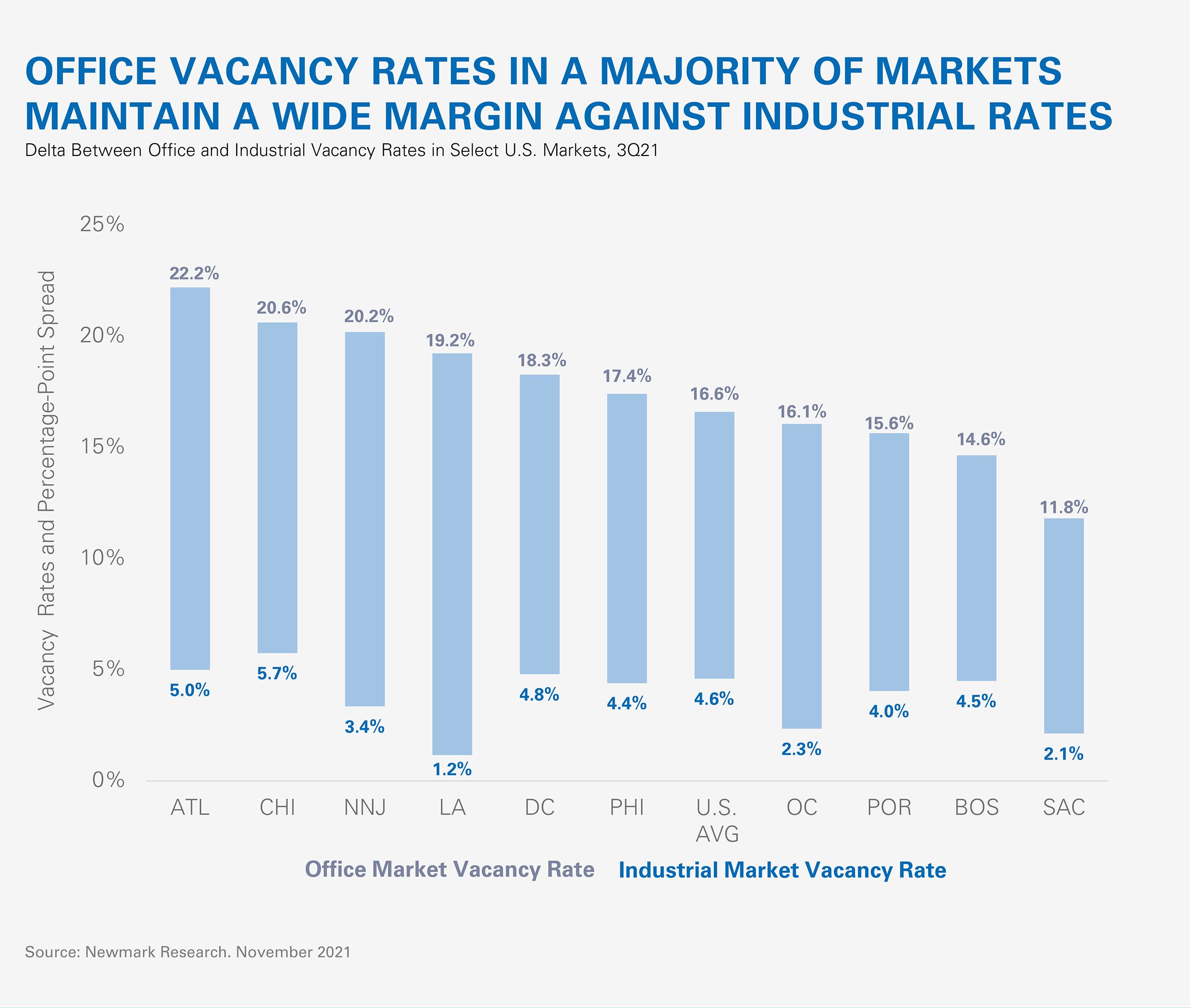

Unprecedented levels of industrial demand across the U.S. have left tenants with a critical shortage of space options, reflected in an all-time low industrial vacancy rate of 4.6% as of the third quarter of 2021. Comparatively, the U.S. office market is contending with uncertainty in the post-COVID-19 world, and the pandemic has only accelerated obsolescence of some older, less-amenitized product. This divergence among asset classes is increasingly driving investors and developers to consider industrial redevelopment opportunities for some unproductive office properties. Since 2018, at least 45 office properties totaling 11.3 million square feet have been redeveloped or are in the process of redevelopment into industrial use. This observed activity is predominantly concentrated in markets where density and land constraints are driving forces resulting in perennially tight industrial vacancy. While office space generally costs significantly more to build than industrial and yields higher rents when occupied, the economics supporting industrial redevelopment in these regions are buoyed by exceptionally strong market fundamentals, particularly when compared to each metro’s office market, where office vacancies are roughly 10 to 18 percentage points higher as of third-quarter 2021.

