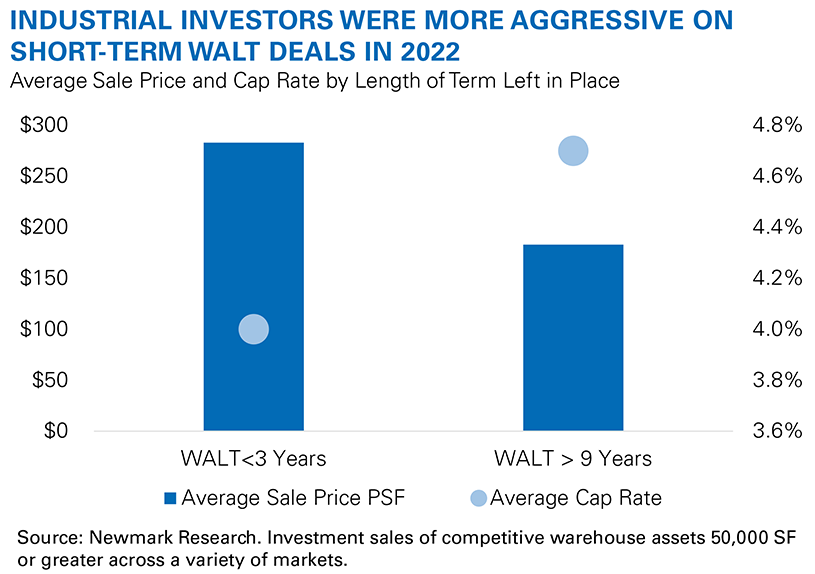

For the past few years, quality industrial assets with shorter weighted average lease terms (WALT) have been more attractive investment opportunities than assets with longer terms left in place. This stems from the mark to market potential. Nationally, the pace of market rent growth has far surpassed the rate of rent increases in leases signed five to 10 years ago. A hypothetical six-year lease signed in 2016 with 2.5% annual escalations would be, on average, 36% below market rent today – much lower still in markets with the steepest rent growth over the same period. Leases rolling in the near term with under-market rents will present new buyers an opportunity for substantial income gain. On the other hand, assets with a longer WALT, even with significantly below-market rents, have not participated equally in the impressive run-up in values and will not see as much of an increase in basis until market rent can be captured at an extended future date with all its attendant uncertainties.

An analysis of industrial sales transactions in 2022 demonstrated that assets with less than three years left of WALT achieved an average 55% premium on pricing per square foot, and cap rates approximately 70 basis points lower, than assets with nearly a decade or more left in WALT. The cap rate delta implies a 17.5% difference in value between short- and long-term WALT assets, on average. Certainly, deal metrics shifted in the second half of 2022 as cost of debt rapidly increased upon successive interest rate hikes. Overall, monthly industrial capital markets activity has experienced double-digit year-over-year declines since August 2022.¹ However muted, transaction activity does continue, with limited data indicating upward lift on cap rates and a decline in pricing for both short- and long-term WALT assets, but higher premiums and lower cap rates are still placed on the former. With the Secured Overnight Financing Rate (SOFR) at 4.31% at the start of January 2023 and more interest rate hikes to come, acquiring near-term WALT assets carries potential for short-term negative leverage, but the prospect of securing greater cashflow and refinancing at a lower rate in the years to come will likely keep this profile of asset competitive in 2023.

This abiding interest in short-term WALT has been predicated on exceptionally strong fundamentals and lender willingness to underwrite rent growth. Going into 2023, fundamentals will continue to drive interest in short-term WALT, but with hyper-focus on the achievable increase in net operating income versus the pace of increasing debt cost.

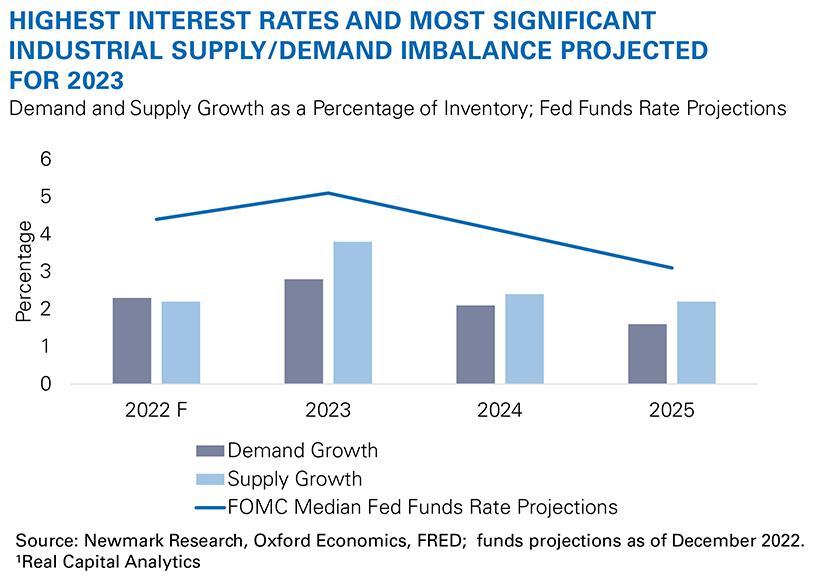

Market fundamentals are projected to react in the following ways during 2023:

- Industrial demand deceleration will coincide with a large volume of new construction delivering. Nationally, the vacancy rate will loosen, causing a reduction in rent growth, with the level of impact highly market-specific.

- Less space will enter the development pipeline during 2023. Construction starts starkly slowed by year-end 2022 amid challenging financing conditions.

By 2024, the result of these projections would bring demand and supply into closer equilibrium. In addition, FOMC projections indicate cuts to interest rates to begin in 2024. Industrial investors who bought quality assets with short-term WALT, rolling in 2024, may foreseeably benefit from refinancing potential at lower debt cost and attractive supply/demand fundamentals for securing new tenancy and appreciating rent growth. These seeds, given other cooperating factors, could germinate into an environment of cap rate compression in 2024.

As lenders become more conservative in the near term, market-specific supply-and-demand fundamentals will become ever more important for investors exploring short term WALT – or any other – industrial investment opportunity.