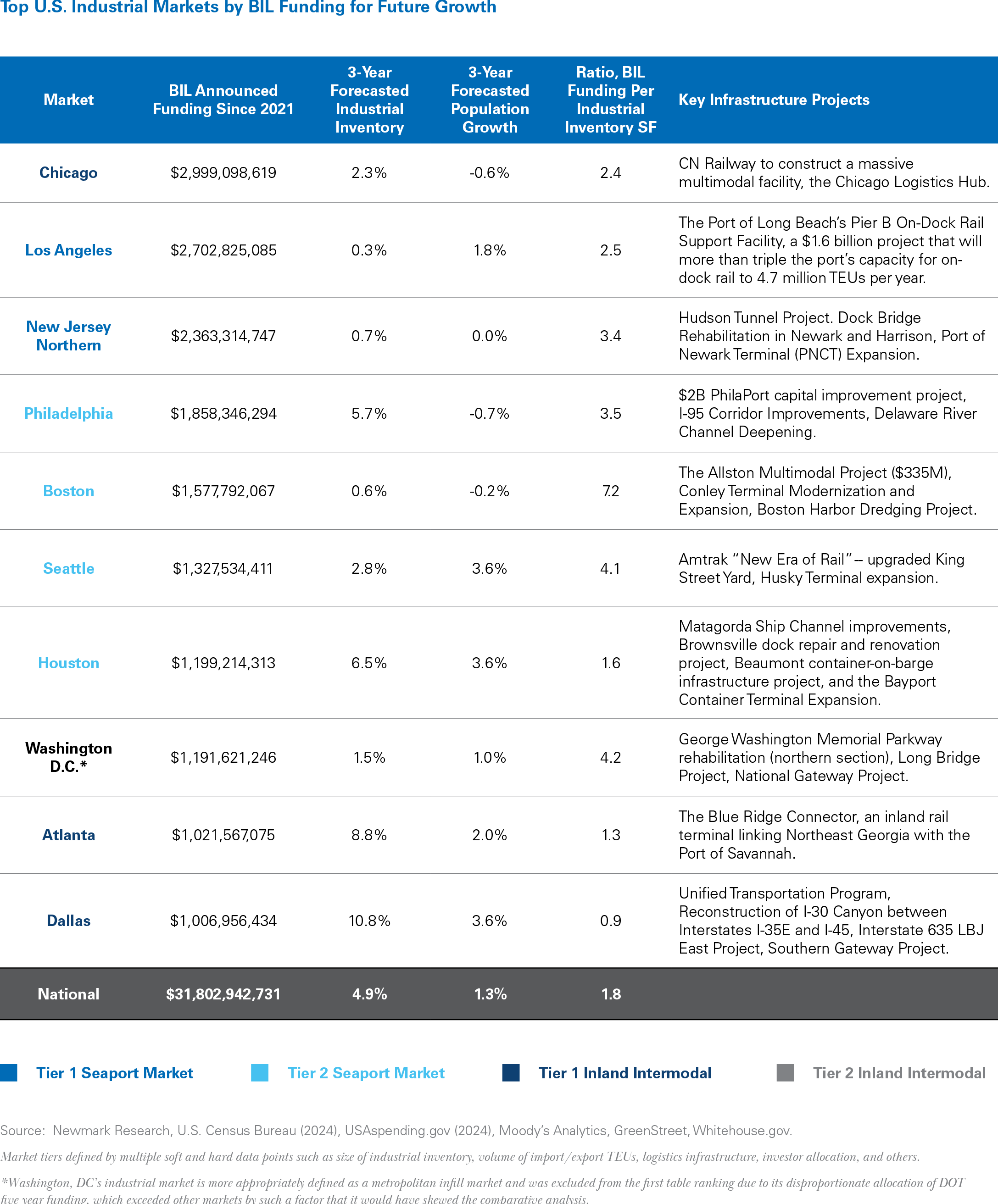

In support of this outlook, inland intermodal markets have become primary beneficiaries of infrastructure spending, drawing on recent allocations and future funding earmarked under the BIL. Dallas and Atlanta, the nation’s fastest-growing Tier 1 intermodal markets, are leading U.S. markets in recent DOT outlays. Chicago, the nation’s largest and most important inland intermodal market, leads the country in BIL funding for future growth. While established Tier 1 and Tier 2 port markets continue to attract significant infrastructure investment, land constraints and regulatory pressures may limit their industrial growth potential, driving value for existing real estate. In contrast, other markets earmarked for substantial infrastructure investment, such as Houston, Atlanta, Dallas and Philadelphia, have fewer development barriers, making them better positioned for continued expansion in the coming years.

As of mid-year 2024, approximately $480 billion from the BIL (40% of total funds) has been announced. The allocation of the remaining 60% will influence future industrial occupancy growth, particularly in inland intermodal markets where infrastructure investments are disproportionately large relative to existing industrial inventory. Moreover, the increase in infrastructure investments will drive industrial market activity through multiple channels, from development and construction-related industrial requirements to the ongoing need for outdoor storage and service facilities supporting projects, to the multiplier effect of more efficient regional transportation systems supporting population and/or freight growth.

Through 2027 and beyond, a generational wave of public and private infrastructure investment will unfold, extending holistically beyond transportation to all types of infrastructure. Energy infrastructure represents the second-largest tranche of current spending and will continue to increase to address rapidly expanding power needs.[7]

Future infrastructure allocations will need to adapt to emerging technologies and evolving supply chains to ensure long-term sustainability. Markets that successfully integrate climate-resilient design, last-mile logistics, multi-modal transport, and adaptive infrastructure will become the next generation of logistics hubs. These hubs may even serve as catalysts for economic evolution, driving the development of new business models and enterprises. By aligning with shifting freight flows, technological advancements, and geopolitical reconfigurations, these markets will be positioned to reshape the industrial real estate landscape and establish new paradigms for meeting the anticipated demands of future consumers.

[1] U.S. Bureau of Transportation, TRIP; annual US freight tonnage measured in 2002 and 2022

[2] Newmark Research, inventory statistically tracked across 51 U.S. markets

[3] U.S. Census Bureau

[4] Preqin

[5] Newmark Research, Green Street

[6] National Transportation Research Center, Bureau of Transportation Statistics and the Federal Highway Administration

[7] U.S. Census, private infrastructure spending data