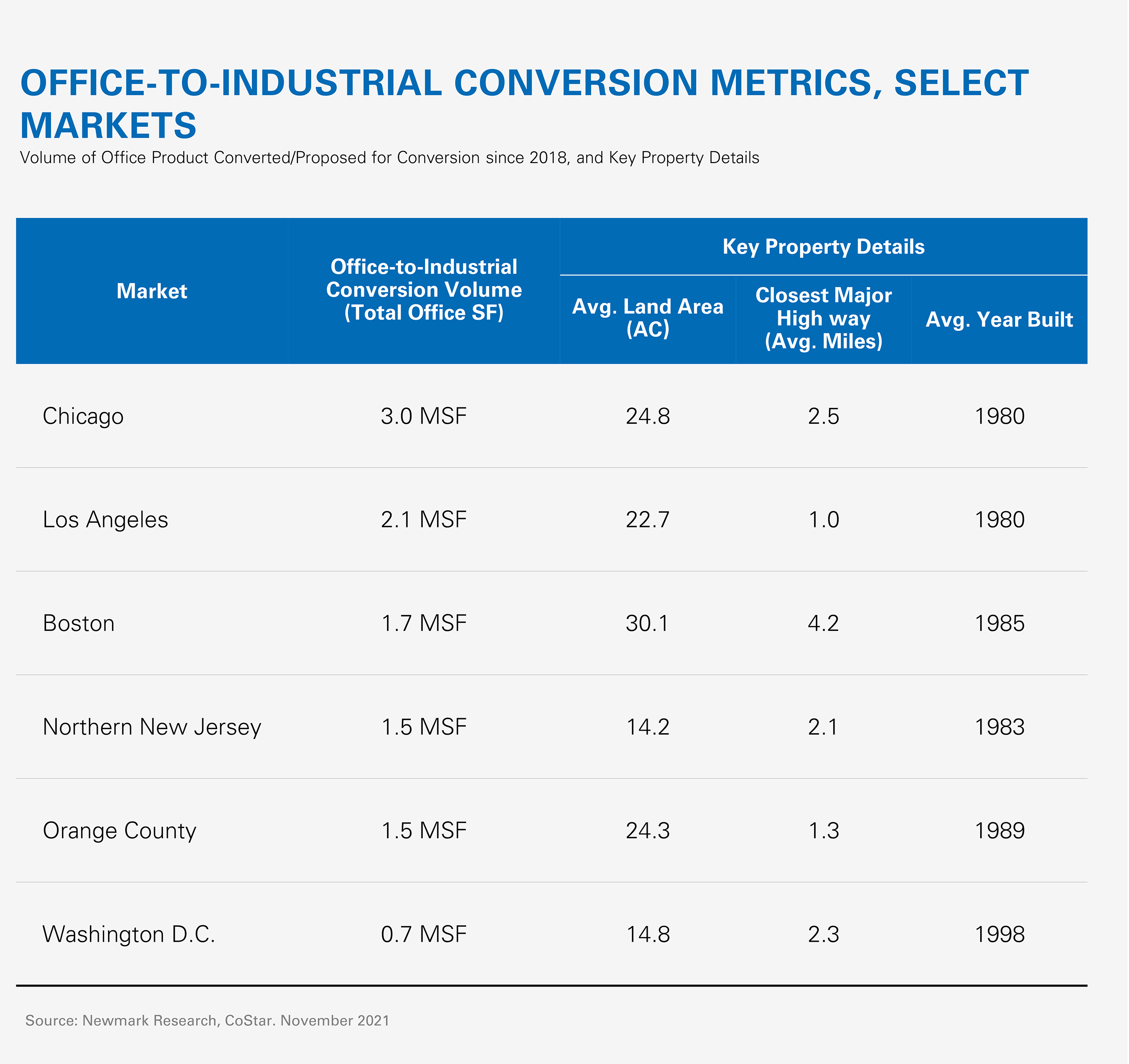

Office-to-industrial redevelopment is a complex scenario. Identifying potential conversion projects could prove invaluable for investors and developers looking to meet increased tenant demand for modern industrial space. Newmark’s proprietary modelling and analysis indicates the most likely office candidates for industrial conversion are older suburban assets with an average land area of roughly 15 to 25 acres, located within four miles of a major highway. Layering in zoning considerations, existing land availability, industrial and office submarket fundamentals and other geographic attributes will also inform strategy, as not all obsolete office buildings present opportunity. Sites may face challenges including community opposition and zoning restrictions, increasing development costs, as well as challenges from competing uses; in particular, multi-family, healthcare and life science reuse. Near- and long-term outlooks for industrial demand are strong, and many supply-constrained markets are facing limited development opportunities. The office-to-industrial conversion trend, while niche, will continue to grow and will offer industrial tenants much-needed space while tightening existing office inventories by removing properties that are no longer competitive.