On November 15th, 2021, President Biden signed the Infrastructure Investment and Jobs Act (IIJA) into law. This new legislation has significant long-term macro implications for the nation’s competitiveness on a global scale by improving resiliency, productivity and economic growth, as well as national and regional implications for development and investment in commercial real estate. The following is a summary of the IIJA and specific implications for industrial real estate.

The roughly $1.2-trillion legislation—predominantly funded by repurposed, unspent monies and new revenue—contains reforms and funding for previously-approved infrastructure projects and programs and an estimated $550 billion in new investment. This spending will focus on a variety of infrastructure projects ranging from hard infrastructure—such as improvements and expansions of physical transportation networks (roads, rail, ports and waterways, airports, and public transit)—to water, power, and internet infrastructure, among other initiatives.

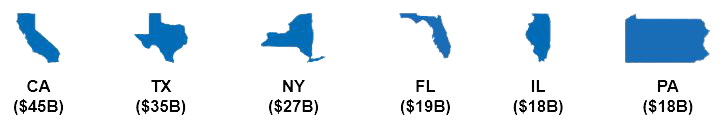

The largest projected beneficiaries from the IIJA:

Now that the bill has been signed, implementation—including the creation of rules and regulations—will take months longer; then, state and local governments will have to decide which projects will receive monetary allocations. This spending on physical infrastructure will necessitate a wide variety of materials and commodities, such as steel and lumber, as well as labor, both in skilled trades and in administration. Labor and commodities markets are still in a state of pandemic-induced volatility, but new spending and construction related to this bill will not commence until well into 2022 at the earliest, and thus may not exacerbate the current shortages of commodities and resultant pricing increases*. However, timing could still present challenges on the path to infrastructure opportunity, particularly in sourcing skilled labor—often a difficulty in the construction sector even prior to the pandemic**.

The new legislation has myriad long-term implications for national and regional industrial real estate. The majority of the IIJA is directed to the transportation sector, with the largest allocation of funds ($110 billion) going to improving roads and bridges, which will facilitate more efficient transport of goods. In a 2014 survey conducted by the Urban Land Institute and EY, infrastructure quality (more specifically, improved roads, bridges, and public transit) was the top factor driving real estate development decisions. According to a November 15, 2021 note on the IIJA from global industrial REIT Prologis, “where states and localities choose to invest their dollars in major development could influence where logistics companies such as Prologis and its customers invest in new properties.” Once transportation improvement or expansion projects have been officially identified, land for industrial development as well as existing industrial properties in the vicinity may increase in value.

E-commerce has been one of the paradigm-shifting demand drivers for industrial real estate, and it stands to grow further through another major provision in the bill: $65 billion has been earmarked for expanding and improving internet access, especially to underserved remote and rural areas. This will provide a number of benefits, including greater consumer opportunity offered by the online marketplace. Improving ease of access has the potential to bring new customers into the digital economy and increase the need for industrial space to support and expand e-commerce supply chains.

Other ways in which the industrial sector may be impacted by the IIJA pertain to energy, ranging from support for the electrification of transportation systems and electric-vehicle charging stations to investments in renewable power and improving electric-grid resilience. This will benefit a variety of industrial users with heavy-power requirements and will support higher investor, tenant and consumer expectations for a logistics-sector shift towards more sustainable, efficient energy usage.

Industrial real estate is fundamental to the production and movement of goods, and this once-in-a-generation infusion of federal spending will support and expand the physical infrastructure that makes such movement possible, ensuring long-term benefit for the industrial asset sector.

*For more information on current supply chain disruption and impact on commodities and pricing, please see Newmark’s 3Q21 National Industrial Market Conditions and Trends Report

**2019 Sage Construction Hiring and Business Outlook Survey, Associated General Contractors of America

Additional Sources: Newmark Research, The White House, Prologis, Brookings Institute, Deloitte, Committee for a Responsible Federal Budget, Urban Land Institute