Hybrid work and high capital costs have impacted office tenants across the country, prompting many to reduce their footprints and delay expansion plans. This has constrained leasing activity and widened the gap between market areas and buildings that are performing versus those that are not.

Identifying the “Haves” in the office market is the focus of a new report where Newmark Research explores top-performing submarkets within major and secondary corridors alike. Understanding the shared qualities of these groupings through proprietary data, coupled with expert qualitative research, will answer: Where is office winning, which assets are favored, and why?

Being in the know is critical for occupiers and investors since what is resilient and currently outperforming today will gain additional strength and value as macro leasing conditions improve and prices rise. Both have implications for timing and strategy.

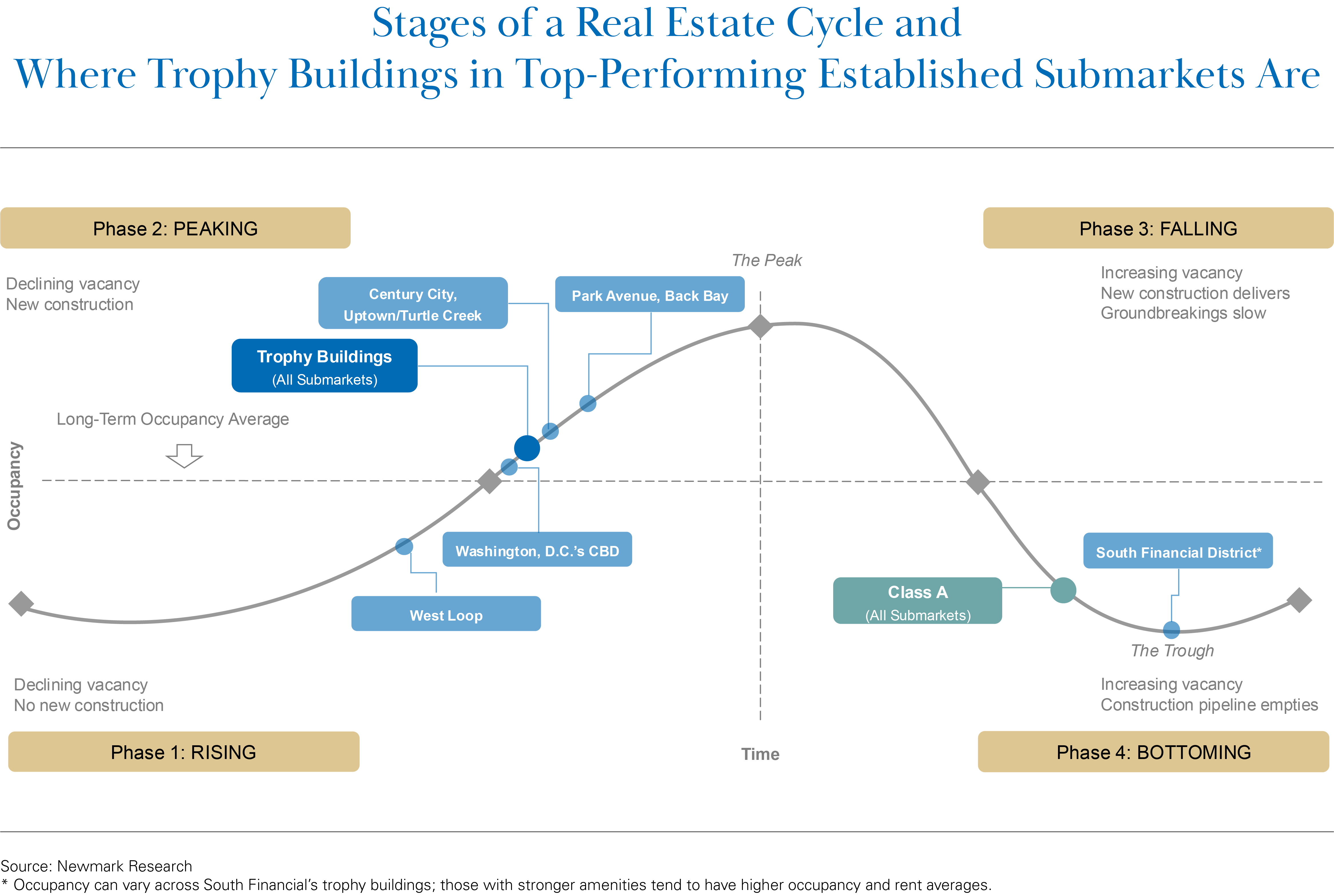

For a preview of one of the many concepts explored in the paper, see the visual below which illustrates the current performance of trophy buildings in the nation’s premier mature corridors.

A supplemental report that closely examines top-performing submarkets is also available. Please reach out to your Newmark business contact for a copy.