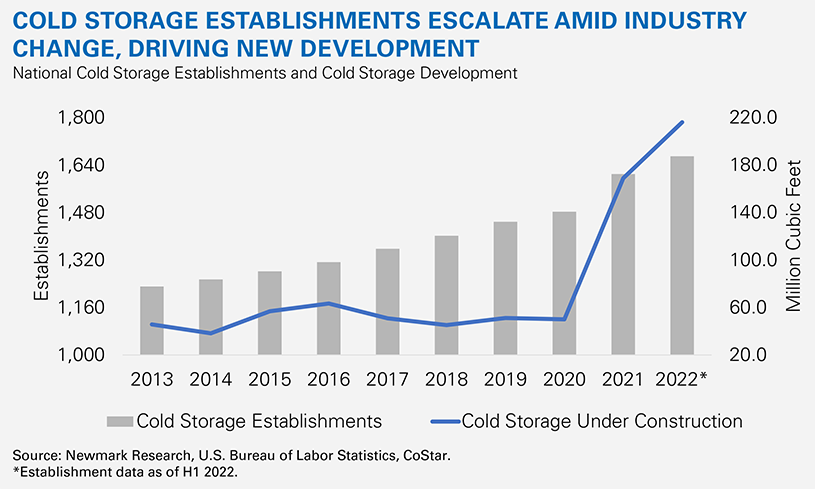

National cold storage development hit an all-time high of 9.8 million square feet (an estimated 216.2 million cubic feet) by the end of 2022 driven by a proliferation of users and operators as the sector grows and evolves. The number of cold storage establishments1 grew 8.6% from 2020 to 2021, and an additional 7.5% from 2021 to the first half of 2022, eclipsing the annual average of 2.2% observed from 2013 to 2020.

Primary demand drivers of this recent momentum in growth include:

- Acceleration of food and grocery e-commerce and supportive last-mile operations, particularly in fast-growing Sunbelt metros. Many consumers pivoted to online grocery shopping and meal services during the initial phases of the pandemic and are now accustomed to the convenience. E-commerce grocery sales are expected to grow at a 6.5% CAGR over the next five years, excluding inflation, outpacing the 2.0% expected for in-store sales.2

- Industry consolidation. To support their top clients’ robust demand for cold storage space, Lineage Logistics, Americold and others increased their share of the U.S. cold storage market through mergers, acquisitions and development. Lineage Logistics and Americold accounted for 71.0% of the storage capacity of the top 25 markets in 2022, compared to 61.0% in 2019.3 This consolidation is conversely driving competition, as new and smaller users unable to attain space in the top cold storage firms’ facilities are presenting opportunities for new cold storage operator formation and development of the next generation of cold storage space, appealing to occupiers with a variety of specific focuses and needs. Third-party logistics companies are increasingly entering this segment, providing additive and complimentary fulfillment and logistics services.

- Aging inventory. The average age of cold storage facilities in the top U.S. markets is 37 years, presenting challenges due to inefficient systems that generate higher operating costs and increased risk for product spoilage. Demand for modern functional space has driven the need for new development in support of supply chain optimization, adoption of warehouse automation and energy cost reduction.

1Companies within the North American Industry Classification System code 49312, defined as engaged in the operation of refrigerated warehousing and storage facilities.

22023 Brick Meets Click/Mercatus Five-Year Grocery Sales Forecast.

32022 IARW Top 25 List of largest refrigerated warehousing and logistics providers in Canada, Mexico and the United States.

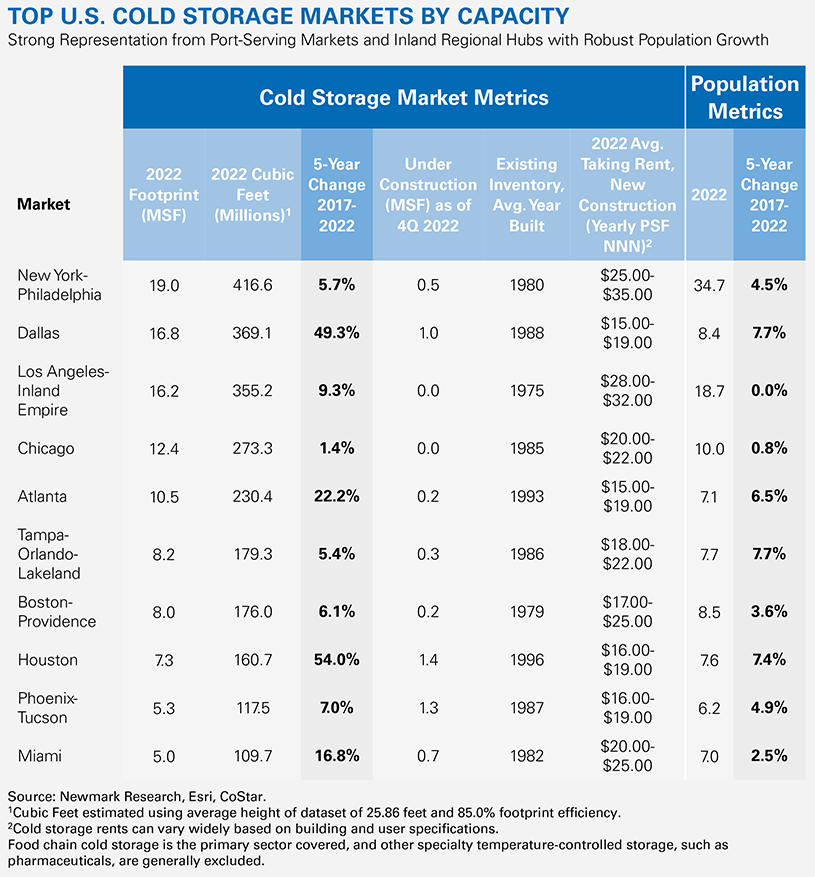

Cold storage development accounts for only 1.5% of the total industrial development pipeline, despite development hitting a new high in 2022. Supply of modern cold storage space has lagged as speculative construction remains risky for investors—even more so given the current interest rate environment. These challenges to develop speculative space are largely associated with specialized costly construction, high operating costs, unique tenant requirements and the inflexibility for potential future conversion. Costs of cold storage construction are twice the cost per square foot of traditional warehouses or more, depending on building specifications and amount of cooler/freezer space, increasing financial risk for not securing a tenant pre-delivery. Much of the demand for cold storage space is client specific and mostly build-to-suit development. However, port-serving and strong-population growth markets are driving a notable amount of speculative development. Largely mirroring broader warehouse/distribution trends, seven of the top 10 cold storage markets are in Sunbelt states, six of which boast the largest increase in cold storage inventory since 2017, with an average of 26.4% increase in inventory. These same six Sunbelt markets experienced an average of 4.8% population growth over the same period. Transportation costs, which surged during the pandemic, account for roughly half of overall supply chain costs. Therefore, cold storage users who need more specialized distribution to maintain the cold chain will follow their end consumers.

There is an overarching national resolve to strengthen and solidify the food supply chain after significant weaknesses were exposed from the effects of the pandemic, which is inducing investment to instill resilience and will spur growth and innovation in the cold storage sector for years to come.